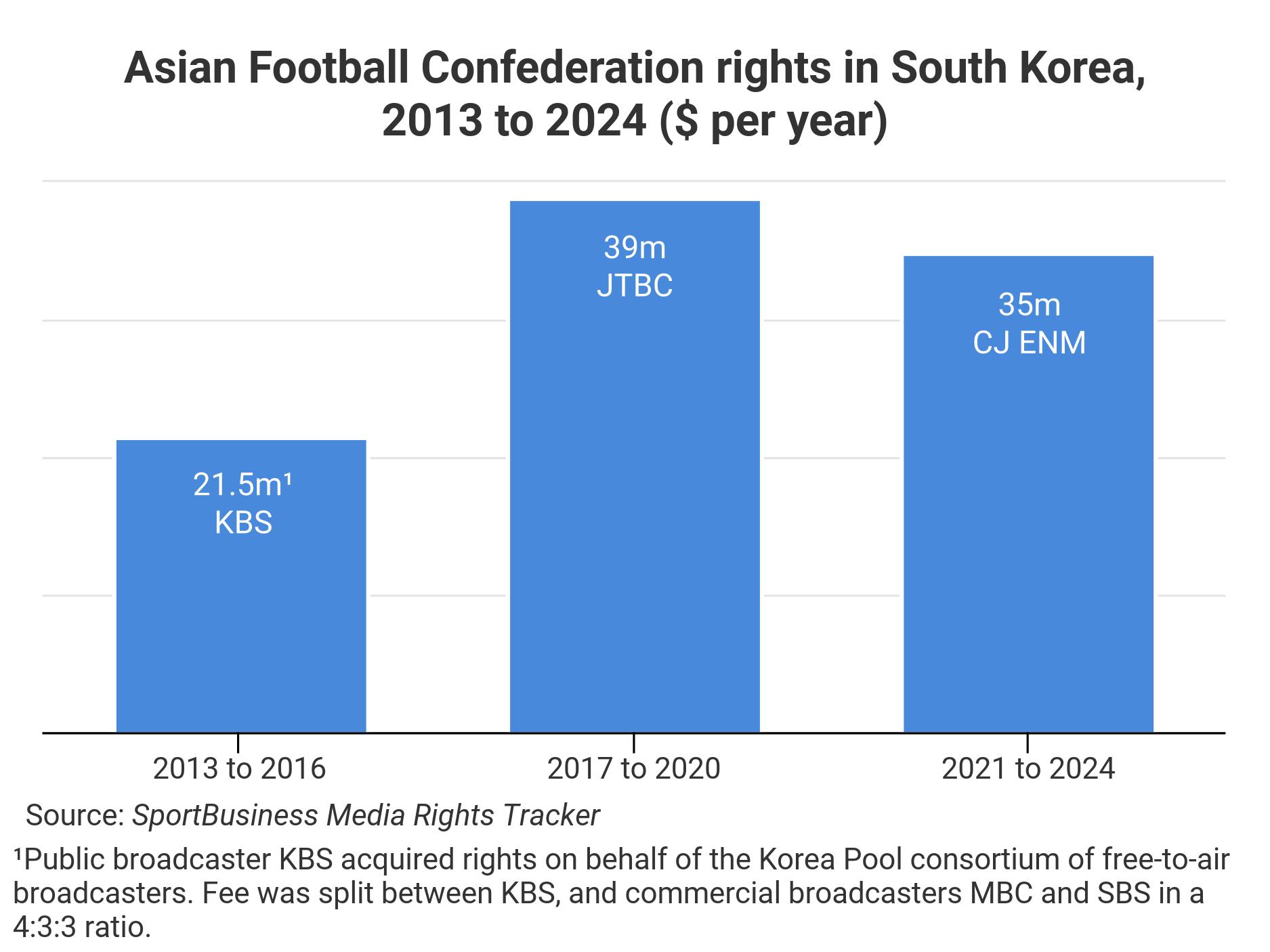

- Value dips to $35m for 2021-24 cycle from $39m amid tough market conditions

- CJ ENM has not been a significant player in sports for nearly a decade

- Fee drop in key Korean market makes DDMC’s sales task even harder

CJ ENM’s step back into sport after a near-decade-long hiatus was not enough to save DDMC Fortis from a fee decline in its sale of Asian Football Confederation rights in South Korea for the 2021-24 cycle.

The media group is understood to be paying about $35m (€32m) for the rights, covering all major AFC national team and club competitions over the four-year period. In the current 2017-20 cycle, pay-television broadcaster JTBC pays $39m.

DDMC Fortis was selling a property whose value in Korea had already increased by nearly 90 per cent in the current cycle, in a deal agreed in a more competitive market in 2016. At the time, JTBC was a relatively recent entrant to sports broadcasting. It had to outbid previous rights-holders the Korea Pool, the consortium of free-to-air broadcasters, who were in a stronger financial position than they are today and bid competitively to retain the rights.

Since then, television industry revenue growth has weakened, particularly for the country’s free-to-air broadcasters, which have traditionally been big buyers of sports content. Audiences for club and national-team football games have also dipped recently. Another major football rights-holder, the Korean FA, in the last couple of months failed to elicit bids that met its valuation of its domestic media rights for the next cycle.

CJ ENM strategy

CJ ENM is one of Korea’s biggest media groups, operating free-to-air and pay-television channels as well as businesses in film, music and live events. The company was created from the merger in 2018 of media company CJ E&M – also referred to as CJ Media – and home shopping television channel CJ O Shopping. Both divisions were owned by conglomerate holding company CJ Group.

The group’s AFC deal was first reported by SportBusiness Media earlier this month. It was announced in late January but largely negotiated last year. DDMC Fortis sold the rights via direct talks with broadcasters rather than a tender.

The AFC package covers all the major national-team and club competitions, including the 2022 Fifa World Cup Asian Qualifiers final round, the AFC Champions League, the AFC Cup, the AFC 2023 Asian Cup in China, and the AFC U23 Championships in 2022 and 2024.

CJ ENM is understood to be primarily interested in the national-team content, to power growth at its flagship free-to-air channel, tvN.

While the company will show some of the other AFC content on its linear channels and OTT platform, a sublicensing or content-sharing deal looks likely. Some sources in the market told SportBusiness Media that JTBC would be interested in reacquiring some of the AFC content it stands to lose.

TvN has built a strong business on the back of entertainment and drama content. Its management’s aim to diversify the offering with sport drove its push for AFC rights. It is understood more sports acquisitions are being considered.

CJ ENM has not been a major player in the sports-media rights market for about 10 years. It ran pay-television sports channel Xports in a joint-venture with the IB Sports agency between 2005 and 2009, when the partners sold the channel to commercial broadcaster SBS.

CJ ENM bought sport rights intermittently after that sale. It acquired Uefa Champions League rights for the 2009-12 cycle but sold them on at a loss to commercial broadcaster MBC. It held WWE wrestling rights in 2008 to 2011.

Limited interest

CJ ENM is thought to have been the only serious contender for the AFC rights. There was interest among other players in the market, but only at values well below the current fee.

JTBC is understood to have had some interest in renewing its rights. But its appetite is likely to have been dampened by other major recent sports acquisitions, including the Olympics in 2026 to 2032 and the PGA Tour. The latter deal is understood to run for five years from 2020 to 2024 and to be worth about $6m per year.

The Korea Pool, composed of public broadcaster KBS, MBC and SBS, is thought to have shown interest too. But free-to-air broadcasters in Korea are under major business pressure due to declining total television advertising spend that is fragmenting over an increasing number of channels.

It is understood exploratory talks were also had by DDMC Fortis with all the other players in the market, including media group Eclat, the IB Sports agency, internet portals Naver and Daum, and the market’s major telcos.

DDMC pressure

While the $35m outturn is arguably a good result given tough market conditions, the falling valuation increases the pressure on DDMC Fortis. The agency has high sales targets after guaranteeing the AFC a big revenue increase for the 2021-28 period. Under a deal finalised in 2018, DDMC Fortis is guaranteeing the confederation close to $2.4bn for its global media and sponsorship rights, excluding media rights in the Middle East and North Africa, over the term of the contract. The guarantee value is around eight times that for the equivalent rights in the previous deal, with Lagardère Sports agency subsidiary WSG.

Korea is the fourth most-valuable market in the current AFC cycle, after Japan (where agency Dentsu pays $220m), the Middle East and North Africa (pay-television broadcaster beIN Media pays $150m) and China (the China Sports Media agency pays $107m).

While DDMC Fortis has many other markets, and a second four-year cycle in 2025-28, to make up the Korea shortfall, it is working in a difficult environment across Asia, where rights fees for many properties are in decline after years of strong growth.

But the agency is expected to get a good deal, or deals, from media and sponsors in China across the 2021-28 cycle. Chinese media-rights values have generally grown since the last deal was agreed in 2015. That was, itself, a period of particularly sharp competition and the current value is a massive 686-per-cent increase on the previous cycle. The Chinese government has also put a huge focus on developing football as a sport and an industry, including successfully bidding to host the Asian Cup national-team competition in 2023. The sport is a favourite of president Xi Jinping.