The National Football League is by far the most valuable sports property in the world by media rights revenue.

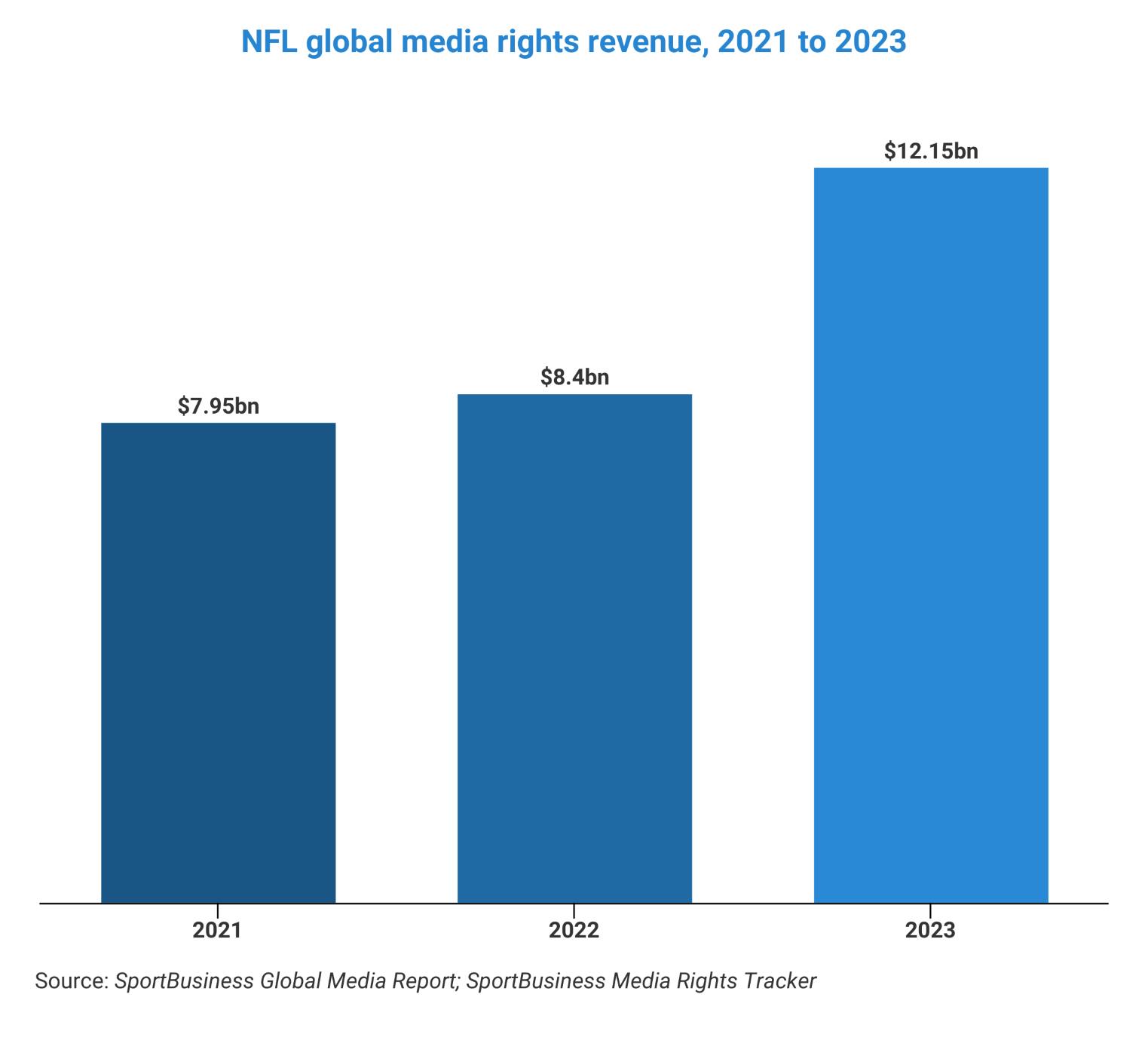

During the 2022 season, which culminated in the Super Bowl on Sunday, the NFL has brought in about $8.4bn (€7.8bn) in global media rights fees. The vast majority of this revenue derives from domestic media rights deals with US media giants Fox, Disney, Paramount, NBCUniversal and DirecTV.

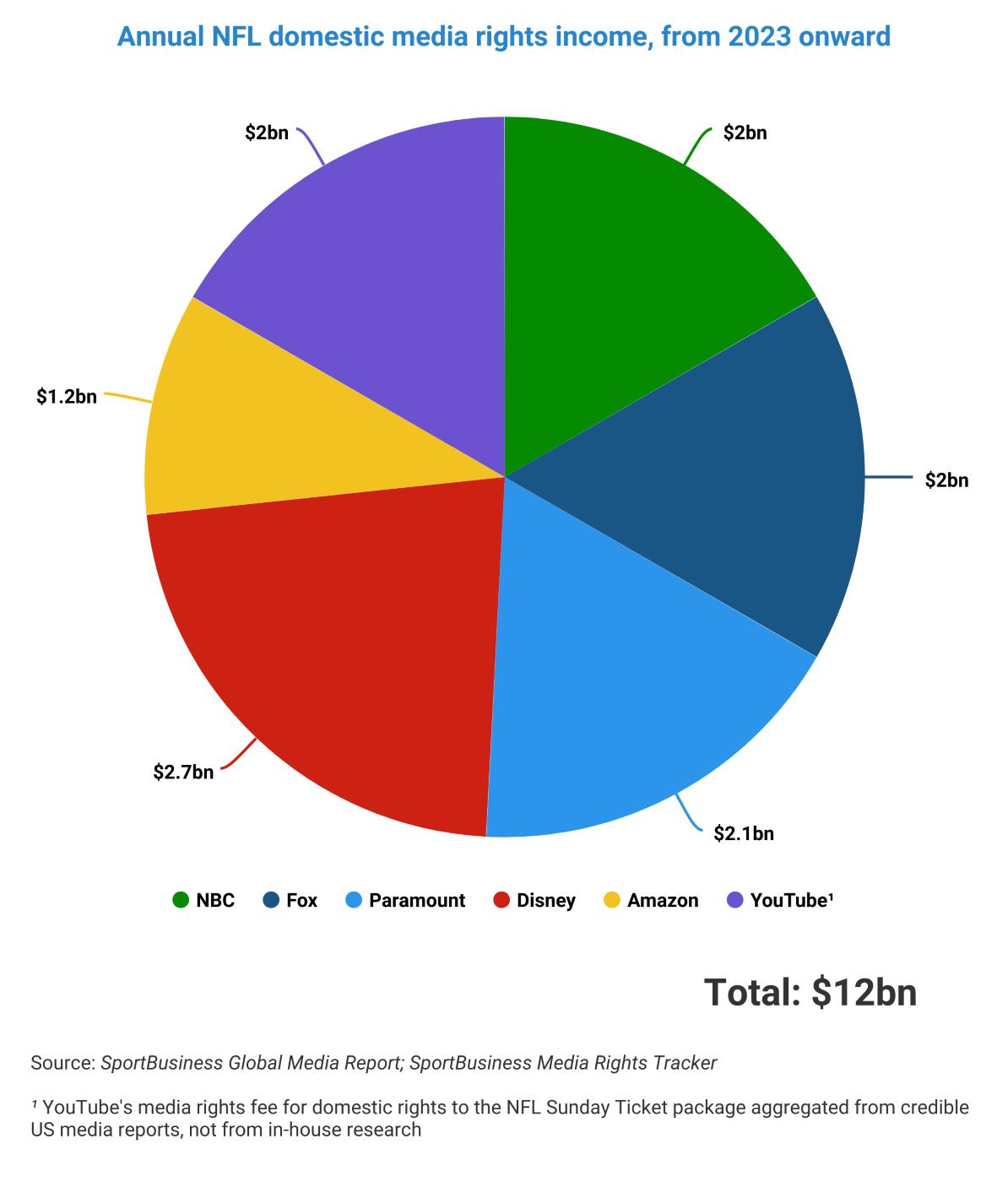

From next season, the league will earn even more, having signed a full slate of domestic media rights deals from 2023 onwards. The league’s domestic media rights revenues will increase to around $12bn per year from 2023.

In 2021, the NFL signed deals spanning 11 seasons, from 2023 to 2033, that are collectively worth more than $110bn. The NFL renegotiated its deal with Disney from 2022 onward to include some of the increased inventory that the broadcaster will have in the new cycle from 2023.

These renewals were completed by the recent announcement that the Sunday afternoon games on NFL Sunday Ticket beginning with the 2023 season will become an add-on component to the YouTube TV streaming service and available as a standalone offering on YouTube Primetime Channels. This deal is understood to be worth about $2bn per year over seven years, from 2023 to 2029.

Beyond North America, where Canada is a significant market through its primary deals with media company Bell Media, the NFL’s most valuable media markets at present are the UK and Germany. The NFL also operates NFL Game Pass, its direct-to-consumer subscription streaming service. It recently signed a 10-year agreement with DAZN which will see the sports streaming service and media company distribute the platform non-exclusively around the world, beginning with the 2023 season.

Domestic deals

The NFL is a domestic powerhouse, earning the highest rights fees in what is the world’s pre-eminent media market.

For the long-term renewals of its domestic rights, there was little to no competition between the US media giants for each package. Each package was too expensive for a company to acquire more than one, so expanding the digital rights made available to the media groups and shaping the offer to their strategic needs was essential to add value.

The NFL’s decision to allow Disney and NBC to each reserve one NFL game per season exclusively for their streaming platforms helped in securing strong increases, as did the decision to provide broadcasters with rights to simulcast all respective games across their linear and digital platforms.

Amazon’s deal for Thursday Night Football rights perhaps best demonstrates the premium that can currently be placed on moving rights from linear to digital in the US.

Within the initial rights extensions, there are a number of notable changes in addition to a sharply heightened presence of streaming for each partner, such as a shift of Thursday night rights from a shared situation to exclusivity for Amazon, and a redistribution of future Super Bowls that will incorporate Disney-owned commercial broadcaster ABC into the broadcast rotation for the game for the first time since 2006.

Domestic distribution from 2023 onwards

NBC: The Comcast-owned network retained its rights to Sunday Night Football, which has spent the past decade as the top-ranked primetime programme in all of US television. The network will have Super Bowls in 2022, 2026, 2030, and 2034.

CBS: The Paramount-owned network maintained its existing rights for the league’s Sunday afternoon American Football Conference package. The network will have Super Bowls in 2024, 2028, and 2032.

Fox: The network kept its rights to the Sunday afternoon National Football Conference package. Critically, it also gains expanded rights to offer NFL programming on Tubi, its free-to-watch streaming service that thus far has lagged behind many of its other network-backed rivals in the emerging space. The network will have Super Bowls in 2023, 2025, 2029, and 2033.

ESPN: The Disney-owned network kept its Monday Night Football rights. Similar to Peacock, ESPN+ also has rights to stream one national game exclusively, which started in 2022. The Monday night package will additionally expand with six additional games each year with the creation of additional doubleheaders. ESPN also gets a new divisional game to its schedule, adding to existing rights for a Wild Card game each year, and ABC and ESPN will carry Super Bowls in 2027 and 2031.

Amazon: The streaming and e-commerce giant expanded its prior rights by taking on the Thursday night package exclusively, with the exception of over-the-air broadcasts in the cities of participating teams each week, a provision that also applies to Monday Night Football on ESPN.

YouTube: The Alphabet-owned social video platform has been experimenting with live sports content over the past two years, dipping its toe in the water with soccer rights in Brazil. However, YouTube believes a property the size of the NFL is necessary to begin driving subscription revenue via its subscription YouTube TV product. YouTube will take over the Sunday Ticket package previously held by DirecTV, which shows all other games not televised by the aforementioned five media groups.

Comparison to other properties

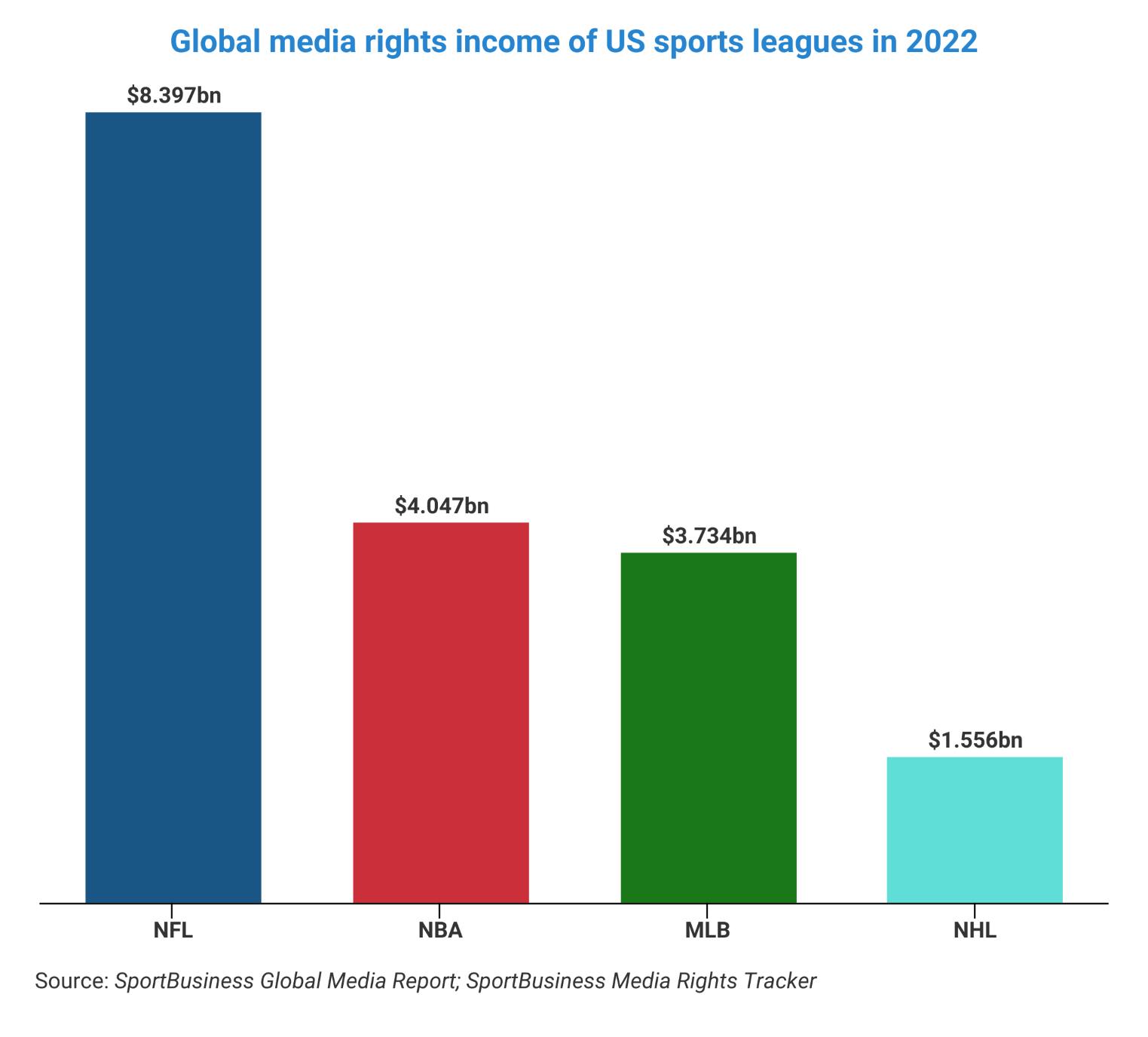

The NFL leads the way among the US’s ‘big four’ sporting properties, which also include the National Basketball Association, Major League Baseball and the National Hockey League.

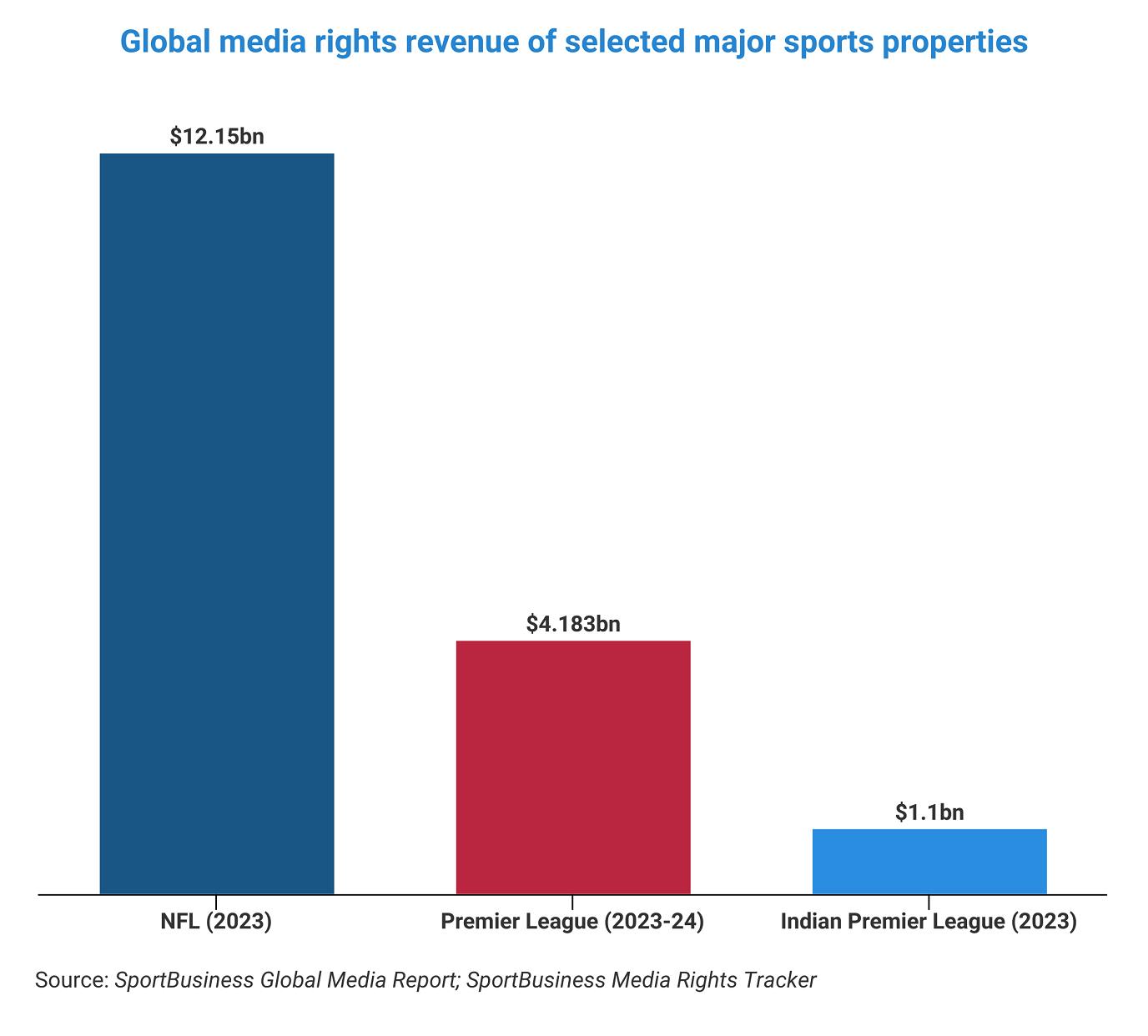

Despite the international growth of the English Premier League and the bumper deal for the new cycle of the Indian Premier League, the NFL will still tower above the two much-heralded sports properties in the coming years in terms of global media rights.

The English Premier League’s global rights are valued at about $4.183bn per season from 2022-23 to 2024-25, while the Indian Premier League will earn around $1.1bn per year from 2023-27.

International growth

The NFL believes that, given the high level of saturation in its domestic US market, the next phase of high-volume fan growth will have to come from international markets.

The league has a multifaceted approach to extend its reach internationally, involving social media, events, partnering with local government and schools to boost participation in the sport, and other marketing activities.

The NFL also seeks growth through hosting games in international territories, with three games in the UK this season and one in Germany providing a boost to interest in key European territories.

Media rights deals, though, are the central pillar of this growth strategy. At present, the NFL has ten primary markets in which it is focused on strong growth: Canada, Mexico, Germany, the UK, France, Spain, Brazil, Australia, China and Africa. The Nordics are also an important market for the NFL.

However, it also invests beyond these regions and is currently working with around 80 global broadcasters, with the league available in 25 languages.

The NFL operates three tiers of distribution with a strategy of building awareness, developing greater interest and then, in an ideal case, a deep engagement with the league and its teams.

The first tier is free-to-air exposure to ensure wide reach and awareness of the property. Next up is pay-television coverage for the more committed sports fan. The third tier is NFL Game Pass, the league’s subscription OTT service which offers comprehensive coverage of all NFL games live and on demand, highlights, documentaries and other content.

Canada, UK, Germany

In Canada, the NFL’s primary broadcaster is Bell Media, whose pay-television TSN channels has been televising NFL games in Canada since 1987, while its free-to-air CTV channel has aired matches since 2007. Bell Media is thought to be paying in the region of $40m to $50m per season for NFL rights in Canada. DAZN also operates NFL Game Pass in the country.

Pay-television broadcaster Sky is the NFL’s primary broadcast partner in the UK, in a deal running from 2020 to 2024. Sky is understood to pay about $25m per season in its current deal, up from about $15m per season in its previous deal, from 2015 to 2019.

The NFL also recently more than doubled its media rights income in Germany, Austria and Switzerland, capitalising on intense competition amid the league’s snowballing popularity across the region. Commercial broadcaster RTL will pay between $10m and $13m per season for exclusive free-to-air rights to 80 games each year, while DAZN agreed to increase its fee to $10m per season in a new three-year deal from 2023 to 2025.

Game Pass

NFL Game Pass enables fans outside the United States to watch every NFL game throughout the regular season and postseason, including the Super Bowl. In addition to NFL games themselves, the NFL Game Pass subscription offers access to NFL Red Zone, and extensive content from the NFL Network and archival material from NFL Films.

From the 2023 season, it will be available through the DAZN app either as a standalone subscription or an add-on to an existing DAZN package to customers worldwide, excluding China.

Since October 2019, Game Pass had been distributed in 181 markets by OverTier, a company set up by a joint venture of sports investment vehicle Bruin Sports Capital, with advertising agency WPP taking a small stake. From 2017 to 2019, the company distributed Game Pass in Europe only.

NFL Game Pass has a range of prices across different international territories.

Betting rights

Data and technology firm Genius Sports holds exclusive global rights to distribute the NFL’s official league betting data and streaming rights, in an agreement signed in April 2021. The deal, which runs for six years from 2021 to 2026, is thought to be worth in the region of $120m per year. The deal’s value is split across cash and equity – a deal in which the NFL took a five-per-cent stake in Genius.

Exchange rate used (as of 9/2/2023): $1 = €0.93