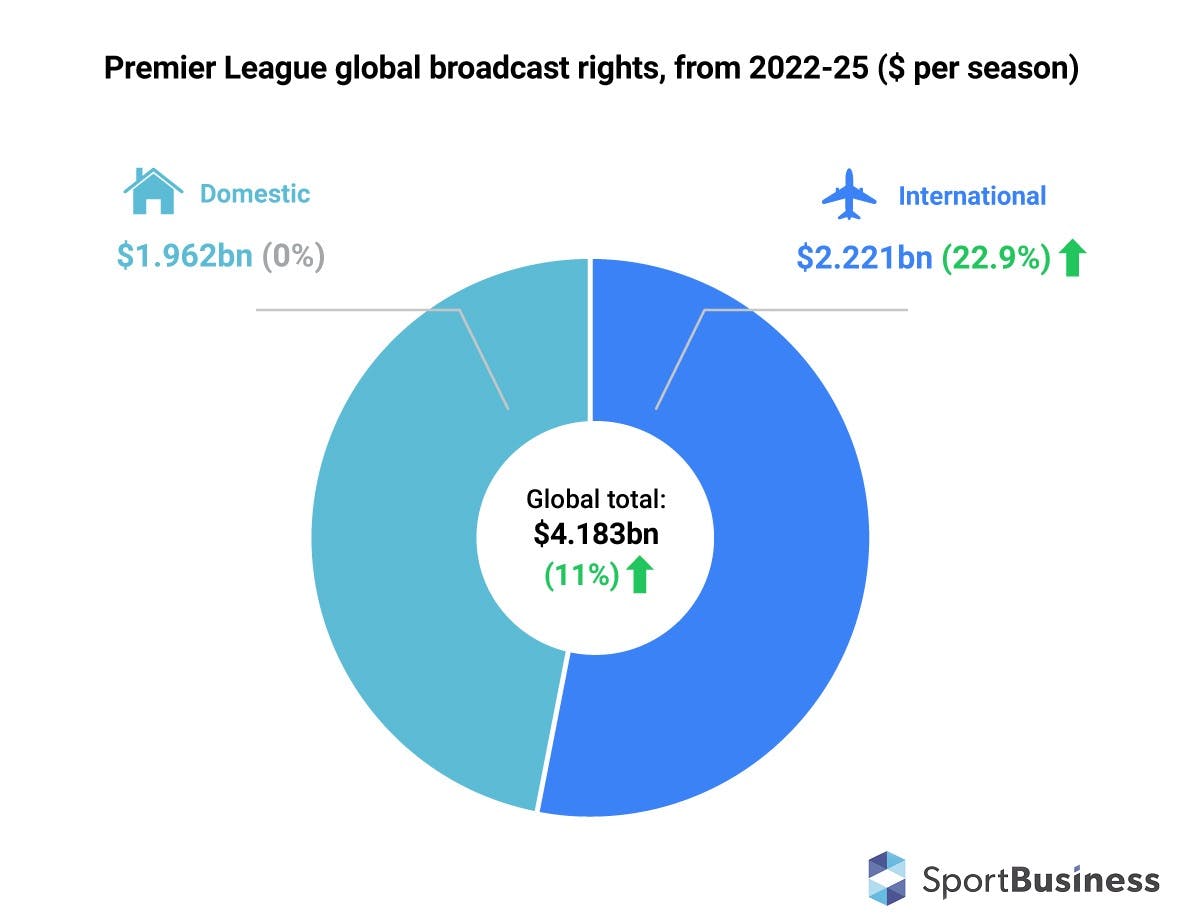

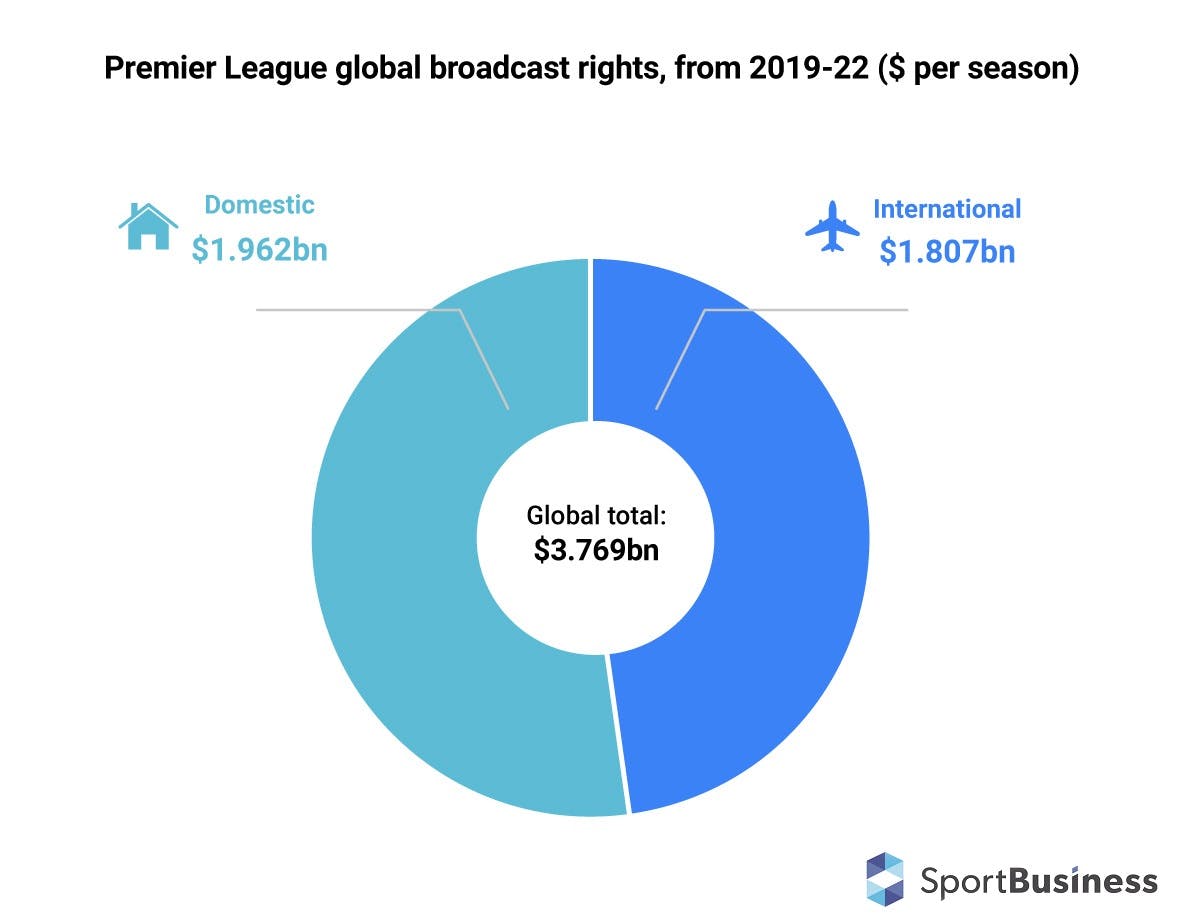

The English Premier League’s global broadcast rights value has increased by about 11 per cent in the current 2022-25 cycle, in large part due to strong results in Europe and an almost exponential increase in revenue across the Americas.

The league’s rights are valued at about $4.183bn per season from 2022-23 to 2024-25, up from about $3.769bn per season from 2019-20 to 2021-22.

The value of the league’s domestic broadcast rights remained flat at £1.621bn ($1.962bn) per season in 2022-25 as the Premier League agreed to extend its deals with UK broadcasters Sky, BT, Amazon and the BBC for a further three seasons on the same financial terms.

This was itself seen as a positive result amid unfavourable market conditions for the league, with a lack of competition between the league’s broadcasters and the economic effects of the Covid-19 pandemic producing downward pressure on rights values in the UK.

As such, all of the league’s broadcast rights growth in 2022-25 has come from its international rights. The league’s international rights are valued at about $2.221bn per season in the current cycle, almost 23 per cent up from the $1.807bn per season it earned during 2019-22.

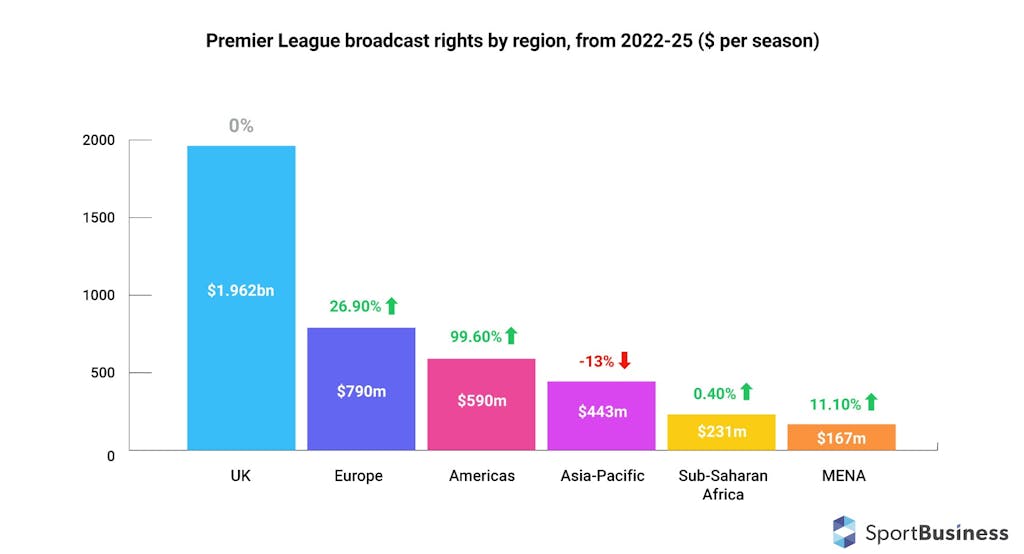

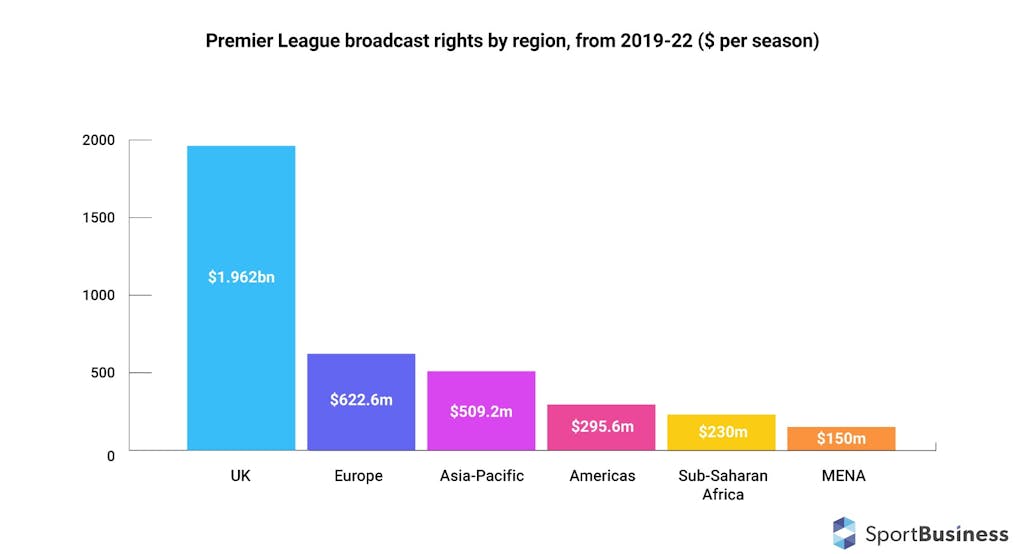

Regional trends

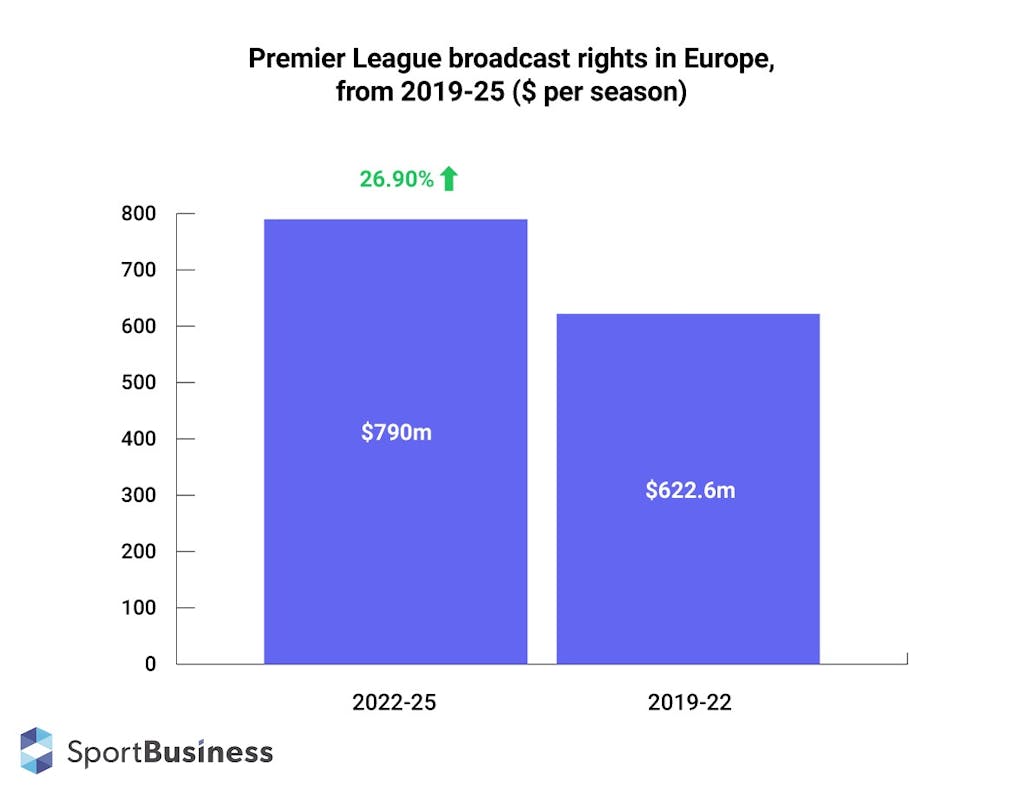

Europe remains the most lucrative international region for the league, where fees grew by just under 27 per cent to $790m per season in 2022-25.

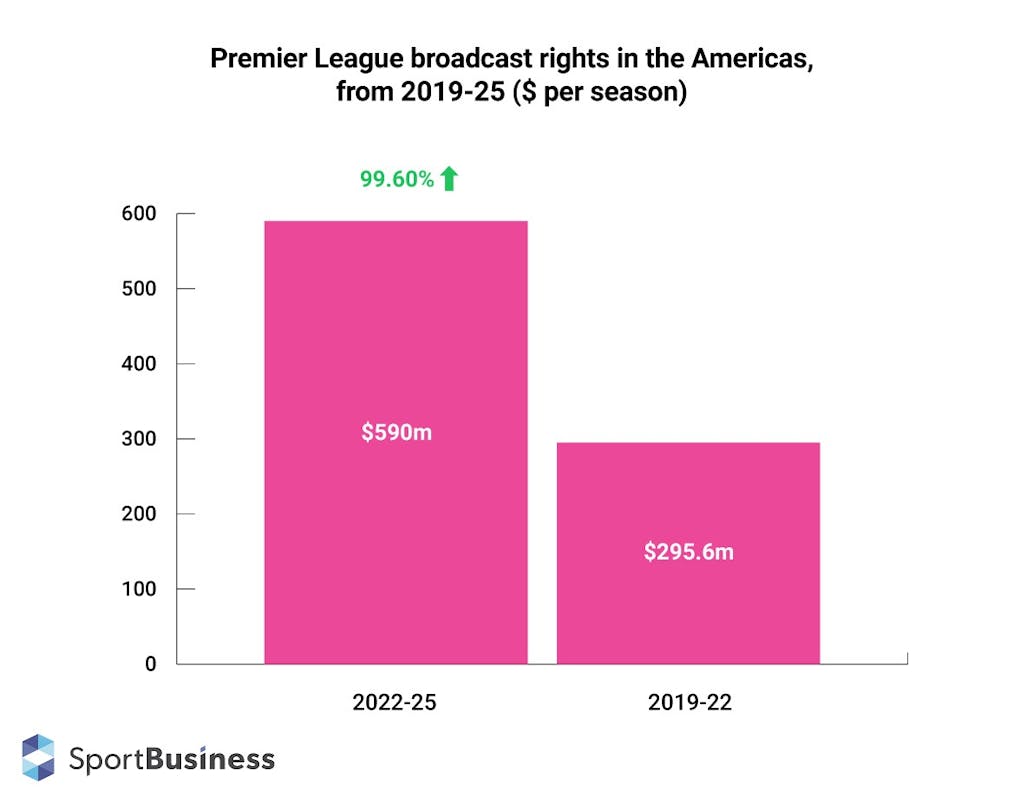

However, the biggest regional increase came from the Americas, where the league doubled its broadcast revenue from about $295m per season to about $590m per season across deals in the US, South America and Central America and Mexico.

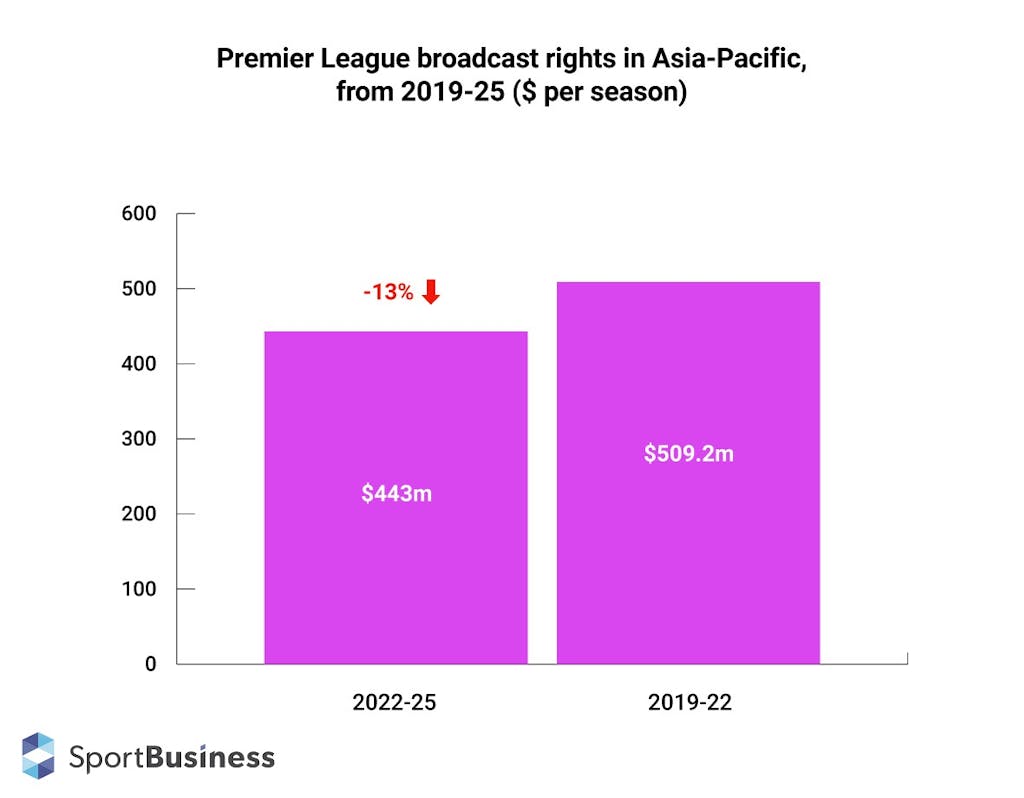

The only region to decline in value from 2019-22 to 2022-25 is Asia-Pacific. This is solely due to the collapse of the Chinese sports streaming rights bubble – a situation that has similarly affected other rights-holders. Excluding China, the league increased its broadcast rights revenues in Asia-Pacific by about seven per cent.

In sub-Saharan Africa, the only movement is thought to have been in the league’s free-to-air media rights deal with the Infront agency. The league’s pay-television deal with SuperSport is understood to have remained flat for 2022-25, producing an almost flat result in the region.

In the Middle East and North Africa, the league has only one deal: with beIN Media Group. The deal’s value increased by just over 11 per cent, producing the commensurate uplift shown for the entire region.

Europe

The Premier League’s broadcast rights in Europe appreciated by about 27 per cent in 2022-25, driven largely by increases in the Nordics, Balkans, Russia, Poland, the Netherlands, Belgium, and the Baltics.

Streaming platform Viaplay and telco Telekom Srbija were largely responsible for the overall increase. Viaplay sent values soaring in the Nordics, Poland, the Netherlands and the Baltics. However, it was Telekom Srbija’s aggressive move to pay an increase of over 700 per cent for Premier League rights in the Balkans that stood out from all other deals struck in the region.

The aggression shown by these two companies counteracted the league’s stagnant or declining values in Europe’s biggest markets. The league’s value declined in France with Canal Plus and in Spain with DAZN, remaining flat with Sky in Germany and Italy. The latter two deals were agreed in tandem with Sky’s domestic renewal, which also remained flat.

Though less dramatic, the league also enjoyed increases across Central, Southern and Eastern Europe.

The league’s media rights in Ireland have been included in the European totals. These deals with Sky, BT and Premier Sports are also understood to have been rolled over from 2019-22 to 2022-25 on the same financial terms.

The league’s deal in Russia with Match TV has also been included in the European total. The deal is currently on hold due to the war in Ukraine but is expected to commence once the conflict ceases.

The Americas

The Americas produced the largest overall increase, doubling in value thanks to consistently large increases across deals in the US, South America, Central America and Mexico.

Three deals were struck in total, the largest of which came in the US with media group NBCUniversal.

The deal is worth an average of $450m per season and runs for six seasons, from 2022-23 to 2027-28. For the first three seasons of the deal, it is expected to be worth an average of about $383m per season. This is due to the Premier League imposing an automatic 35-per-cent increase in value from 2022-25 to 2025-28 in all deals struck over six seasons.

In South America, the league struck a three-season deal with media group Disney that saw the property’s value increase by over 80 per cent. In Central America and Mexico, the league agreed a three-season deal with media group Paramount that increased the league’s value by well over 200 per cent.

Asia-Pacific

The Premier League’s value in Asia-Pacific declined due to a significant fall in revenue from China. However, when China is excluded, the league’s value increased by about seven per cent in Asia-Pacific – a fantastic result for the league in an increasingly tricky region for international rights-holders.

The biggest increases came in deals with media group Eclat – which acquired exclusive rights across South Korea and Japan – and telco Optus, which acquired exclusive rights in Australia. In addition the league earned unlikely increases in deals across Thailand, Cambodia, Laos and Indonesia – bucking wider trends for those markets.

These deals insulated the league against stagnation and decline in other major markets such as Singapore, Hong Kong and Malaysia.

While the league’s current deals in China with iQiyi and CCTV are worth a fraction of its previous deal with PPTV, the league is still earning good money from the country and has a strong base from which to build on. In particular, the restoration of its deal with CCTV is crucial for exposure and maintaining interest among the general Chinese population.

Methodology

The values presented in the piece have been calculated via SportBusiness Media’s reporting and analysis on the Premier League’s individual broadcast rights deals. Each of the individual deal values have been combined to produce a global and regional analysis of the league’s overall broadcast rights value.

The league’s broadcast rights values are displayed in US dollars throughout this piece. As the league has agreed deals in pounds sterling, euros and US dollars, each non-dollar value has been converted using the following exchange rates.

€1 = $1.017

£1 = $1.21

Before conversion to US dollars, SportBusiness Media understands the league will earn the following amounts in the 2022-25 cycle:

GBP: £1,675.5bn per season

USD: $1,455.2bn per season

EUR: €688.5m per season

These amounts exclude the Premier League’s income from radio rights deals with the BBC and Talksport, as well as its deals with IMG for global archive rights and rights in aerospace/international waters.

Rebates agreed with broadcasters during the 2019-20 season have not been taken into account for the 2019-22 cycle, as this analysis aims to provide a cycle-on-cycle comparison of the league’s media rights value rather than its outright income.

However, the league’s lost revenue from the collapse of its deal in China with PPTV has been factored in to the 2019-22 totals as the exact end-value of that deal is a known quantity.

In the current cycle, the league has struck several six-season deals that span from 2022-23 to 2027-28. In at least the majority of those deals, the per-season value increases by 35 per cent in the second three-season cycle from 2025-26 to 2027-28. This has been applied to all six-season deals struck by the league and is reflected in each of the international and regional values.