- Malaysian Football League will earn about MYR30m per year from Telekom Malaysia deal in 2020-22 cycle

- Previous deals, nominally worth just under MYR90m per season, both collapsed last season

- New deal considered good result for league given market conditions

The value of the Malaysian Football League’s domestic media and sponsorship rights have dropped significantly in the latest deal with Telekom Malaysia after two previous rights rounds of inflated valuations and, ultimately, collapsed deals.

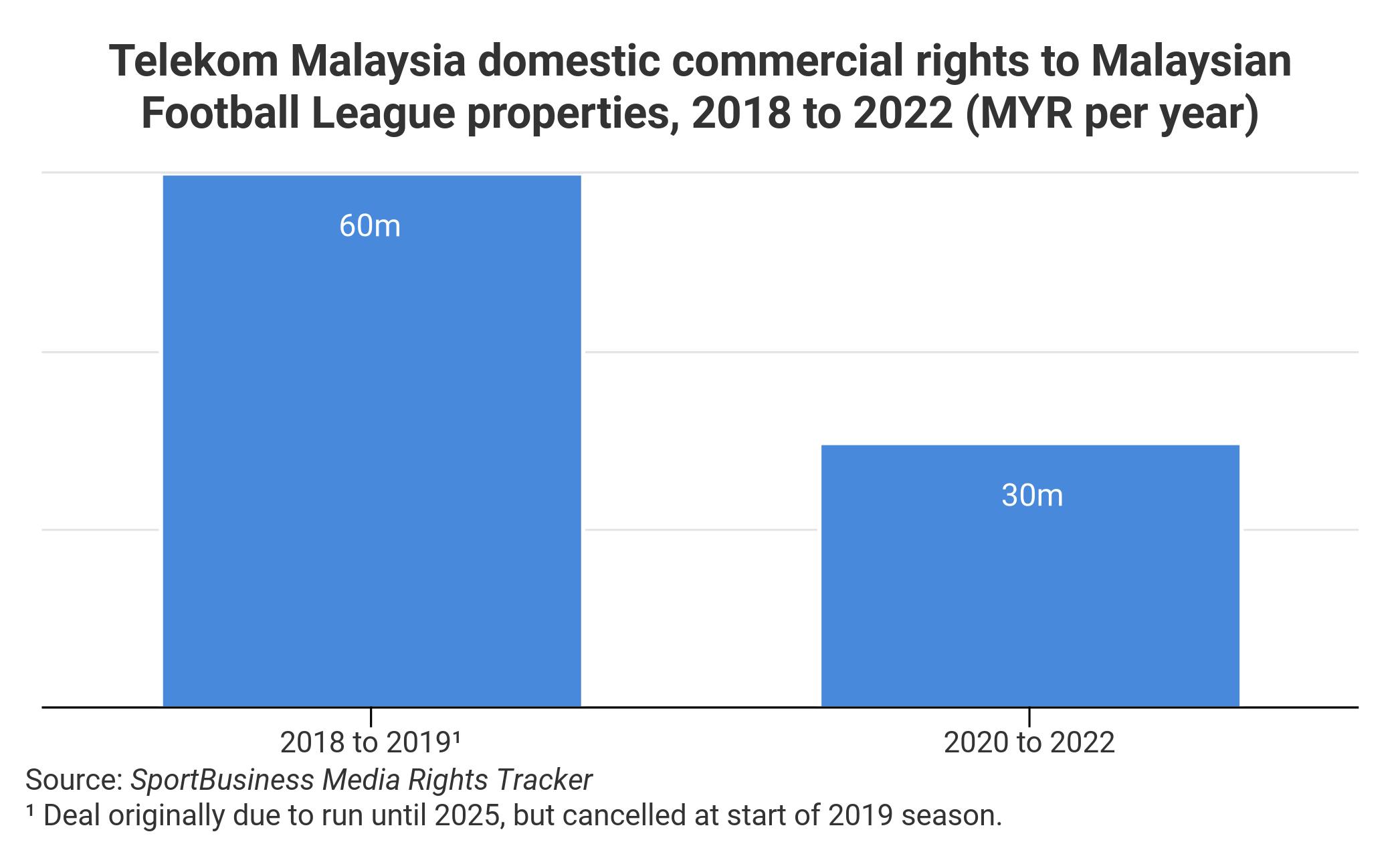

The league’s joint media and sponsorship rights deal with telco Telekom Malaysia, announced in February, is thought to be worth about MYR30m (€6.2m/$7m) per season over the three seasons from 2020 to 2022. The league has also agreed sponsorship deals with bank CIMB and online shopping platform Shopee, each thought to be worth a low single-digit million Malaysian ringgit figure per year.

The league’s previous deals, with TM and OTT operator iflix, were together valued at just under MYR90m per season. They began in 2018 and were due to run until 2025 and 2027, respectively. But TM walked out on its deal at the start of last season and iflix and the league decided to cancel their deal at the end of the season. The league is not thought to have earned anywhere near MYR90m in any of the years the deals were active.

TM’s new deal covers exclusive broadcast, mobile and online streaming rights for the top-tier Liga Super, the Liga Premier second division, the Piala FA and Piala Malaysia cup competitions and the Piala Sumbangsih season-opening match.

Live coverage of all matches is available on TM’s Unifi pay-television platform and via the Unifi PlayTV app, for subscribers to the Unifi TV Ultimate Pack. Those that don’t subscribe to the Ultimate Pack can access coverage via the Unifi TV set-top box and PlayTV app on an individual match basis or through monthly or seasonal passes.

TM’s deal also covers title sponsorship of the Piala Malaysia and co-sponsorship of the Liga Super, the Piala FA, the Liga Premier and the Challenge Cup competition. In TM’s previous deal, it was also the title sponsor of the Liga Super. In February, CIMB was announced as the title sponsor of the Liga Super for the 2020 season, with an option to extend for a further year. In the same month, Shopee renewed its sponsorship of the Piala FA cup competition for 2020, a third successive year.

Industry insiders say the new deal is a positive result for rights-holder the Malaysian Football League even if it means the league and clubs will have to tighten their belts in the coming years. The deal rekindles the league’s relationship with TM, one of the market’s most important media platforms and sports sponsors.

The league will hope the new deal draws a curtain on several years of turmoil in its commercial partnerships.

Winnie Chan, the MFL’s chief commercial officer, declined to disclose or comment on the values of the new or previous deals, but told SportBusiness Media: “I think it’s positive because we’ve got TM involved both as broadcast platform as well as a sponsor. It is a good deal in the sense that fans can watch on both pay-TV and on OTT… Also, TM’s mobile, broadband and TV businesses will activate their sponsorships in ways that will help enhance the fans’ experience on and off match days.”

No competition

TM did not face any competition for the rights. Chan said the league spoke to all the players in the market and that TM made the best offer.

“As with many other countries, it’s slim pickings [in the market at present],” she said. “We’ve got FTA, we’ve got pay-TV. We’ve got some OTT players as well. It’s the usual suspects. Whilst most broadcasters expect Malaysian sports to be free, we are grateful to have some who understand the real value and that the rights fee paid will help the participating clubs financially too.”

Malaysia’s leading sports broadcaster, pay-television operator Astro, for a long time the league’s broadcast partner, is not willing to spend money on the rights. The broadcaster’s business has been squeezed by cord-cutting and piracy, and its once-close relationship with the league broke down when it was sidelined in the last two rights cycles.

However, the league has again agreed a one-year deal with public-service broadcaster RTM to show one live match per week from the Liga Super. The league has traditionally agreed one-year deals with RTM, as the broadcaster’s budget is determined by the government on an annual basis. The agreement is a three-way deal between RTM, the MFL and TM.

Chan said TM is open to sublicensing deals and “other opportunities” with other free-to-air broadcasters in the market.

Failed deals

TM’s previous eight-year deal, due to run until 2025, was worth about MYR60m per year. TM walked away from the deal in April last year, early in the season, saying the two parties “were unable to agree on several fundamental commercial terms necessary for the intended collaboration”. Market insiders said the deal was considered overpriced and TM, which is a ‘government-linked company’, may have experienced political pressure to cancel it. Government-linked companies are an official category in Malaysia, as companies owned by state investment funds.

The cancellation soured the relationship between TM and the MFL, and each took legal action against the other in the aftermath.

The iflix deal was for 10 years, from 2018 to 2027, and was worth an average of about MYR30m per year. The deal was cancelled at the end of the 2019 season. Market insiders say iflix struggled with the cost.

Iflix was streaming coverage for free to registered users via its mobile and internet-connected television apps. Its rights included all matches from the Liga Super, the Liga Premier and the Piala FA.

Before these two deals, the now defunct MP & Silva agency had struck a deal with the Football Association of Malaysia – then the rights-holder – to pay a minimum guarantee of MYR70m per year for its media and marketing rights for six years from 2016 to 2021. The deal collapsed in 2017 after MP & Silva struggled to generate revenue from the rights.

Rift healed

The new deal marks a healing of the relationship between TM and the MFL.

Chan said: “Both parties decided to relook at the situation and make football the centre of their attention. A lot of things have changed in terms of the people that are managing the project and the contracts.”

Both organisations have had changes of leadership in the last year. In September, Hamidin Mohd Amin, the president of the Football Association of Malaysia, also became president of the MFL. In June, TM appointed a new chief executive – Noor Kamarul Anuar Nuruddin replaced Datuk Seri Mohammed Shazalli Ramly, who was in charge when the previous MFL deal was agreed but had left the company in 2018.

Chan said another reason TM returned to domestic football was that the sport remains important to the company’s marketing strategy. The company is a current sponsor of the FAM and English Premier League team Manchester United. TM has already started activating its sponsorship rights – for the first match of the season it ran a competition for a “money can’t buy” match experience for fans involving local influencers and a tour of leading club Johor Darul Ta’zim’s new stadium.

Sports broadcasting in Malaysia – particularly of football, the country’s most popular sport – is a political business, and one well-placed market insider said this week that TM is likely to have also been encouraged by political figures to support the league by doing a new deal.

TM’s exit from the MFL deal last year was considered by some market insiders as part of a wider retreat from sport. The company was under heavy scrutiny from the then newly-elected Malaysian government over its poor financial performance. It’s not yet clear if the company’s ambitions in sport now extend beyond the MFL rights.

Read the interview with the MFL’s Winnie Chan here.