The Australian Football League is a core part of the social and cultural fabric of Australia and its media landscape. It’s also very big business.

In an era of plateauing rights fees across global markets, marquee properties at the top of domestic food chains – much like the Indian Premier League cricket tournament in India – have brought home steep rises in fees.

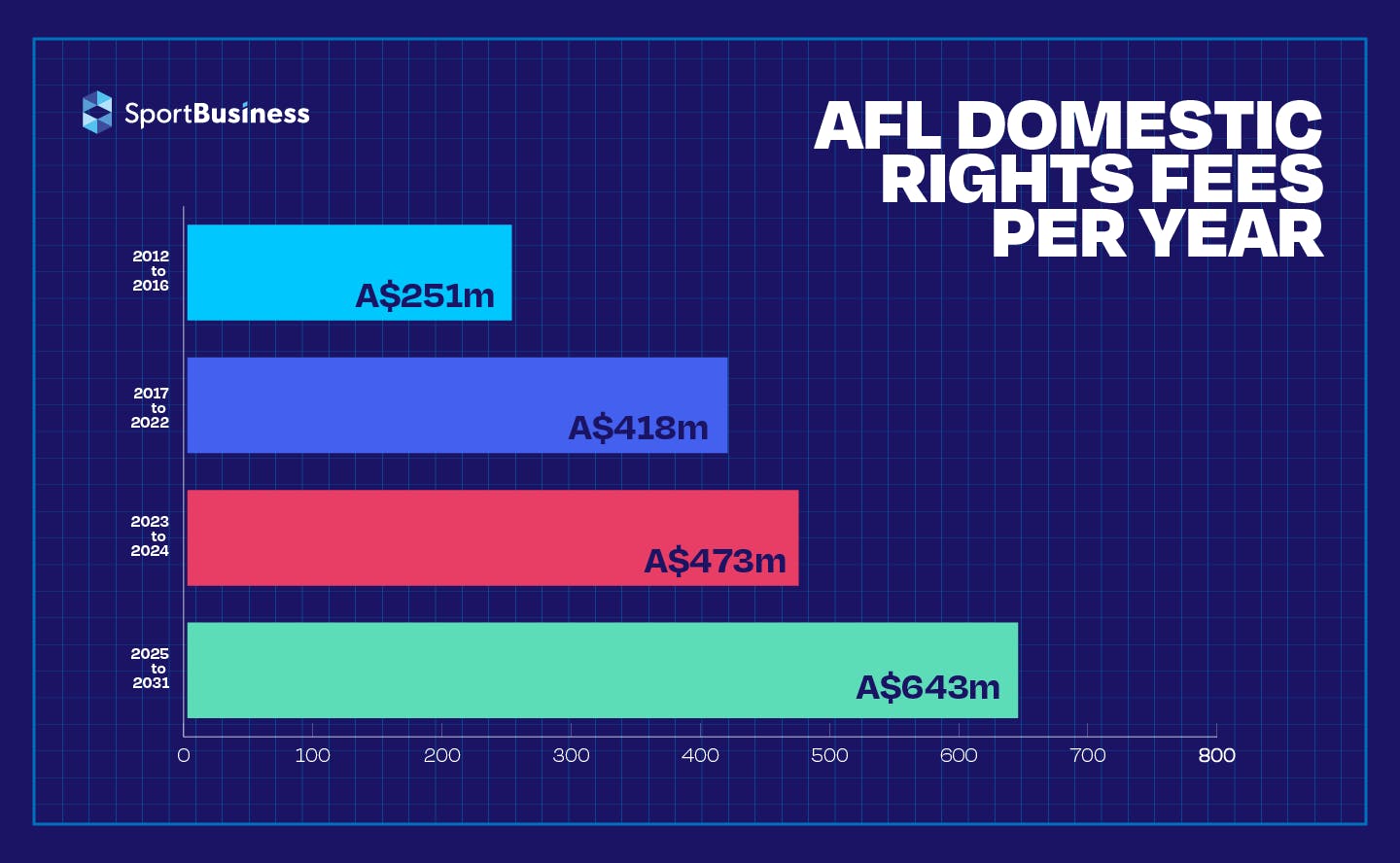

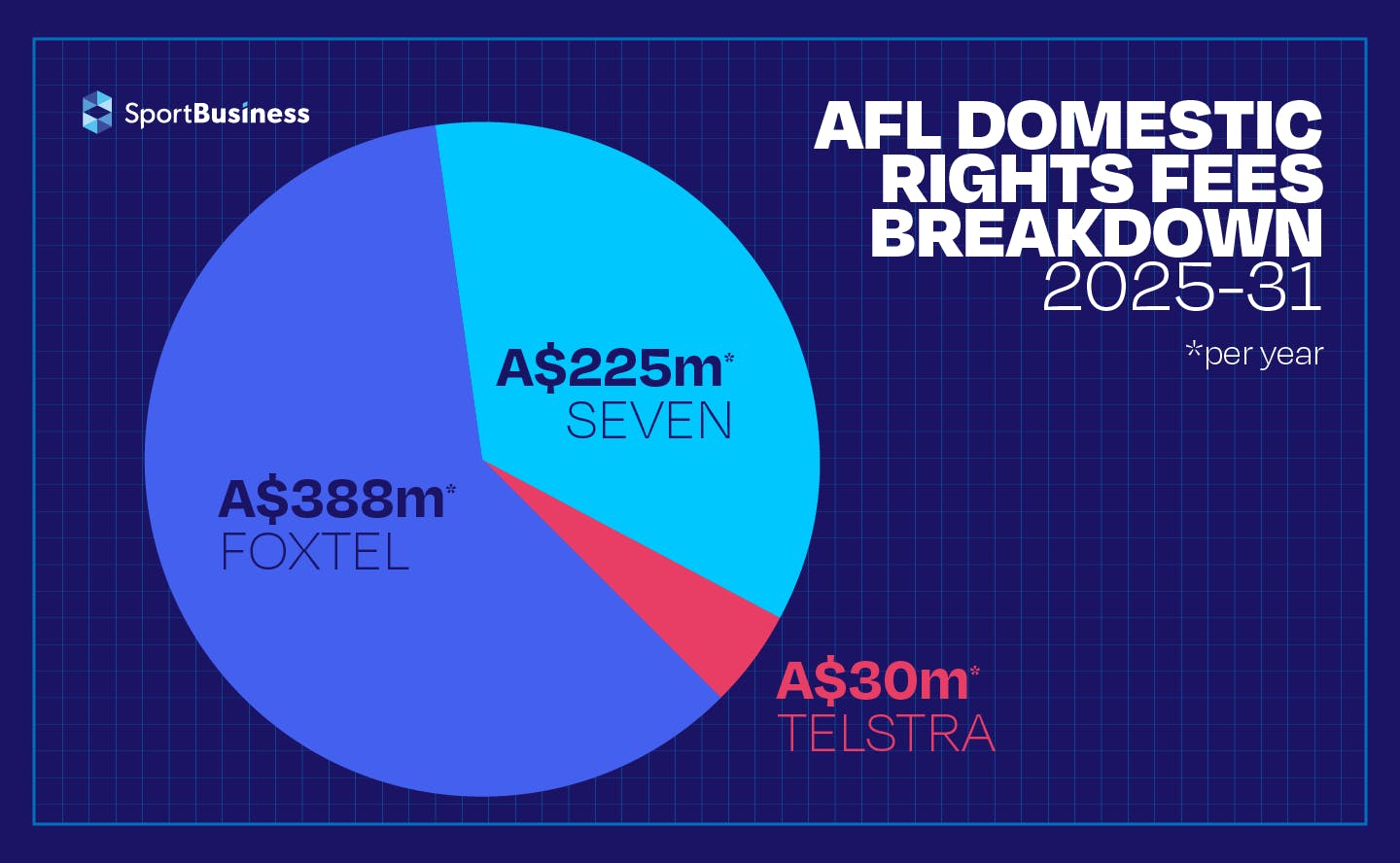

This trajectory shows no signs of changing in Australia, where Foxtel, Seven and Telstra recently agreed to pay a combined A$4.5bn ($3.02bn/€3.06bn) for AFL rights for the seven years from 2025-31.

This is an increase of 36 per cent on the two-year deal struck for 2023 and 2024; and an increase of 54 per cent on the original value of the current six-year deal from 2017 to 2022.

Revisions to current deal

The current deal, from 2017 to 2022, was set to be worth A$2.51bn with the same broadcasters covering six years. In 2020, when the Covid-19 pandemic disrupted the AFL season, Seven, Foxtel and Telstra negotiated a reduction in their rights fees for the 2020-22 period of the deal.

The broadcasters then revised and extended their deals to cover two further years, 2023 and 2024. The extensions will generate a total of A$946m for the AFL over the two years, helping to offset the pandemic-related reductions.

Broadcaster fees

The breakdown of the new domestic deal from 2025-31 is the same as in the current and future two-year deal. Foxtel and Telstra together pay about 65 per cent of the fee, with Seven paying the 35-per-cent remainder.

Cash/Contra

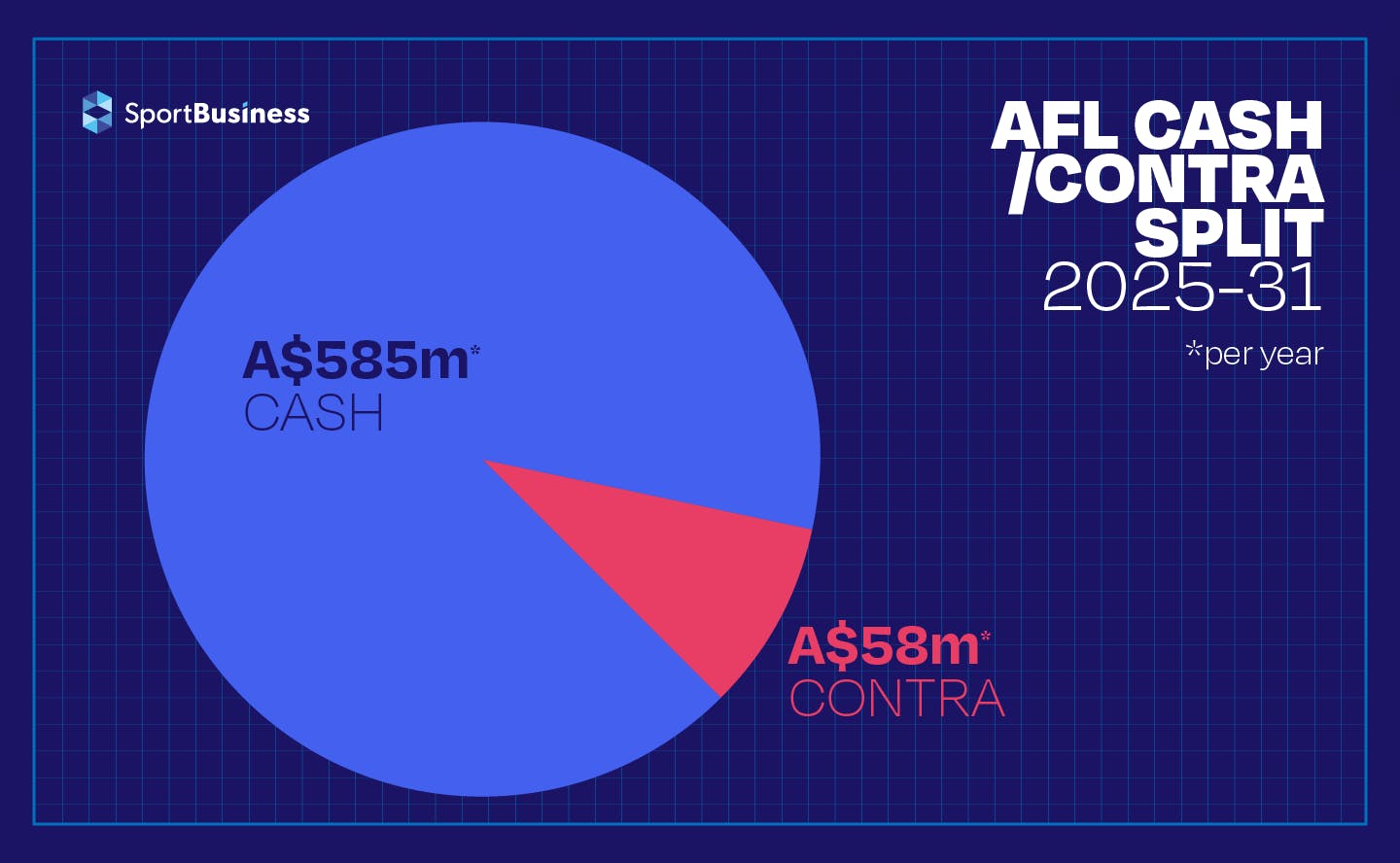

As is standard in rights deals for major Australian sports properties, a significant component of the total fee for the deal will be paid ‘in contra’, or value-in-kind such as promotion, marketing and airtime.

The value for this in the new AFL deal is around nine per cent, mirroring Foxtel and Seven’s current deal for Cricket Australia, in which the contra percentage is worth just under nine per cent of the total value.

International rights fees

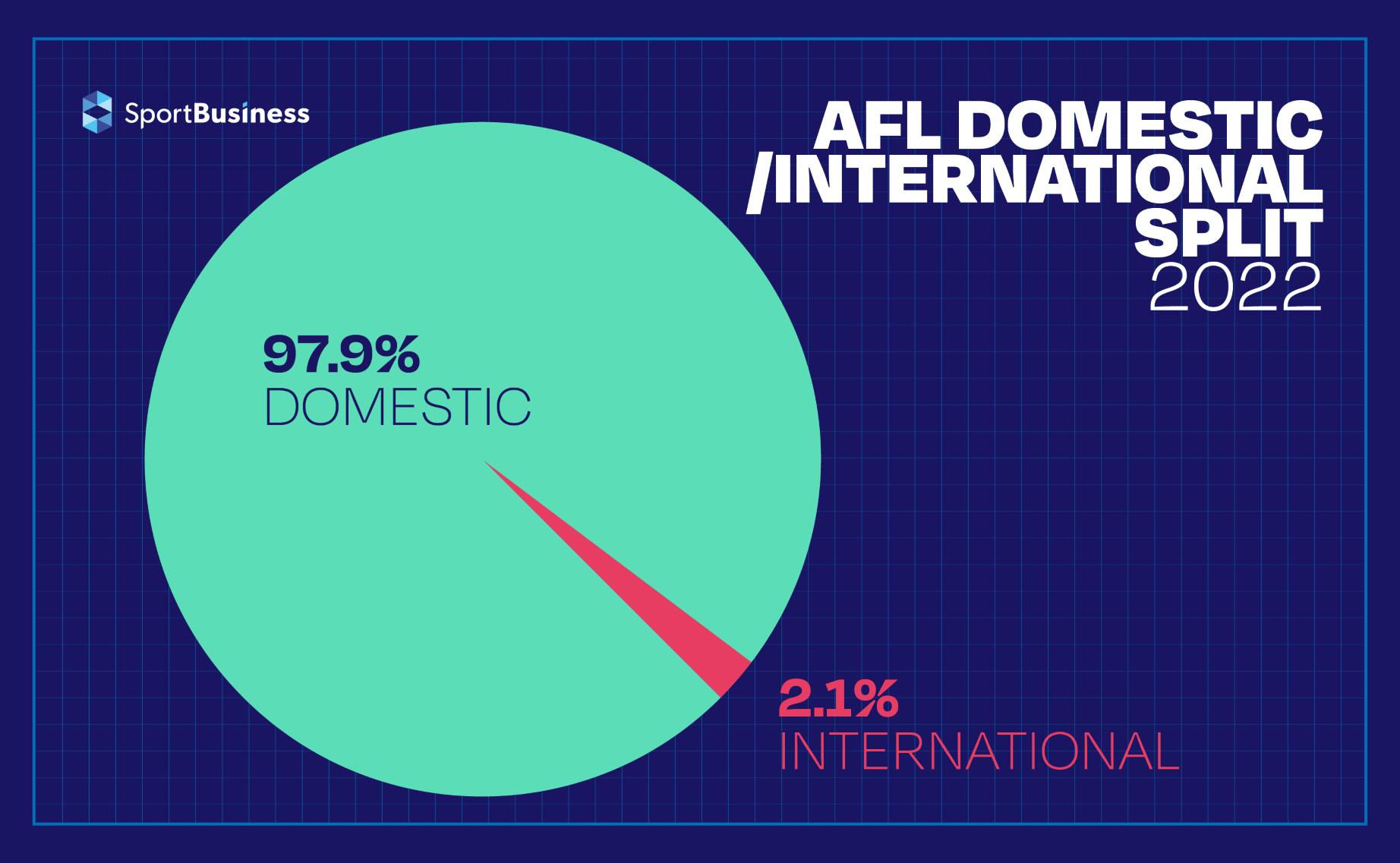

Another similarity between the AFL and the IPL is the overwhelming dominance of domestic rights fees in comparison to international revenues. Both properties have around a 98:2 split in this regard.

The AFL’s total international media rights value in 2022 is around A$8.5m per year, compared to A$418m domestically. The property’s key deals and markets are with Foxtel, which operates the AFL’s international OTT platform Watch AFL, in Asia with multiple broadcasters, with Fox in the USA, with Star+ in Latin America, and with BT Sport in the UK. International rights are currently sold by the IMG agency.

Competition

Competition

For subscription and free-to-air broadcasters in Australia, the success of their operations is made much more likely with one of the country’s top-tier sports properties such as the AFL, National Rugby League and Cricket Australia.

Of these big properties, the AFL is at the apex. As a result, Foxtel and Seven were both eager to keep it – even as a ‘loss-leader’ going into the next decade – in order to ensure their medium-term strategic position.

The broadcasters have made what they consider a justified bet – given the AFL’s centrality to Australian life – on the economic conditions being strong enough for viewers to continue paying for subscriptions and advertising revenues to continue to flow at a healthy rate.

As such, the rights for 2025-31 were hotly contested with bids going right down to the wire. Nine Entertainment, owner of commercial broadcaster Channel Nine and streaming service Stan, and Paramount ANZ, owner of commercial broadcaster Network Ten and streaming service Paramount+, also bid aggressively.

Comparison to other leagues

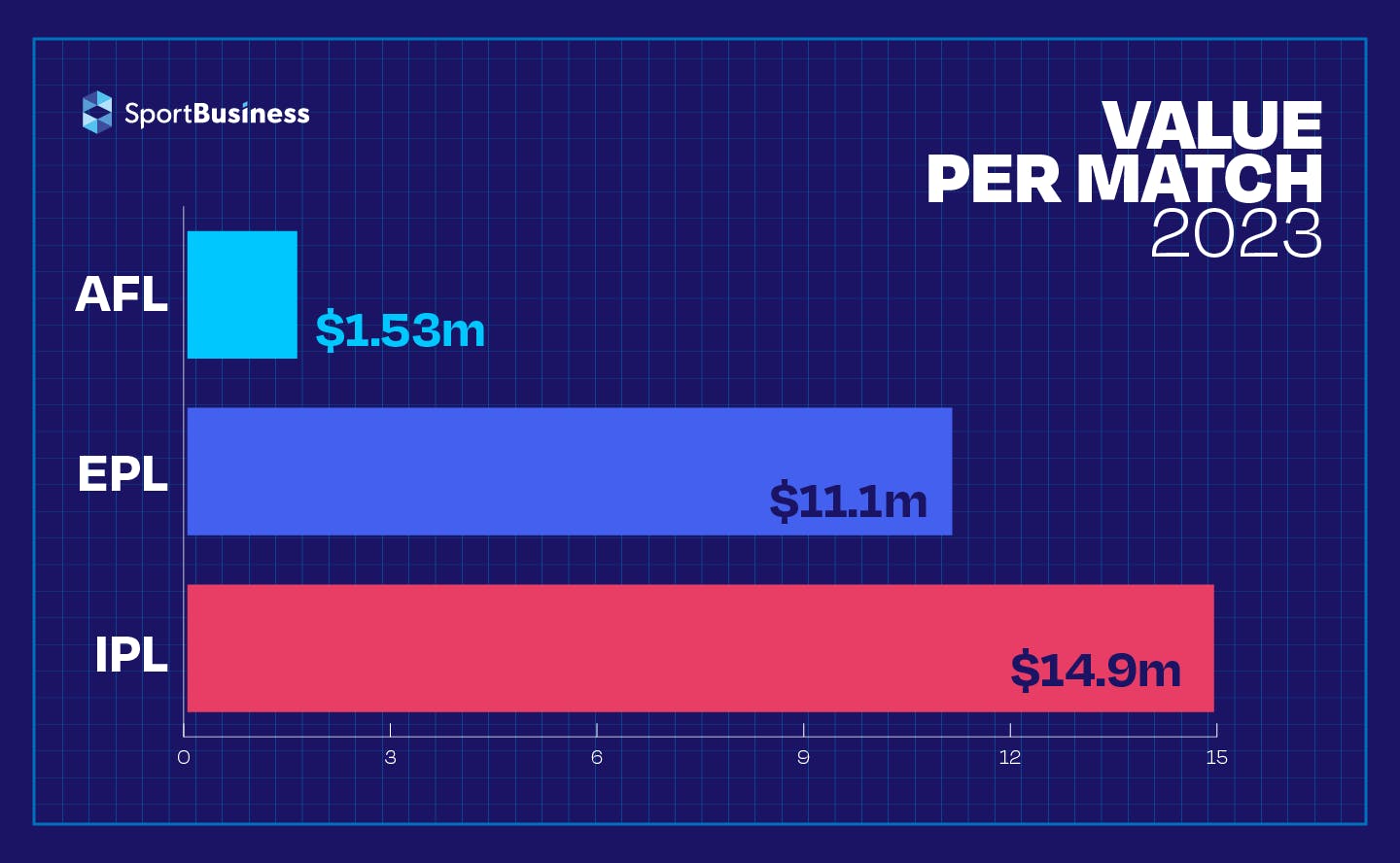

While the AFL is primarily a domestic property, its value is still comparable to major global leagues in terms of its revenues from subscriptions and advertising on a per user basis. With 206 AFL matches per year currently, in 2023 the value of one AFL match on average will be A$2.3 per year.

The AFL is the most prominent property in Australia, but the country’s population of just over 25m is the key factor in limiting its prospects when compared to the world’s biggest sports leagues in terms of overall value.

The English Premier League does not suffer from this problem due to the global popularity of the property. The league’s rights are valued at about $4.18bn per season from 2022-23 to 2024-25, with international rights valued at about $2.22bn per season.

The IPL’s new deal is worth just under $1.2bn per year, far lower the Premier League’s media rights income. However, the IPL has a total of 410 matches over the five years, while the Premier League has 380 matches each season.

Further growth

Celebrating the deal, AFL chief executive officer Gillon McLachlan said: “We are a game where, today, one in every 22 Australians are members of an AFL club.” Starting from a strong position, viewership and participation in AFL is likely to continue to grow – which is not guaranteed for less prominent properties.

The women’s game is also becoming an increasingly strong media product, having recently professionalised. The value at present is a tiny part of the overall AFL pie, but broadcasters see long-term potential in AFLW. For several years, there has also been speculation about a team from Tasmania joining the AFL, which would be the league’s 19th team.