- Rights-holder to earn at least €5m-€7m per season for 2019-22 cycle

- LaLiga, pay-TV Premier to share revenues from LaLigaTV distribution

- Channel deal may herald full LaLiga B2C push in next cycle

Spain’s LaLiga has for the first time agreed a revenue-sharing deal for its rights in the UK and Ireland for the 2019-22 cycle. LaLiga will receive a fee from pay-television broadcaster Premier Sports, but the two parties will also share revenues in both territories from LaLiga’s dedicated channel, LaLigaTV, SportBusiness Media understands.

Under the deal, which was announced in September, Premier Sports acquired exclusive linear and digital rights in the UK and Ireland to LaLiga for the three seasons from 2019-20 to 2021-22. The inventory comprises live, delayed and on-demand rights to all Primera División matches and the six-match promotion play-offs as well as highlights and magazine programmes.

It is understood Premier Sports will guarantee LaLiga around €5m ($5.4m) to €7m per season for the rights. The league will also share revenues from the LaLigaTV channel when it is sold as a standalone offering rather than as part of the standard Premier Sports bundle, alongside Premier Sports 1 and 2.

LaLigaTV effectively becomes Premier Sports’ third premium channel as part of the deal. This marks the first time the dedicated LaLiga channel will be shown in the UK and Ireland. It will be available on the broadcaster’s Premier Player OTT service by October 18 and on the Sky linear platform in the UK from January 2020.

LaLiga’s deal with Premier Sports began in time for match-week four. The league had secured a stop-gap arrangement with commercial UK broadcaster ITV for the first three match-weeks.

Premier Sports broadcast the full slate of top-tier matches during match-weeks four and five across its two premium channels as well as one match non-exclusively each of those match-weeks on its digital terrestrial channel FreeSports.

From match-week 6 until January 2020, the number of live matches shown on Premier Sports falls to a minimum of four during those weekends when the broadcaster is covering the Pro14 rugby championship. The latter competition is shown on half of the weekends until end of 2019. Every match Premier Sports does not show live will be shown delayed. The broadcaster will show all LaLiga matches live when Pro14 rugby is not taking place, subject to UK blackout restrictions at 3pm on Saturdays.

When LaLigaTV launches in January on Sky’s linear platform in the UK, it will be the only way to watch live LaLiga matches on pay-television. However, Premier Sports will continue to show select match content and a weekly highlights show on FreeSports throughout the duration of the deal. For example, FreeSports will exclusively broadcast one LaLiga match in each of match-weeks seven and eight, immediately preceding the October 2019-20 international break. It is understood some free-to-air exposure in the new rights cycle was a key issue for LaLiga to support brand-building in the UK and Ireland.

Distribution

Premier Sports adds LaLiga to a football portfolio that already includes Italian Serie A, Dutch Eredivisie and the English Premier League (Ireland only).

The broadcaster does not possess its own linear distribution platform, so requires carriage agreements. In the UK, it is distributed on the pay-television Sky and Virgin Media platforms, with FreeSports additionally carried on Freeview HD and Freesat, while in Ireland, Premier is exclusively distributed by Sky.

Premier Sports has, so far, only confirmed that LaLigaTV will be available linearly in the UK through Sky’s platform and digitally in both the UK and Ireland through its own OTT platform, Premier Player.

The broadcaster expects LaLigaTV to also be available on the Sky linear platform in Ireland, but this is yet to be confirmed. It is in discussions to determine the timeline for LaLigaTV’s launch on Virgin in the UK.

Viewers will have the option to subscribe to LaLigaTV on a standalone basis for £5.99 (€6.72, $7.35) per month or £49 per year once the channel launches on the Sky and Premier Player platforms. Alternatively, subscribers can purchase the full Premier Sports bundle — including Premier Sports 1, 2 and LaLigaTV — on both Sky and the Premier Player at £11.99 per month or £99 per year.

LaLiga and Premier will share subscription revenues from the LaLigaTV standalone option, while Premier retains all revenues on the full bundle. It is thought LaLiga could receive anywhere from 50 per cent to 80 per cent of the standalone LaLigaTV revenues in the UK and Ireland.

Commercial establishments will be able to show LaLiga through their Sky TV box or through Premier Sports’ soon-to-be-launched Screach streaming solution.

‘Toe in the water’

LaLiga, which runs the top two divisions of Spanish football, has moved to a new model, distributing rights on a fee-plus-revenue-share basis, rather than just selling outright, because of the difficulties it has faced finding broadcasters willing to meet its valuation of the property.

One industry expert told SportBusiness Media: “It’s a toe in the water for LaLiga. They are the first of the rights-holders that previously commanded high rights fees that are now finding things difficult, so they are trying to find ways to deal with the situation.”

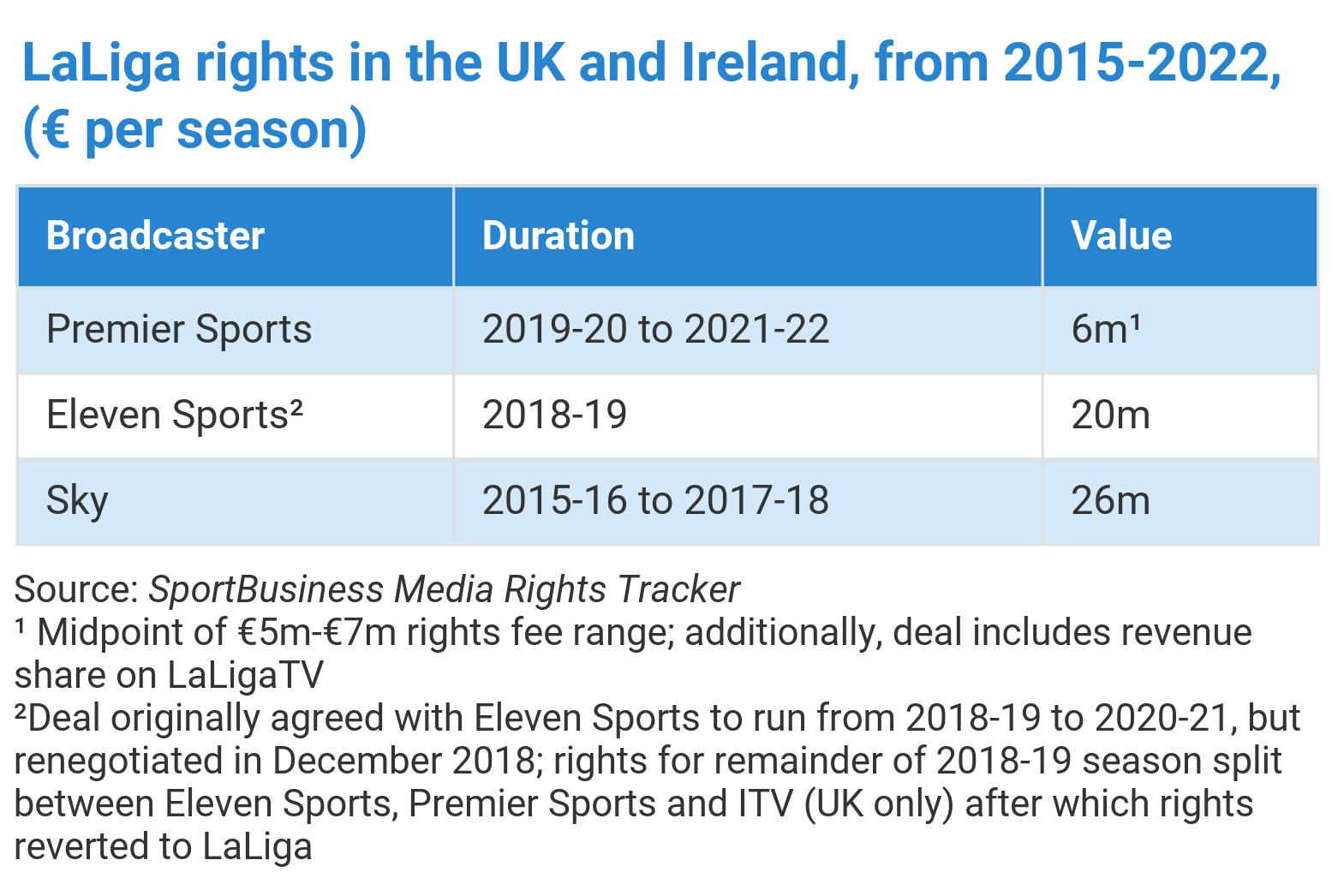

The league was earning as much as €26m per season from 2015-16 to 2017-18 in a deal with its prior long-term partner in the UK and Ireland, pay-television broadcaster Sky. This was followed by a €20m-per-season exclusive rights deal with OTT platform Eleven Sports, which was originally due to run from 2018-19 to 2020-21, covering the two territories.

But the Eleven deal was renegotiated last December on the back of financial difficulties the OTT broadcaster was experiencing with its UK business. The result of the renegotiation was a much-altered LaLiga broadcast landscape in the UK and Ireland in the second half of last season. Instead of a single partner, the rights-holder had three: Eleven, ITV and Premier Sports.

After the renegotiation, Eleven retained non-exclusive OTT rights to all 10 live matches per match week, as well as highlights and magazine shows in the UK and Ireland for the whole of 2018-19. But from February to the end of the season, LaLiga was additionally shown on Premier Sports and free-to-air through ITV.

Premier Sports’ rights last season extended to both the UK and Ireland. It showed four matches per match week across its two premium channels. Its coverage included weekly magazine and highlights shows.

ITV’s rights were limited to the UK. It showed one lower-profile fixture per match week and a weekly highlights show.

B2C move?

LaLiga’s deal with Premier for the 2019-22 cycle was reached in private negotiations after the league cancelled its original UK and Ireland rights tenders. LaLiga first separated the two territories for rights purposes in 2015.

It cancelled the tenders because no satisfactory bids were received. It had offered six packages in each territory, comprising a traditional ‘winner-takes-all’ offer; three pay-television packages with varying degrees of exclusivity; an OTT package; and a free-to-air package. Not all packages were complementary.

Some industry participants speculated that LaLiga’s decision to launch LaLigaTV through Premier Sports may be a staging post towards the league bypassing broadcasters altogether in the 2022-24 cycle to go direct to consumers with the channel.

One industry expert said: “It’s very difficult for someone that’s not a media group to launch a channel not in their country, without facilities; it’s better to test the waters with a partnership first.”

LaLiga is expected to have access to linear and digital viewer data for the standalone LaLigaTV package. Eleven is thought to have had a subscription base of 25,000-30,000 for its LaLiga coverage last season.

But another expert told SportBusiness Media that LaLiga agreed to the new arrangement purely due to a lack of options: “Launching LaLigaTV is a ‘needs must’ for LaLiga; I don’t think it was part of a strategic move.”

LaLigaTV only featured in the original UK and Ireland tenders as a source of ancillary content, such as highlights and magazine shows. Its inclusion in the Premier deal as a fully-fledged channel with a revenue-share component on subscriptions is an indication of the league’s search for additional income.

Direct-to-consumer offers by rights-holders may become more common as rights-holders adapt to what some consider a correction in the sports-rights market.

“All rights-holders may end up going on their own unless they get big broadcast deals,” one industry expert said.

Germany’s Bundesliga is preparing to launch an OTT subscription service at the start of the 2020-21 season in markets where the league cannot derive acceptable rights bids from broadcasters, and where it is looking to develop the property.

The availability of an OTT platform would also give rights-holders like the Bundesliga and LaLiga more leverage in rights negotiations.

Limited interest

It is understood only Premier Sports and Eleven bid for the property. The absence of Sky and rival pay-television broadcaster BT shows that LaLiga has become a casualty of the increased financial discipline of the two big-hitters.

It is understood Sky valued LaLiga at no more than £2m per season for the 2019-22 cycle. While BT is understood to have placed a higher valuation on the property – of £5m-£7m – it does not see LaLiga as a key subscription driver. Its main focus is on the forthcoming Uefa Champions League and Europa League 2021-22 to 2023-24 tender, for which it is the incumbent rights-holder.

ITV is understood to have held informal discussions with LaLiga but these did not progress much further than their temporary coverage deal. Its appetite for LaLiga, was constrained by match-choice restrictions placed on the free-to-air package the league offered for the 2019-22 cycle. Amongst other restrictions, a successful free-to-air bidder would have only had the right to show up to 20 matches per season that involve one top-five LaLiga club, but never two.

One industry expert said: “The value of LaLiga is in Real Madrid and Barcelona and everyone wants those games, so LaLiga is a tough property to share.”

LaLiga’s original six-package 2019-22 tender design had opened the door to a continuation of the multi-broadcaster model that existed in the second half of last season. But ultimately, this proved to be an arrangement the market could not support.