- Star’s move for one of rival’s biggest cricket properties surprises market

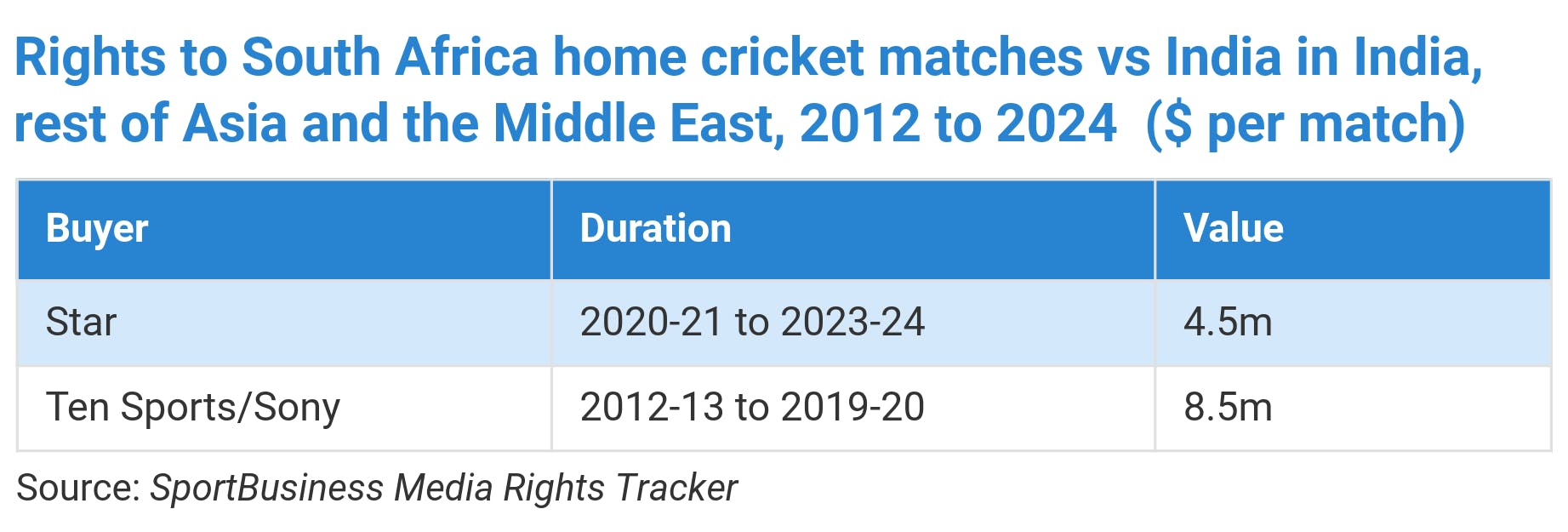

- Value of each match v India has fallen from about $8.5m to about $4.5m

- Decline reflects changed conditions since previous deal agreed in 2011

Indian pay-television broadcaster Star is poised to strengthen its grip on cricket broadcasting in the subcontinent by beating incumbent Sony to the rights for Cricket South Africa content.

The deal, which runs from April 2020 to April 2024, is understood to be close to completion but has not yet been signed. The territory covered comprises India, the rest of Asia and the Middle East, which is identical to the geographical reach of Sony’s deal. Most of the value of the deal is in India. Star operates television channels in the Indian subcontinent and several other markets including a cricket channel in Southeast Asia. It has a team capable of distributing the rights in territories where it does not operate channels.

As with all international cricket board deals in India, almost all the value lies in India’s tour matches, and the fee per India match is considered the key indicator of the overall deal value. One Indian cricket rights expert told SportBusiness Media that India matches generally account for 75 to 90 per cent of the value of such deals.

It is understood Star has agreed to pay a fee of about $4.5m (€4m) per South Africa v India match. The previous deal with Sony is understood to have valued each match against India at about $8.5m.

Only one India tour of South Africa, in December 2021 and January 2022, is currently programmed in the period covered by the new deal. It comprises six matches – three tests and three Twenty20s. But industry insiders expect more India matches in South Africa to be scheduled during the deal and that this would have been factored into the talks.

Although there are big differences in the durations of different types of cricket match, with test matches running to five days and T20 matches completed in about three hours, cricket rights experts say they attract similar audiences on average and so their value in India is broadly similar. Though Sony and Star – which controls the rights to India’s home cricket matches – are pay-television broadcasters, they generate a large proportion of their revenue from advertising, so audience figures remain highly important.

CSA’s previous deal with Sony, which ran for eight seasons from 2012-13 and 2019-20, comprised 17 India matches. There were two India tours of South Africa during the deal: In December 2013, when the teams played two test matches and three one-day internationals, and a large tour in January-February 2018, when they played three tests, six one-day internationals and three T20s. That deal is understood to have been worth $175m in total. At $8.5m per match, India matches would have accounted for 83 per cent of the total value.

Declining value

During the sales process, Sony is understood to have made a relatively weak $3m-per-India-match offer.

The broadcaster’s appetite may have been dampened by its major recent deal for WWE wrestling – its single most important sports rights property. After cricket, wrestling has the highest sports ratings on Indian television.

Insiders said the drop in the per-India match value was to be expected given trends in the market. In recent years, many sports properties have struggled to generate significant rights fee increases in India.

Values have generally been coming down from a peak several years ago when four pay-television broadcasters – Ten Sports, ESPN Star Sports, Sony and Nimbus Communications – were fighting for content. Now there are just two major players – Star and Sony.

The previous CSA deal was agreed in 2011 during that period of greater competition. Ten acquired the rights and was itself acquired by Sony in 2017. Nimbus, and its Neo sports channels, have essentially exited the market having failed to compete with its bigger rivals.

The Indian pay-television business has become tougher in the past year, after the government introduced regulations that allow customers to choose the channels in their bundles, rather than having the channel bundles constructed by pay-television platforms. This has put a greater squeeze on second-tier channels and content.

Star surprise

Star’s acquisition of the CSA rights was a surprise as Star and Sony were thought to have reached a détente over the current share of cricket rights.

While Star has spent heavily to take the most valuable properties – Board of Control for Cricket in India rights, Indian Premier League rights and International Cricket Council rights – Sony had held its corner with the best of the overseas cricket boards. Aside from the CSA deal, it also has rights for the England and Wales and Australia boards. It also held rights for the Sri Lanka board until the recent expiry of that deal.

Experts had thought the marginal gains for Star in outbidding Sony for these ‘away-from-home’ rights were not worth the outlay. Star’s acquisition of the CSA rights strengthens an already strong cricket hand somewhat but weakens Sony’s involvement in India’s most important sport significantly.

The deal also runs counter to another assumption that had taken hold in some parts of the market: that Star’s new owner Disney would curb its sports spending. Disney’s approach is considered more cost-conscious than previous owner News Corp.

Correction: This story was updated on 26 November 2020. It previously stated that Star only operated channels in the Indian subcontinent, which is incorrect.