In honour of Super Bowl LIII, SportBusiness Consulting has updated its USA market focus – part of the 2018 SportBusiness Global Media Report – and made it freely available.

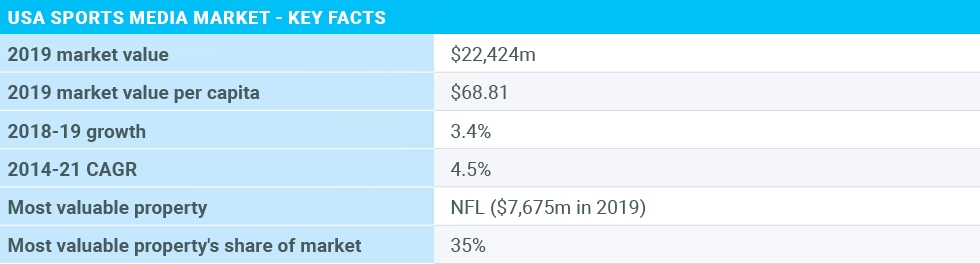

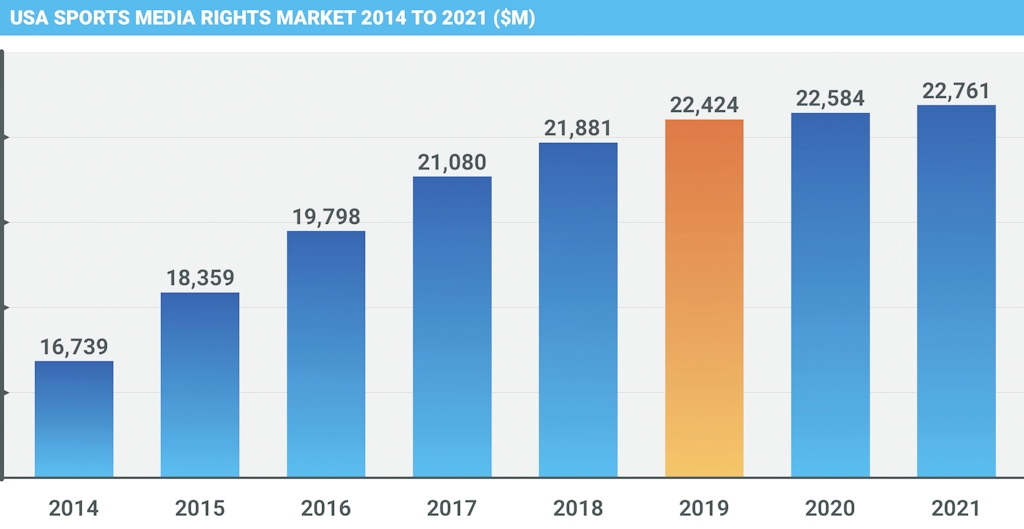

The US market will generate $22.42bn in 2019, making it by far the world’s biggest media rights market. It accounts for 44 per cent of the total global sports rights market.

It is home to four of sport’s 10 largest properties, the NFL, the NBA, MLB and the NHL. The huge rights fees paid by US broadcasters also play a major role in determining the world’s 10 most valuable sports: NBC pays 52 per cent of all Olympic Games rights fees; US College Sports is the fifth- most valuable sport; while the domestic fees paid for Nascar rights are greater than the combined media revenues generated by Formula One.

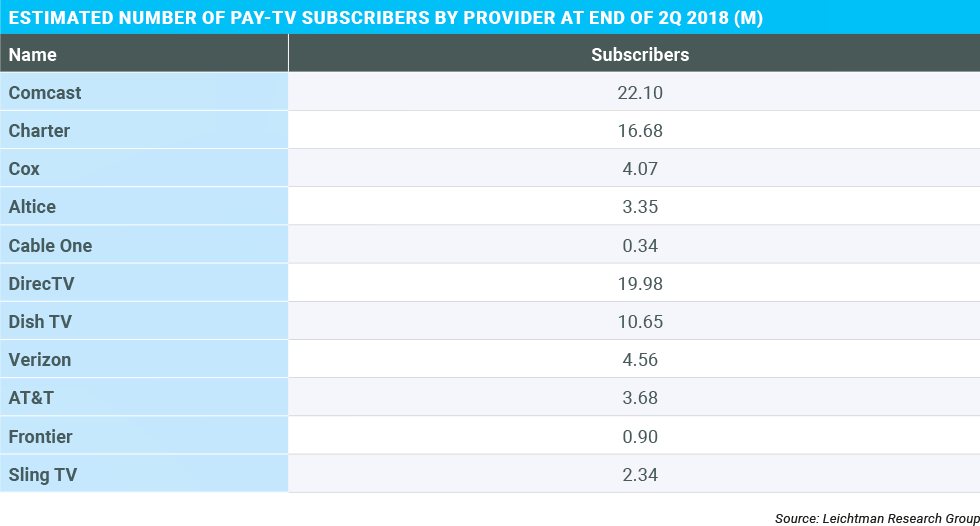

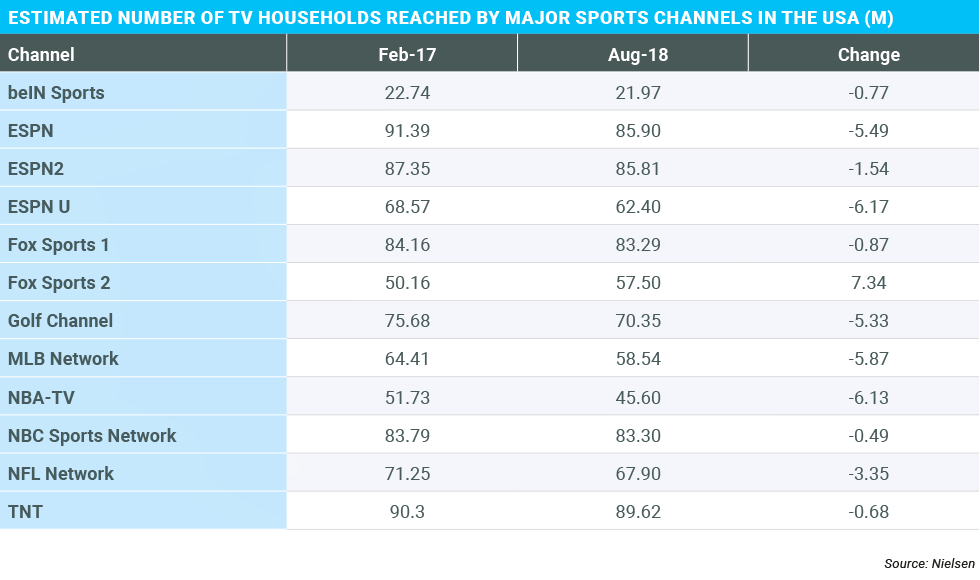

The last few years has seen much debate over cordcutting, with pay-TV subscriptions decreasing from about 87 per cent penetration in 2011 to 83 per cent in 2017, while ESPN has lost around almost 5.5 million TV households since February 2017.

This doesn’t seem to have led to a decrease in interest in acquiring sports rights however, with rights fees for recently renewed properties such as the NFL’s Thursday Night Football package, the Uefa Champions League and Europa League and Italian Serie A all being acquired for more than their cost in the previous rights cycle.

The US market is also unique in that its major NBA, MLB and NHL teams also generate significant revenues from the sale of their local rights to regional broadcasters. These are popular in part due to the sheer amount of content made available to broadcast partners in each sport.

The long-term nature of most sports agreements in the United States means that new agreements are relatively rare, so the total value of the US media rights market does not fluctuate a great deal. However, new MLB, UFC and WWE agreements commence in 2019, leading to the total value increasing by 3.4 per cent.

The US has become a thriving football market in the last ten years. European football leagues generate significant rights fees from the US, for example, the States is currently the English Premier League’s second-most valuable international market.

2018 saw the entrant of a new player to the US market, as DAZN announced its intentions to compete with existing players by acquiring rights to mixed-martial arts series Bellator and forming a joint venture with Matchroom Sport to show Matchroom-contracted boxers’ fights in the United States.

It followed these combat properties up by acquiring nightly MLB highlights rights. DAZN certainly seems likely to keep spending: DAZN Executive Chairman John Skipper has been quoted as saying that DAZN is ready to bid on rights for all major US properties, including the NFL.

DAZN brings competition to at least five major players in the English-language sports rights market. The market leader is ESPN, which has rights to all of the major domestic sports leagues aside from the NHL. In 2018 it launched an OTT player, ESPN+, which requires a separate subscription to access and can be viewed without needing access to ESPN’s linear

channels. In 2019 it has acquired rights to UFC events, which it will exploit on both ESPN+ and it’s linear channels.

Turner has used its acquisition of rights to the Uefa Champions League and Europa League to launch its own OTT service, Bleacher Report Live, matching a similar strategy to how NBC exploits its rights to the English Premier League.

Fox has added rights to the WWE’s Smackdown Live programme to its portfolio, while losing rights to the UFC. The move means, that in the Autumn (when the agreement commences) the Fox network channel will show live sport on four consecutive afternoon/evenings (NFL on Thursdays and Sundays, sandwiching Smackdown and college football on

Fridays and Saturdays). With NBC renewing rights to Monday Night Raw, WWE’s domestic deals are now worth a combined $470m per year.

While 2009 sees relatively few deals commencing, it has the potential to be a fascinating year for the rights market; speculation will only grow in DAZN and the FAANG’s intentions, especially with the potential for the NFL to go to market soon.