- Pay-TV broadcaster agreed €5m per season revenue floor with league

- No deals yet struck in key UK, Australia, South Africa markets

- Canal could see ‘multi-million-euro loss’ over 2019-25 cycle

Pay-television broadcaster Canal Plus is facing a big loss on international rights to the French Top 14 rugby union competition following difficulties securing distribution in key markets.

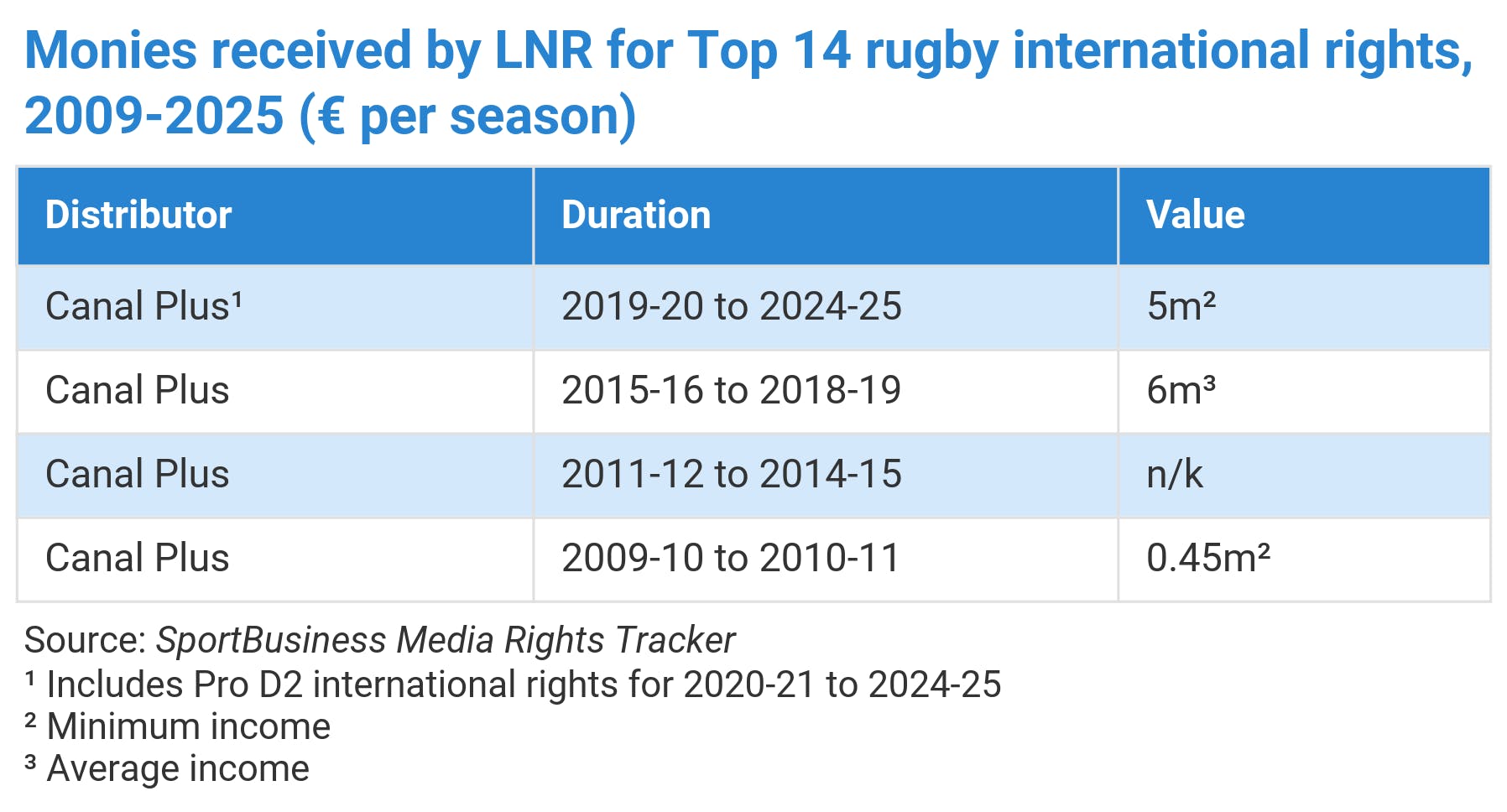

The French broadcaster pays the Ligue Nationale de Rugby a minimum guarantee of €5m ($5.5m) per season over the six seasons from 2019-20 to 2024-25, for the rights to distribute international rights to the Top 14, France’s top division of rugby union, and – from 2020-21 – the second-tier Pro D2. Discovery-owned Eurosport holds Pro D2 international rights until the end of the 2019-20 season.

The LNR and Canal had employed a pure revenue share in the 2015-16 to 2018-19 Top 14 international rights cycle.

But among the key territories of the UK, Australia, South Africa and New Zealand, Canal Plus has only agreed distribution in the last country, with pay-television broadcaster Sky. It also has yet to announce deals in other important territories such as Asia-Pacific and the Middle East & North Africa.

One industry expert told SportBusiness Media: “It appears as though Top 14 international distribution has collapsed — Canal Plus will be looking at a multi-million-euro loss.”

Some industry players had expressed surprise at the size of Canal Plus’ minimum guarantee, which was agreed last February, given current values for the international rights to other high-profile rugby union competitions.

The RDA agency pays a minimum guarantee of about €3.75m per season for European Professional Club Rugby events, consisting of the top-tier Champions Cup and the second-tier Challenge Cup, from 2018-19 to 2021-22.

RDA also pays a flat $4.4m (€3.9m) per season for international rights to England’s top-tier Premiership from 2016-17 to 2020-21, in a joint deal with French telco Altice. In addition, RDA pays a minimum guarantee of about £500,000 (€576,440/$638,855) per season for the international rights to the Pro14 cross-border league from 2018-19 to 2020-21.

Industry players had suggested that a significant proportion of Canal Plus’ Top 14 international rights guarantee for the 2019-25 cycle must have reflected the broadcaster’s allocation against the rights in the territories where it operates, rather than their open-market value.

One expert said: “The Top 14 deal is worth a maximum of €2m per season, excluding the Canal Plus territories.”

Canal Plus operates channels in Canada, Poland (via NC Plus), Switzerland, Vietnam (via K Plus) and sub-Saharan Africa.

The broadcaster’s Top 14 international rights marketing relationship with the LNR began in 2009-10. It also has a long-standing partnership with the LNR in the domestic sphere, paying the league €97m per season during the 2019-20 to 2022-23 domestic rights cycle.

Neither Canal Plus nor the LNR responded to SportBusiness Media’s requests for comment.

UK troubles

Canal Plus’ problems with Top 14 international rights distribution are starkly illustrated by its inability to place the property in the UK.

Pay-television broadcaster Sky is understood to have paid €2.4m per season from 2014-15 to 2018-19. But it has not renewed its deal, and no other UK broadcaster appears interested in the property.

One industry expert told SportBusiness Media: “Sky’s deal was grossly overinflated, and there are now no buyers for Top 14 in the UK as the rugby union landscape is saturated.”

Pay-television broadcaster BT Sport and commercial broadcaster Channel 4 hold rights to EPCR events; BT and commercial broadcaster Channel 5 have the English Premiership; pay-television broadcaster Premier Sports holds Pro14 rights; Sky and public-service broadcaster the BBC have rights to England autumn internationals; and the BBC and commercial broadcaster ITV cover the Six Nations.

Values fall

It is thought by some that Canal Plus’ Top 14 minimum guarantee was never achievable, given the fall in values seen for international rights to other rugby properties. RDA’s €3.75m per season minimum guarantee for EPCR rights is almost half the €7m per season the IMG agency paid to buy out rights for the 2014-15 to 2017-18 cycle. RDA’s guarantee for Pro14 rights is also around half the near £1m per season the Pitch agency promised for 2014-15 to 2017-18.

The latest EPCR and Pro14 deals were agreed just last year, and the decline in their values contrasts markedly with the 120-per-cent rise in the value of English Premiership international rights when they were sold in 2015, a more buoyant time for sports-rights fees.

The value of Top 14 international revenues is understood to have fluctuated in a €5m to €10m per season range during the 2015-16 to 2018-19 rights cycle, against industry expectations of €2.5m-€3m per season ahead of the start of that cycle. The LNR is believed to have earned an average of about €6m per season over the period.

Another industry expert said: “Canal Plus just looked at previous prices paid for Top 14 to arrive at an allocation; they thought that rights values wouldn’t fall, but they have.”

The distribution problems come despite the LNR’s decision to implement a new marketing plan, as part of the Canal Plus deal, designed to boost the international appeal of its competitions. This included a rise in the number of matches offered for broadcast each match week to four from two, with these matches presented in full HD alongside commentary and graphics in English.