An estimated 229 million people in India watched the first week of the fifteenth edition of the Indian Premier League at the end of March 2022.

On May 29, the Gujarat Titans, a brand-new franchise owned by private equity firm CVC Capital Partners, capped a spectacular debut season by winning the final.

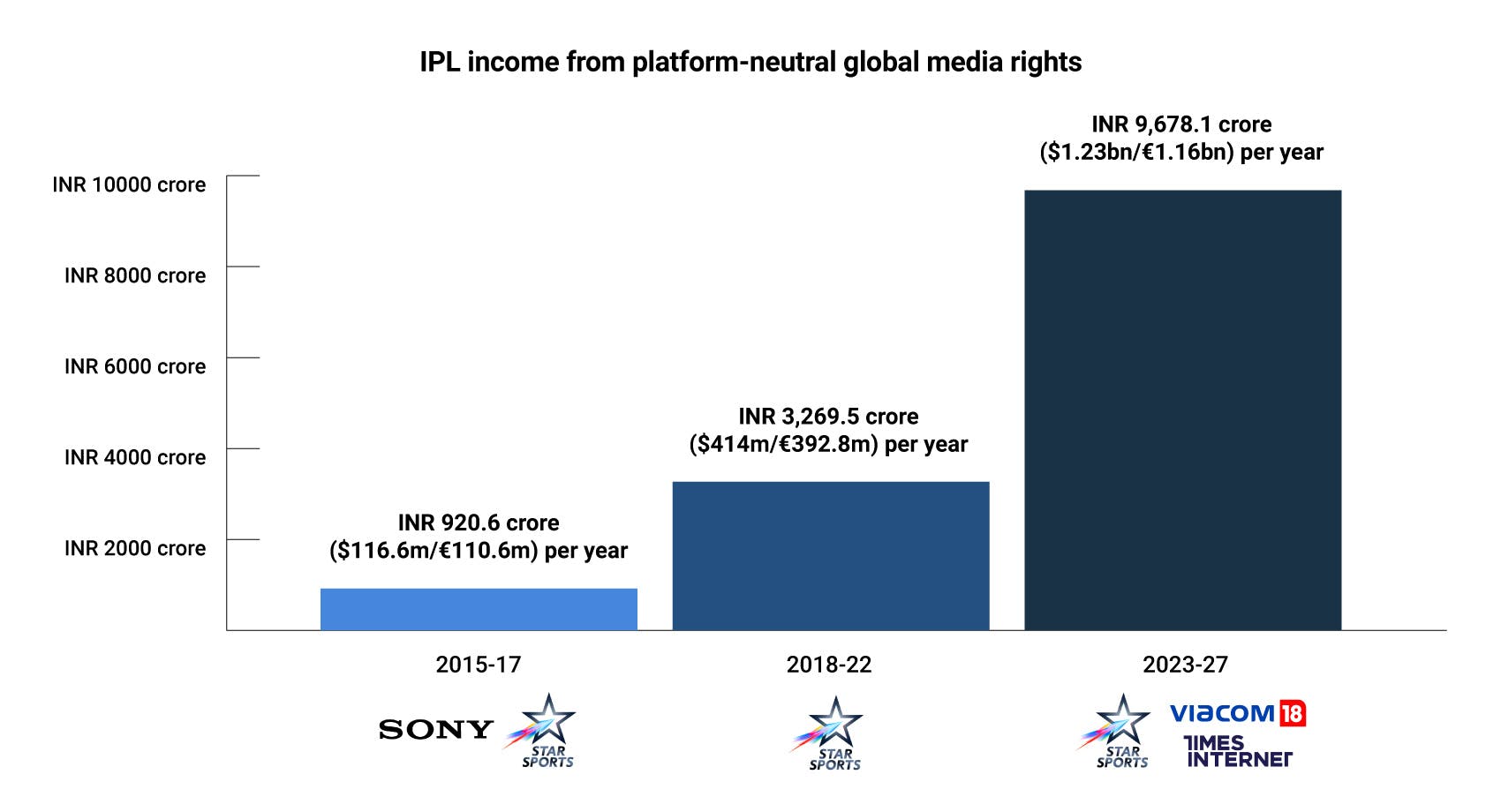

What followed in June was even more striking, as the IPL’s global media rights value more than doubled for the five-year cycle from 2023 to 2027.

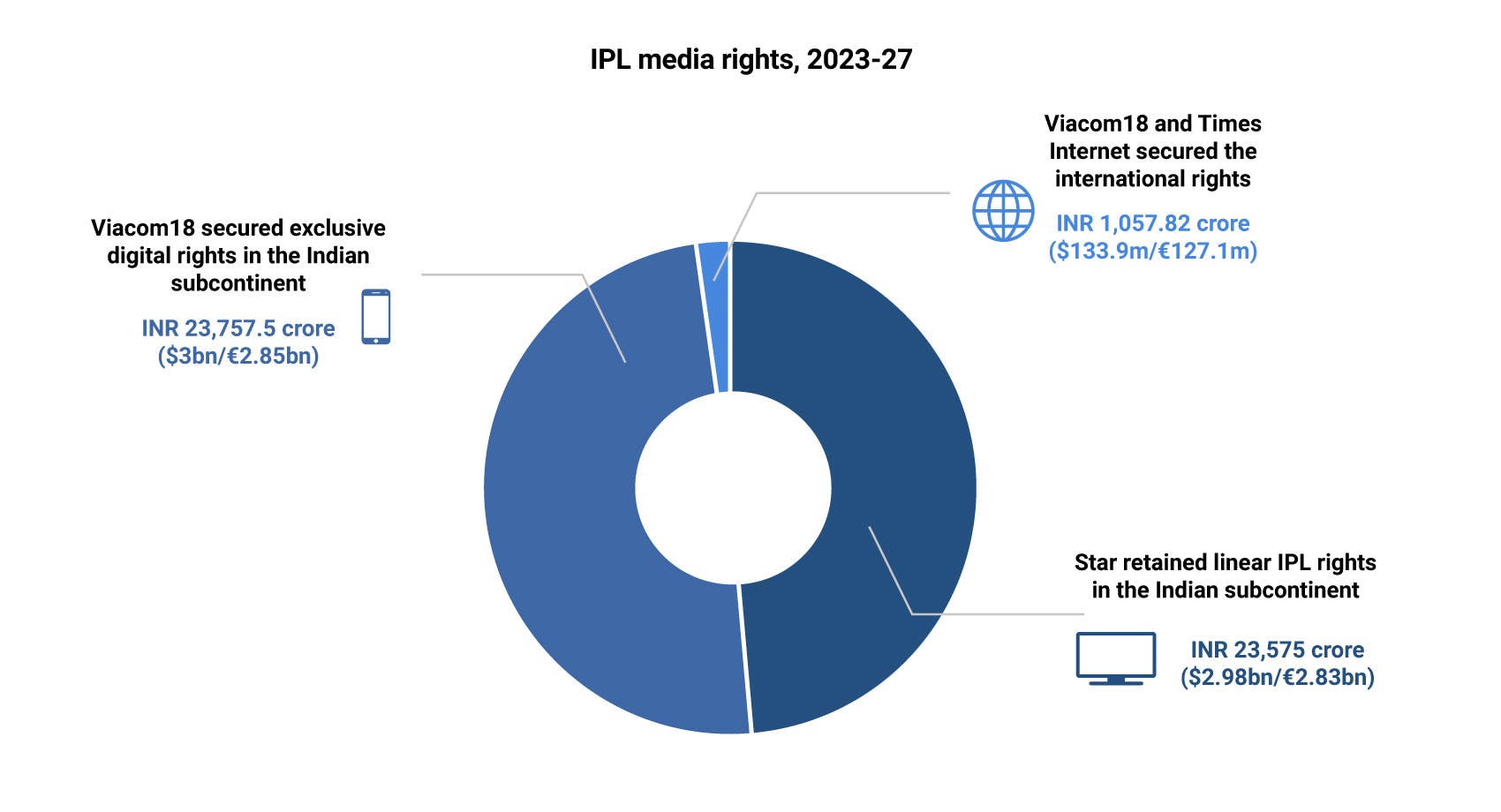

The IPL’s total media rights value over the five years, from 2023 to 2027, will be INR 48,390.32 crore ($6.1bn/€5.8bn). In Indian rupees this represents a 196-per-cent increase on the INR 16,347.5 crore that Disney-owned Star paid for exclusive, platform-neutral global rights, from 2018 to 2022.

Star Sports broadcast the 2022 tournament but from 2023, it will share domestic rights with media group Viacom18.

Rapid rise

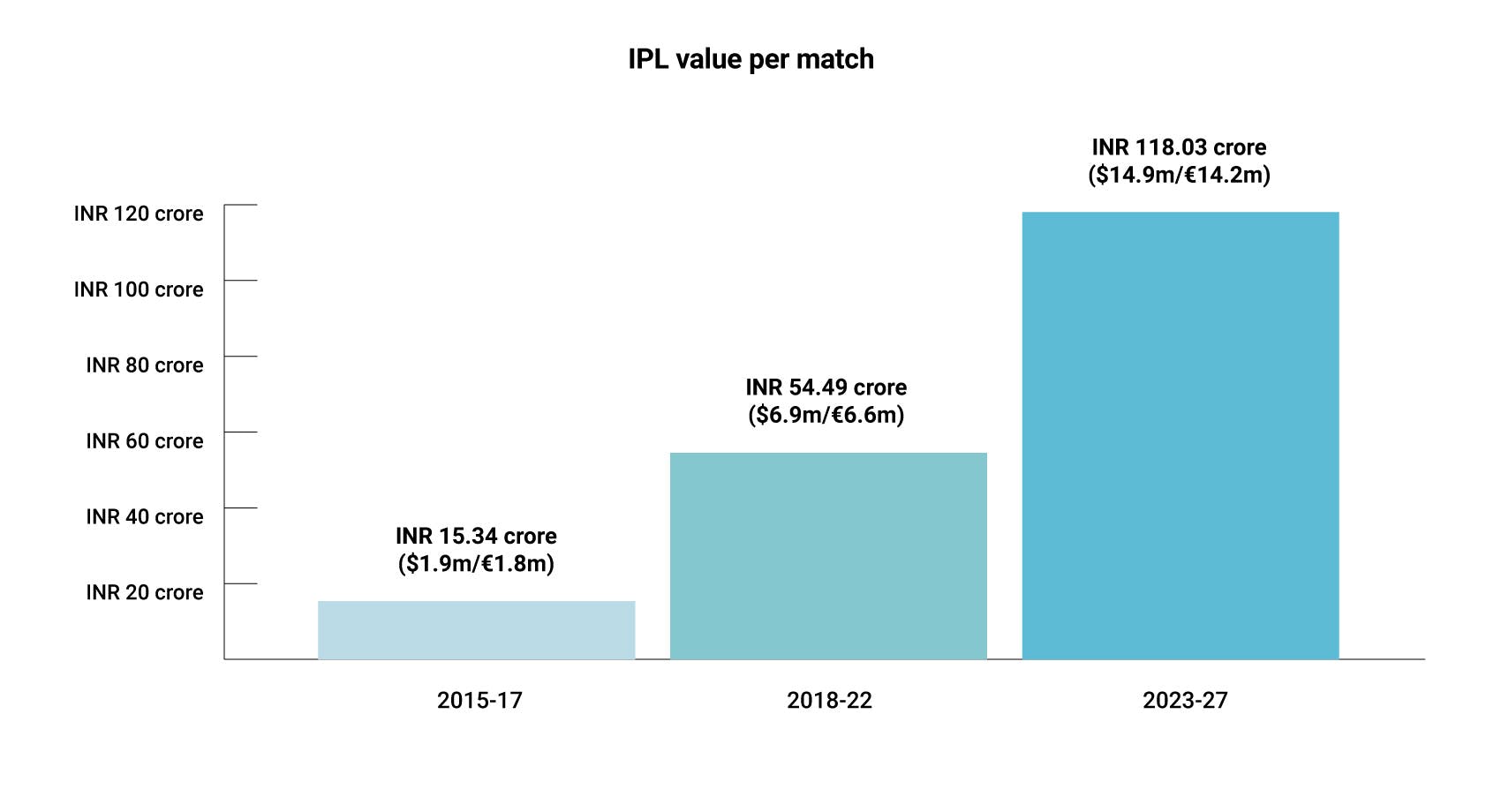

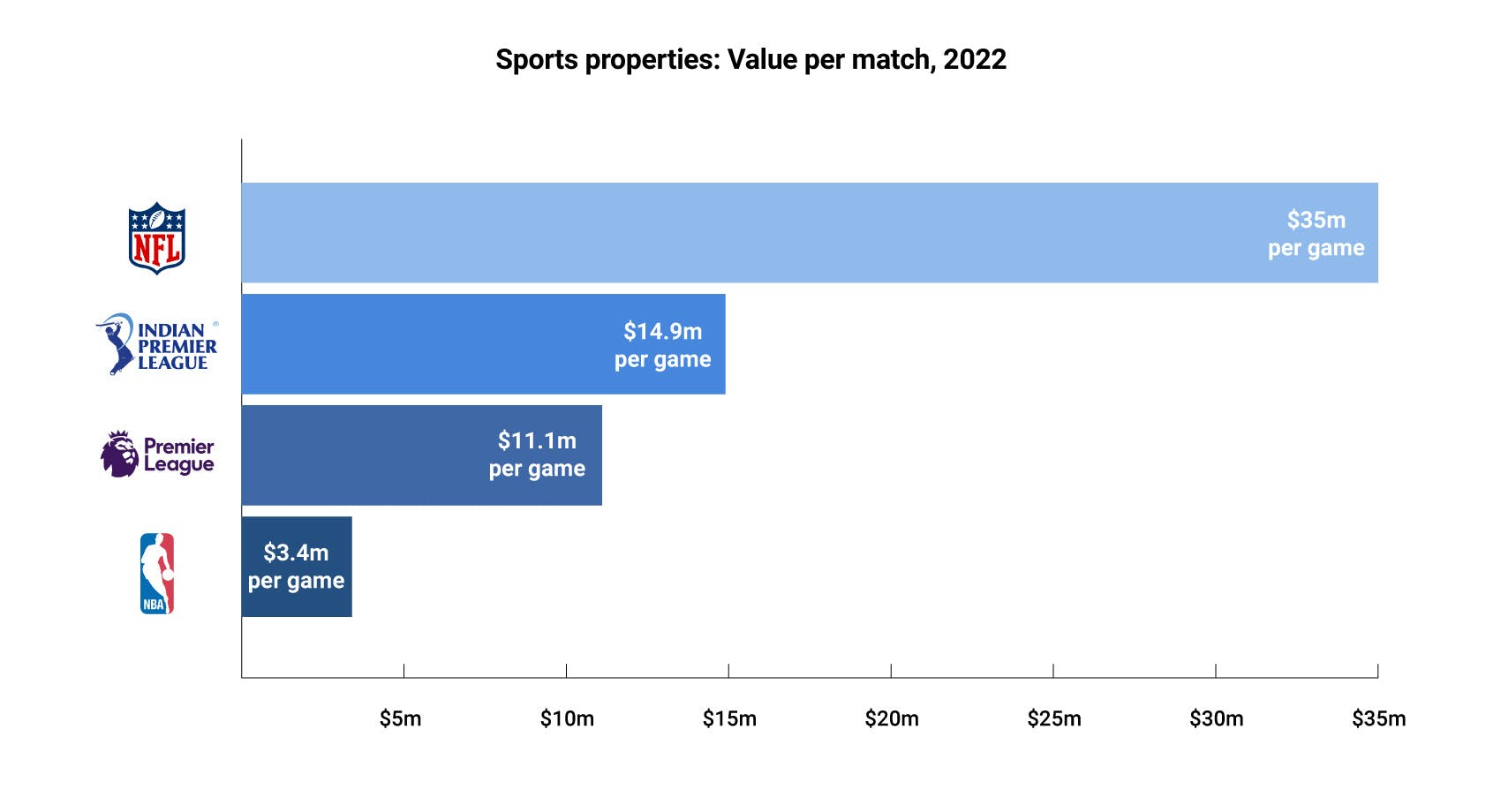

In the years since its inaugural edition in 2008, the IPL has become the second most valuable sports property in the world, measured in media rights fee per match.

The IPL’s growth is inextricably linked to India’s economic growth and media penetration. With cricket unlikely to lose primacy among sports in India, this relationship will deepen as communications technology and mobile adoption spread further among the country’s 1.4 billion people.

Since the IPL auction for the previous rights cycle was held in September 2017, internet usage has grown exponentially in India. 5G services will be rolled out in India over the next year or two, increasing the value of a prime marquee media product such as the IPL.

The general shift in terms of media consumption in India will have only gathered more steam by the time the next IPL cycle begins in 2028.

2023-27

The IPL’s media rights from 2023-27 will bring in just over $6.1bn for the Board of Control for Cricket in India, the governing body for Indian cricket that owns and operates the IPL.

Star has lost out on the digital and international rights it held in the previous cycle, and will almost certainly lose subscribers to its Hotstar subscription streaming platform. However, the Disney-owned broadcaster is confident it will be able to recoup its outlay for linear rights despite the threat to advertising spend posed by challenging global macroeconomic conditions and competition from Viacom18.

Viacom18 is a media group owned by conglomerate Reliance, Paramount Global (formerly ViacomCBS) and, pending closure, the media investment vehicle Bodhi Tree, which is backed by James Murdoch and former Disney president Uday Shankar. The entity has bet big on the continuing rapid rise of digital penetration in India, with the prospect of majority shareholder Reliance also bundling the IPL rights with mobile, internet and data packages provided by its telco Jio – the largest in India.

Over tenfold uplift in eight years

From 2008-2017, pay-television broadcaster Sony paid INR 8,200 crore ($1.04bn/€985m) for linear rights to the IPL in the Indian subcontinent. Initially, digital and international rights were split between a number of broadcasters, but for the last three years of the ten-year cycle, Star paid INR 302 crore for digital and international rights.

The tender format helped push the value of digital rights above that generated by linear rights, with Viacom18 determined to ensure its exclusive hold over digital rights. Sony and Star pushed Viacom18 towards a higher figure but both were ultimately content to walk away.

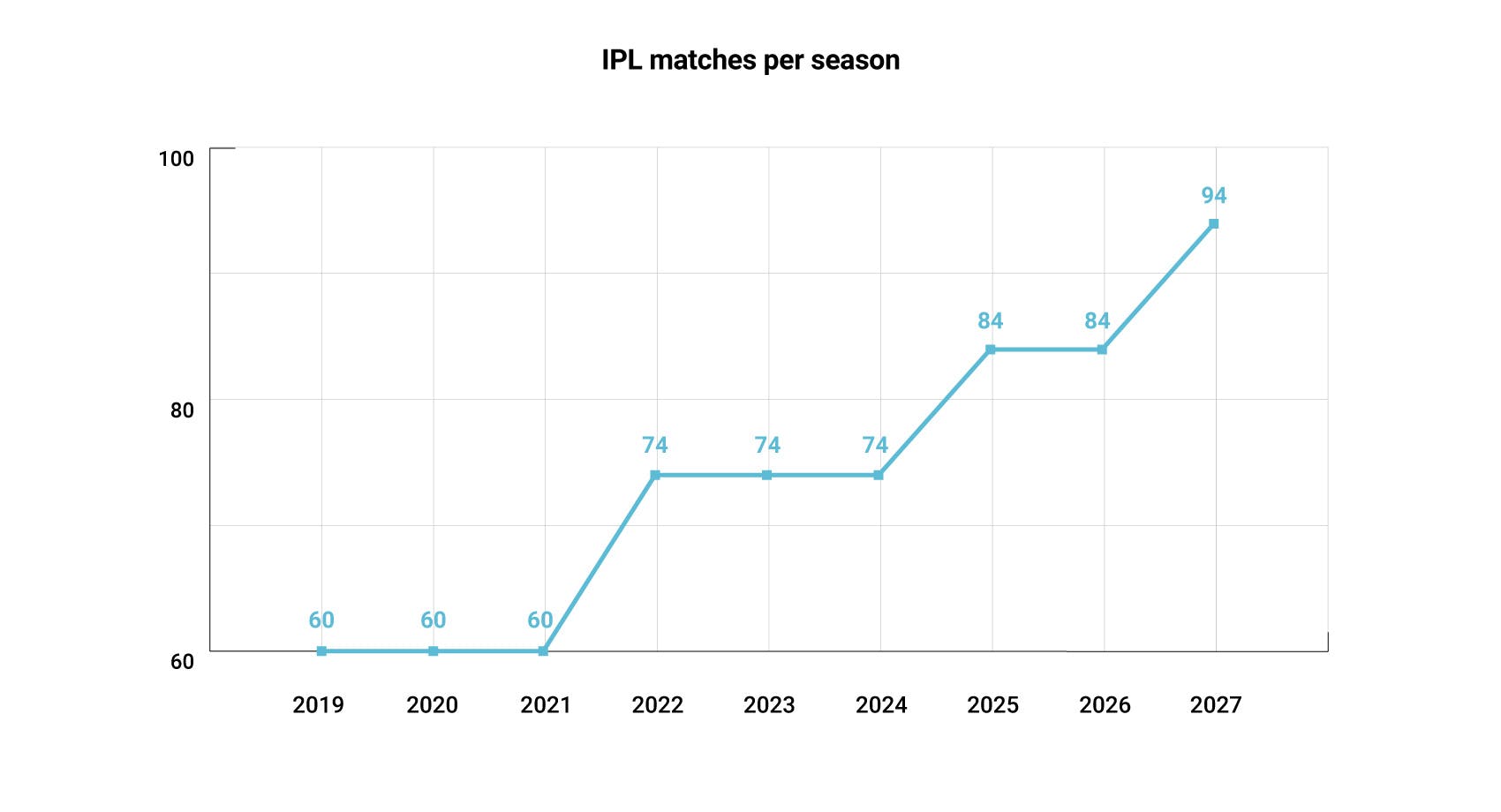

Value per match

The previous cycle, from 2018-22, comprised 60 games per season, at a total of 300 matches over the five years. The new cycle, from 2023-27, will reach 410 matches over the five years, an increase in inventory of 36.7 per cent.

On a per-match basis, the value in the previous cycle was INR 54.49 crore. It has now increased to INR 118.03 crore per match, an uplift of 116.6 per cent.

Digital first?

Much has been made of an inflection point having been reached in India at the IPL auction, after which digital will extend its ascendency over linear.

India is undergoing a digital revolution, in no small way powered by Reliance Jio, which since its launch in 2016 has used bundles of free calls, cheap data and high-speed fibre broadband to become the biggest telco in the country. Reliance is at present the majority shareholder of Viacom18.

Reliance chairman Mukesh Ambani has previously talked about data as the ‘new oil’ and heralded India’s rise in total mobile data consumption from 155th in the world to number one.

Jio has around 380 million active subscribers and Reliance could exploit its IPL rights on a free basis, bundled in with mobile and internet packages. The prospect of 5G spectrum auctions in India widens the possibilities further.

For now, though, advertising spots on linear television command higher prices than those on digital, but with the caveat that digital holds the ability to tap into the wider ecosystem of telco packages and e-commerce.

Comparison to other global leagues

The IPL’s new deal is worth just under $1.2bn per year, far lower the English Premier League’s media rights income of around $4.2bn per season in 2022.

However, the IPL deals contain a total of 410 matches over the five years, while the Premier League has 380 matches each season.

Domestic dominance

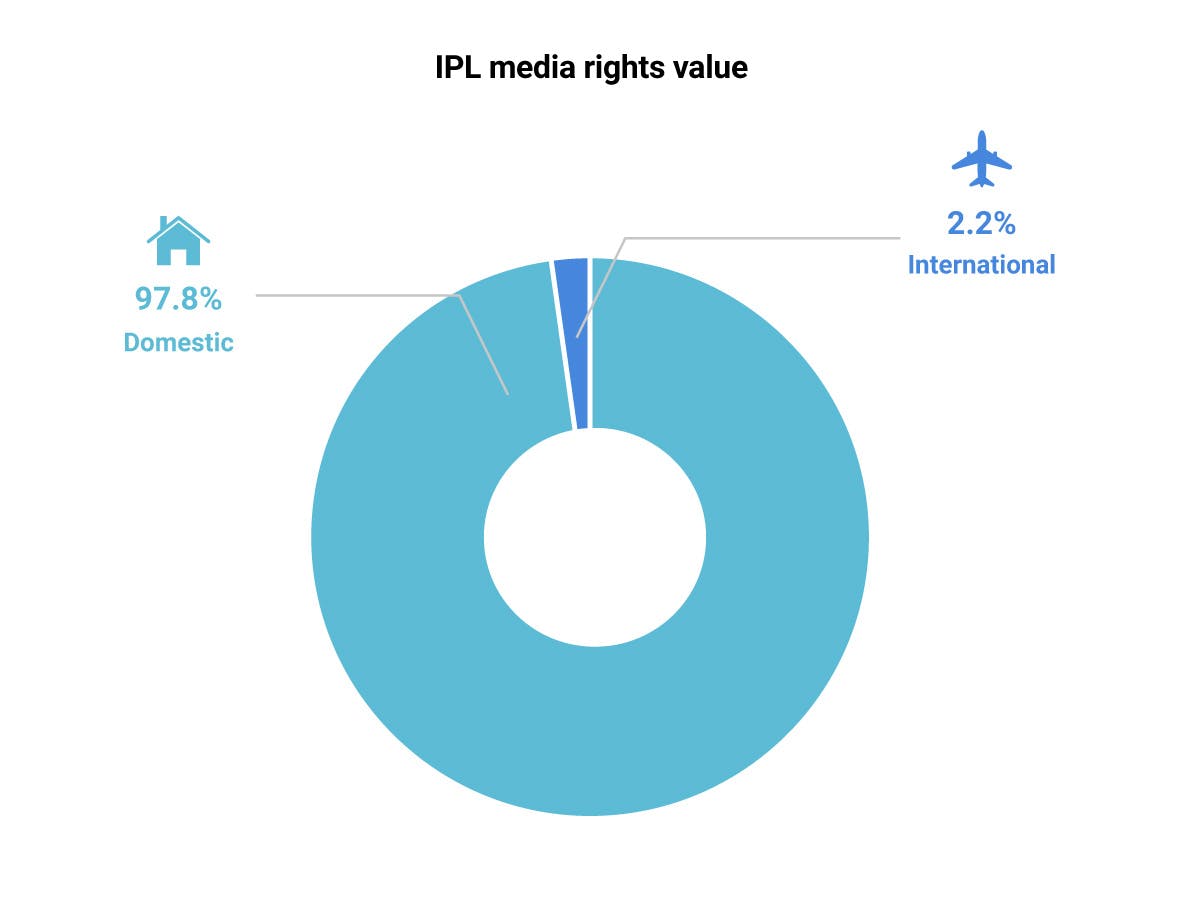

In its next cycle, the English Premier League’s international media rights value climbed above its domestic value for the first time. The IPL, by contrast, is more like the NFL, as a domestic powerhouse with relatively limited international appeal.

The NFL, however, has the disadvantage of being very much an American sport. Cricket, while not having the universal following of football, has a far wider international footprint, meaning the IPL perhaps has some work to do in upping its game outside its home market. It also starts with a natural advantage, given the large Indian and South Asian diaspora.

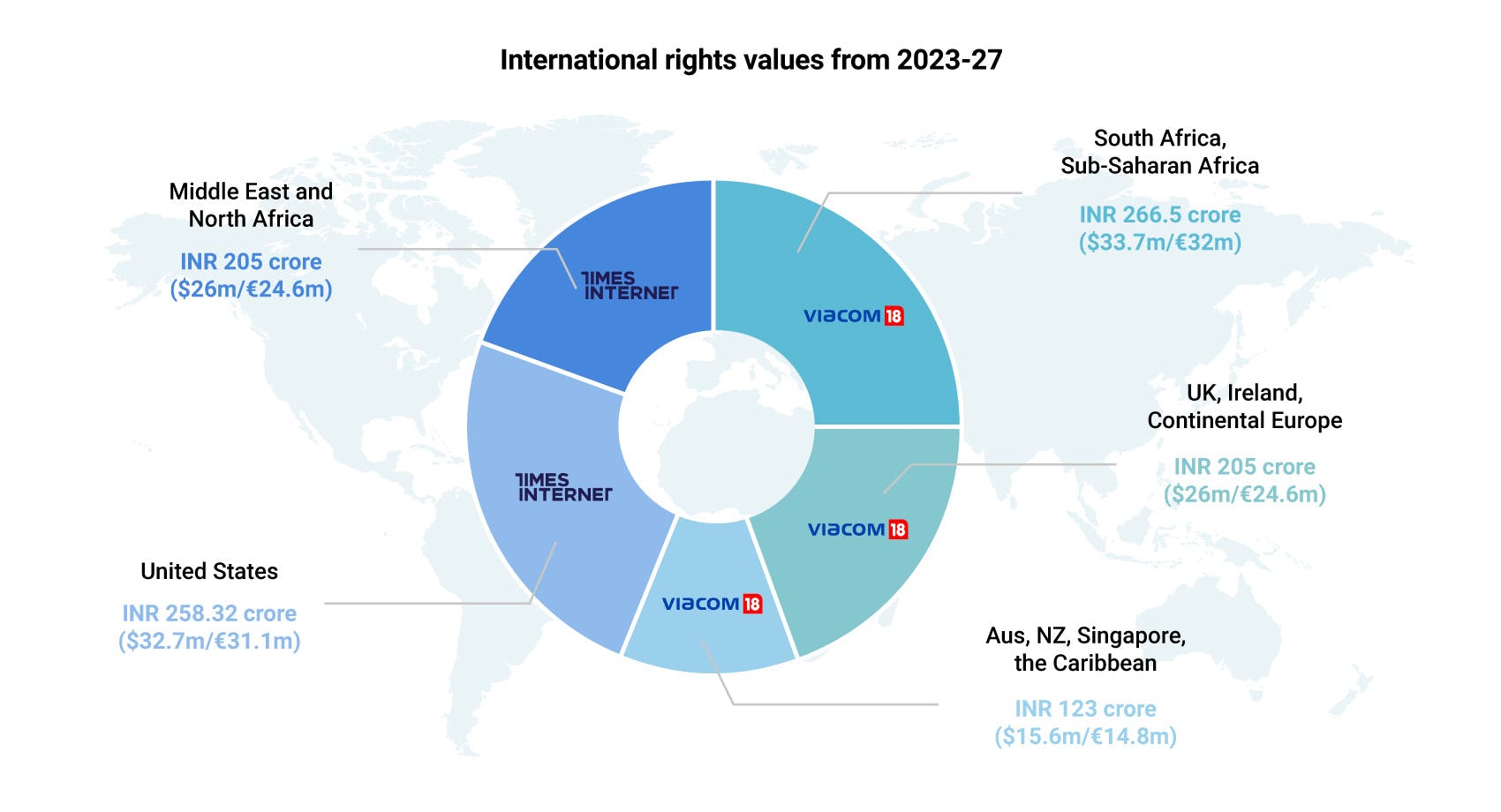

International rights distribution

The IPL’s international rights sold for $134m in the new cycle from 2023-27, or $26.8m per year. In the previous cycle, the international rights made up around $29m-$30m per year out of Star’s global spend of about $420m per year.

The value of IPL international rights has therefore decreased both in absolute value (by about 9 per cent) and as a percentage of the total rights value (from about seven per cent to about two per cent).

The higher value paid for sub-Saharan Africa compared to the UK was due to pay-television broadcaster SuperSport also competing for the rights in that territory.

One prominent area to watch is the US market. The cricket fan in the US is somewhat unique – relatively educated and affluent, more digitally savvy than the average sports fan and accustomed to paying for niche sporting content, be it via streaming or cable.

Times Internet is a tech company which is part of Indian media conglomerate the Times Group. The group owns cricket-focused pay-television broadcaster Willow, which is the primary cricket broadcaster in North America.

Monetising $6.1bn

Star previously agreed consolidated ad sales across linear and digital with an overall strategy; it will now be under greater pressure as Viacom18 will also be competing in the same market with advertisers. There is also the prevailing macroeconomic backdrop, in India and globally, with inflation affecting real disposable incomes.

Nevertheless, the IPL remains a magnet for advertisers given its position as mass entertainment product with no regional barriers. The competition will also boost subscriptions across linear and digital.

Beyond 2027

The rights were sold on a per-match basis on the understanding that the number of matches will increase to 94 by 2027. This means a longer window for the IPL in the international cricket calendar, stretching from March to May.

The next International Cricket Council Future Tours Programme, from 2024 onwards, will be marked out for the IPL so that cricketers will not have to choose between representing their country and the IPL. The direction of travel is clear: more IPL and less bilateral cricket.

With India’s large population, the centrality of the IPL to its entertainment landscape and the upward trajectory of telecommunications and digital penetration in the country, few in the industry would bet against another uplift in the rights fee in the next cycle.

Exchange rate used (as of 28/6/2022): $1 = INR79 / €0.95