- Pay-TV broadcaster Sky pays about $6m per year for rights from 2020 to 2022

- OTT platform Hotstar exploited Disney-owned Star’s IPL rights in UK last year

- Hotstar’s IPL marketing was stymied by UK compliance issue

Disney’s decision to refocus Star India’s Hotstar OTT platform on its domestic market paved the way for the return of Indian Premier League cricket rights in the UK to pay-television broadcaster Sky.

Sky re-acquired the exclusive rights to the Twenty20 tournament in a three-year deal, from 2020 to 2022, after a tender process launched by the global rights-holder, Indian pay-television broadcaster Star, in January.

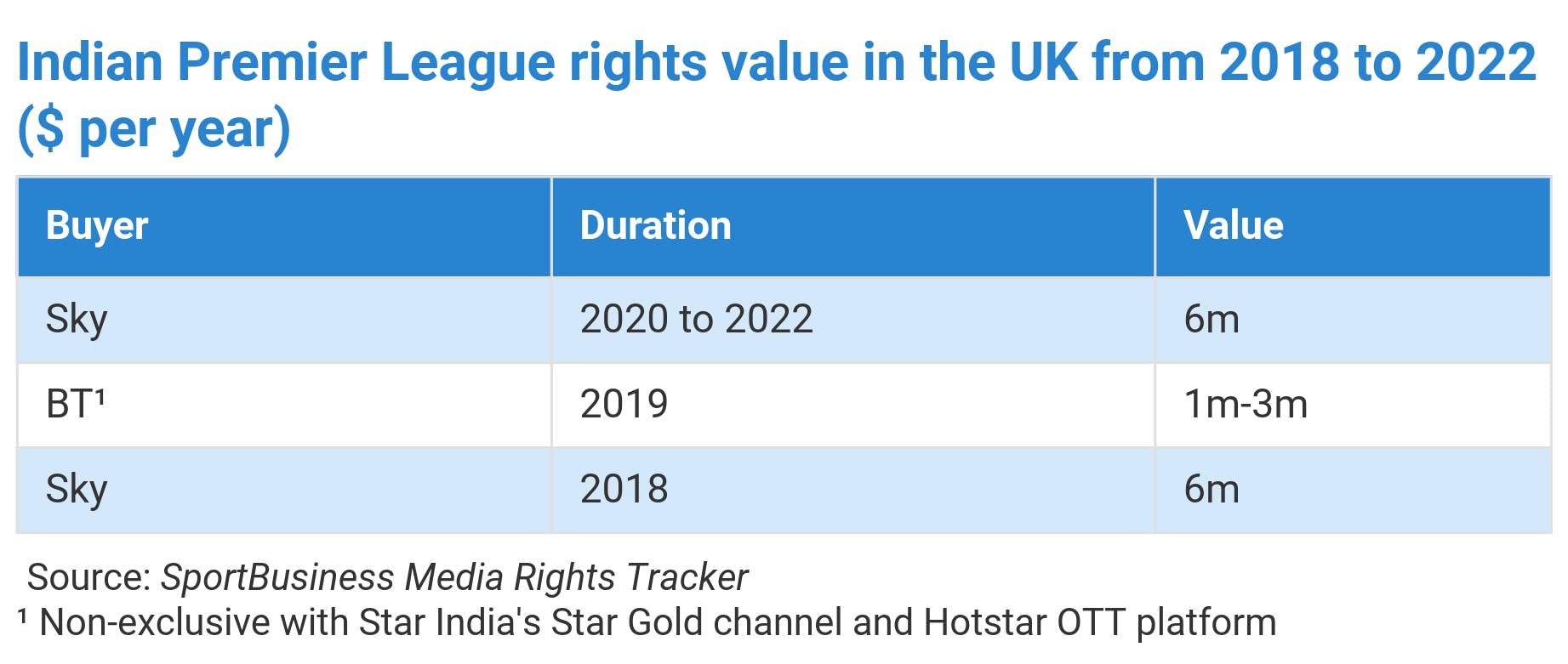

The deal, which is understood to be worth about $6m (€5.4m) per year, allows the broadcaster to show all 60 matches per edition.

Sky last held IPL rights in 2018 as part of a commercial arrangement that was expected to last through to 2022, also thought to have been worth about $6m per year. However, only a formal one-year contract was actually in place. Star retained an option to extend the deal, but instead chose to end its relationship with Sky in order to use the IPL to develop its Hotstar platform in the UK.

Star holds platform-neutral global IPL rights for the 2018 to 2022 cycle, which it acquired in 2017 for $2.55bn in a deal with the Board of Control for Cricket in India. The five-year deal was worth $510m per year, with rights in the Indian subcontinent accounting for most of the value.

However, its move to exploit these rights in the UK on Hotstar did not work, particularly against the background of Star owner Disney’s decision to pursue a different OTT strategy to previous owner 21st Century Fox. Disney formally acquired Star in March last year, around the same time Star began implementing its IPL strategy for the UK Hotstar service.

One industry source told SportBusiness Media: “Their [Disney’s] focus is purely on India with Hotstar; they thought it better to go with a partner [in the UK] that could monetise the [IPL] rights better.”

Non-compliance

Hotstar, which is owned by Star subsidiary Novi Digital Entertainment, debuted in India in 2015. It specialises in Indian TV shows, films and sports. The platform expanded into the US and Canada in 2017, and the UK in 2018.

Last year, Hotstar UK showed the IPL non-exclusively with Star’s linear channel Star Gold and telco BT. The latter is thought to have paid between $1m and $3m for its rights to the 60-match tournament.

SportBusiness Media understands specific issues with the UK service were an additional factor in Disney’s decision to return to an exclusive third-party IPL rights arrangement. It is understood that the Hotstar OTT product does not fully comply with legislation in the UK, and that this non-compliance restricted Star’s ability to market Hotstar’s IPL coverage last year. It is not clear what this non-compliance specifically involved, and Star did not respond to a SportBusiness Media request for comment on the matter.

That said, the Hotstar platform still operates in the country. It shows exclusive cricket content from India national team home test matches and the Asia Cup, the biannual Men’s One Day International and T20 International cricket tournament.

Star paid INR61.381bn (€785m/$852m) to renew Board of Control for Cricket in India global rights for the 2018-23 cycle. At the time of the deal, the rupee-denominated rights fee converted to €765.1m/$943.4m.

Tender

It is understood Star ended the IPL tender process a few days before the formal January 24 deadline. It had invited all major UK broadcasters to participate, but it is thought only BT joined Sky in submitting a bid.

Industry experts said BT’s huge €466m ($505.9m) per-season outlay on the Uefa Champions League for the 2021-24 cycle left it in no shape to enter a bidding war with Sky for IPL rights.

Commercial broadcaster ITV is understood to have been uninterested in bidding for the property. ITV was the IPL’s exclusive broadcaster until 2015, when Sky first took on the rights.

One industry expert told SportBusiness Media that recovering IPL rights made strategic sense for Sky: “[Cricket] is clearly one of Sky’s key sports… I suspect [the IPL] reaches a younger audience compared with Test cricket and it also helps reach an Asian demographic.”

The 2020 edition of the IPL takes place from March 29 to May 24. At December’s player auction, a total of 13 England players were either signed or retained by the eight IPL franchises. These include England stars Eoin Morgan (Kolkata Knight Riders), Jason Roy and Chris Woakes (Delhi Capitals), Ben Stokes, Jofra Archer and Jos Buttler (Rajasthan Royals) and Jonny Bairstow (Sunrisers Hyderabad).

Sky will look to leverage wider public interest in cricket in the wake of England’s 2019 Cricket World Cup win.

Star holds the global rights to International Cricket Council events, including the Cricket World Cup, for the 2015-23 cycle. In the UK, these rights were sold to Sky for a total of $200m.