- Deal worth around NZ$100m per year from 2021 to 2025

- Sky, Spark battle doubles fee for New Zealand Rugby, Sanzaar

- Renewal considered critical to Sky NZ’s business

The battle between Sky and Spark for control of New Zealand’s sports broadcasting and streaming market has resulted in a major revenue increase for rugby union rights-holders New Zealand Rugby and Sanzaar.

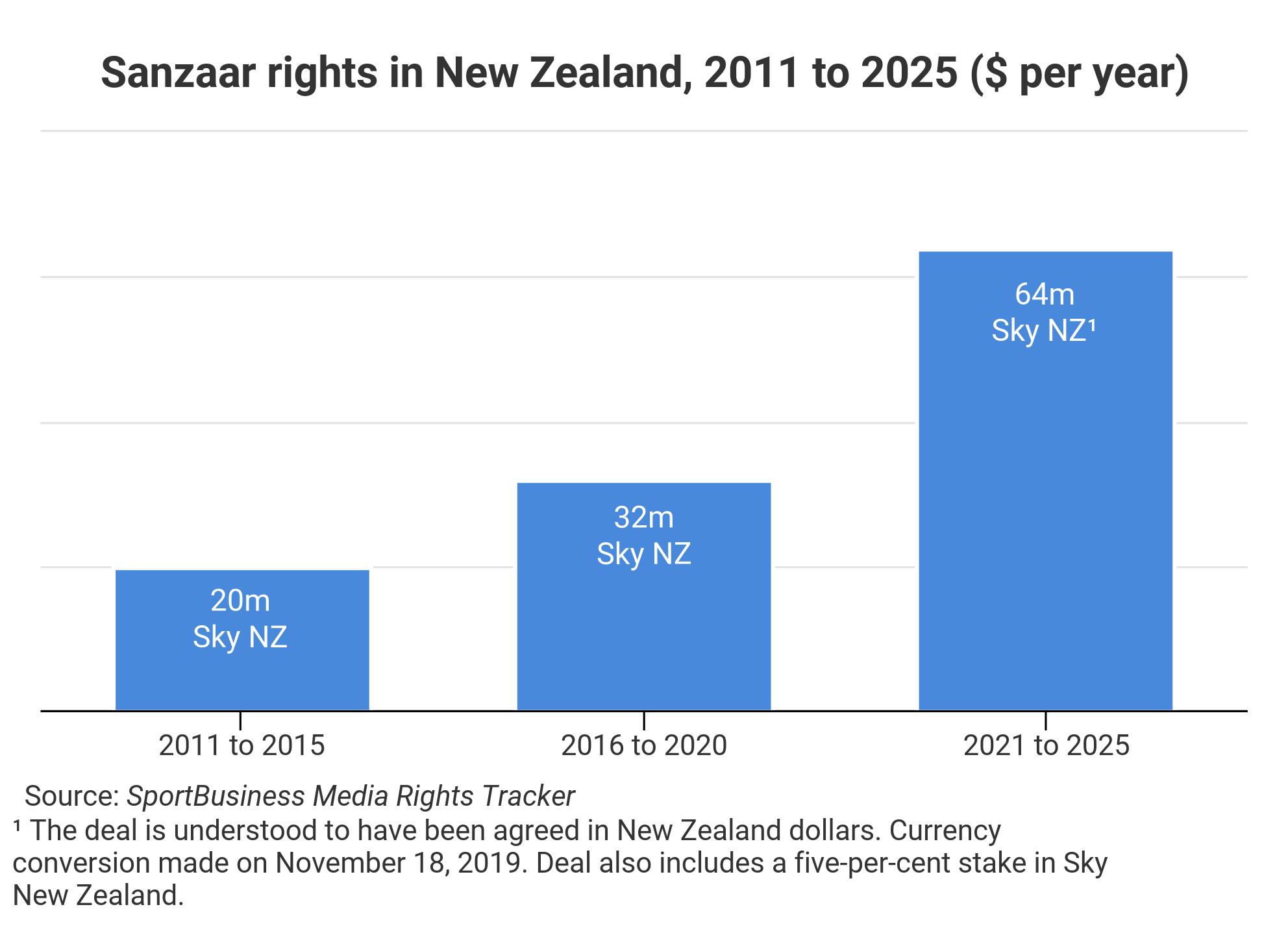

NZR’s renewal with pay-television broadcaster Sky for the five years from 2021 to 2025 is understood to be worth around NZ$100m (€58m/$64m) per year. Sky paying is paying around US$32m per year from 2016 to 2020.

The current deal’s value in New Zealand dollars has risen by more than 30 per cent since it was agreed in 2014. At that time, the New Zealand dollar was worth around $0.85, giving the deal a value of NZ$37.6m per season. By mid-November this year, the exchange rate was $0.64, giving the current-cycle deal a value of NZ$50m. Thus, judged at prevailing exchange rates, the new deal represents a doubling of income for the rights-holders.

The deal, agreed in mid-October covers the exclusive rights in New Zealand to all NZR and Sanzaar properties. NZR properties are all home All Blacks matches, except those in the Rugby Championship, and domestic competitions such as the Mitre 10 Cup and women’s competition the Farah Palmer Cup. The Sanzaar properties are Super Rugby and the Rugby Championship, which are contested by teams from Argentina, Australia, New Zealand and South Africa. The Sanzaar member unions sell the domestic rights for the Rugby Championship and Super Rugby. In all other territories, sales of the rights are managed by the central Sanzaar organisation.

The most valuable parts of the package in New Zealand are All Blacks matches in the annual Rugby Championship, other home All Blacks matches, and rights for all matches from the Super Rugby club tournament, which features five teams from New Zealand.

Sky went to extraordinary lengths to secure the rights, which are critical to its business. As well as the fee increase, NZR has acquired a five-per-cent stake in Sky as part of the deal. In the closing stages of the negotiations, Sky had to seek shareholder approval for the deal because its value represented more than half the total value of the Sky business. The broadcaster said at the time that a failure to acquire the rights would represent “a significant threat to shareholder value”.

The deal is a major blow for rival Spark, a telco, which did not even get a chance to bid. Sky renewed its rights during an exclusive negotiation period. Spark has been aggressively building its position in sport, taking major properties from Sky in the last few years, most significantly this summer’s Rugby World Cup and New Zealand Cricket rights from 2020 to 2026. It had declared its interest in the NZR rights, which would have given it a leadership position in the market.

The NZR rights are the market’s most valuable by some distance. As one market observer put it to SportBusiness Media: “They are bigger than the Premier League is in the UK…there’s New Zealand Rugby, and then there’s daylight.”

Revenue-share model

Under Sanzaar’s revenue-share model, NZR will retain the income from its Sky deal that relates to its own properties. Revenue related to the Super Rugby and Rugby Championship, from deals in the domestic Sanzaar markets and internationally, is pooled and divided between the unions. The revenue split for the next cycle is not thought to have been decided. However, it usually reflects the contribution made by each domestic market – so, for example, New Zealand’s share is likely to increase due to its large new deal.

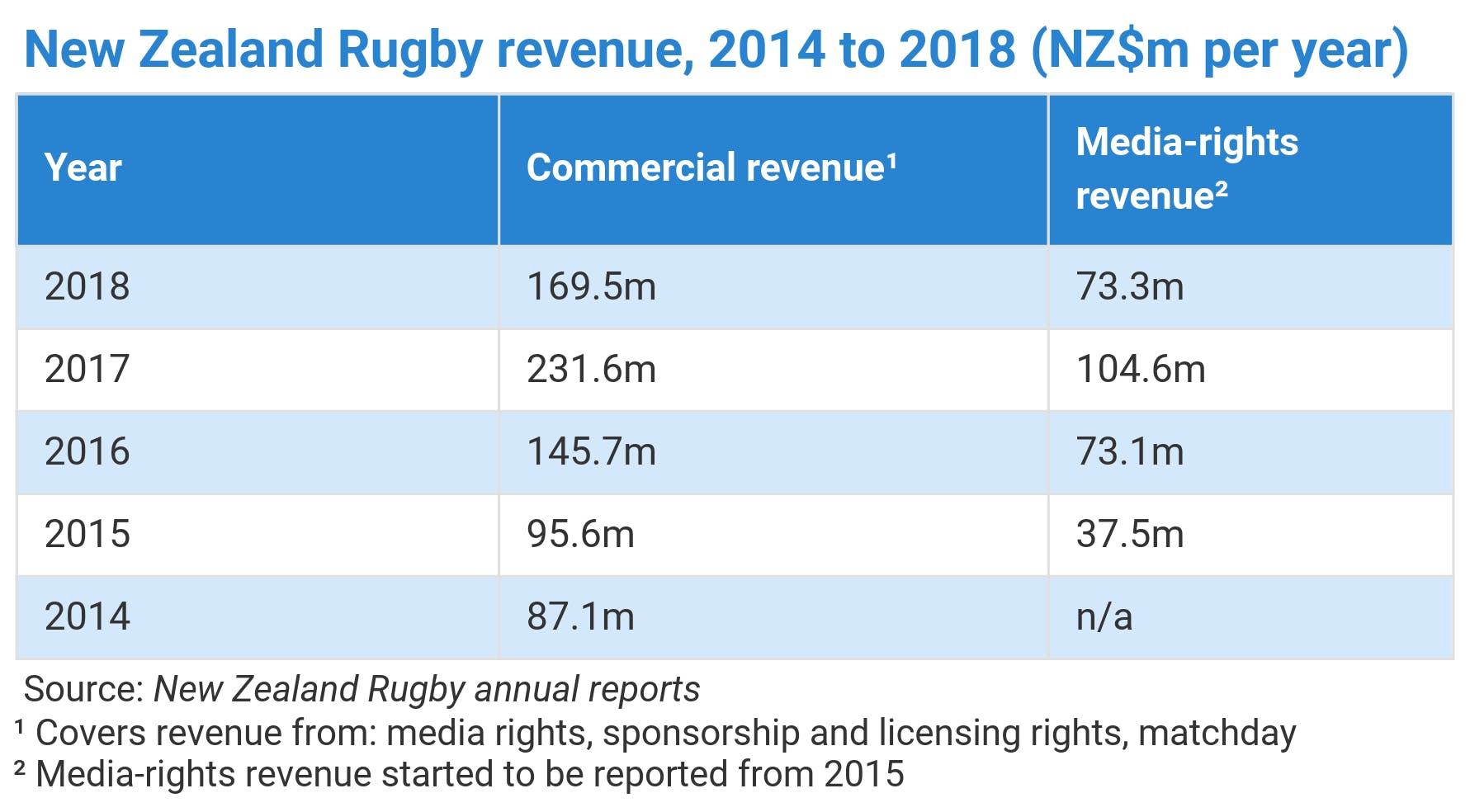

NZR reported its media-rights revenue in 2018 at NZ$73m, down from NZ$105m in 2017. The vast majority of the organisation’s media-rights revenue comes from its domestic deal with Sky and its share of Sanzaar international revenue. The 2017 figure was boosted by the British and Irish Lions tour of New Zealand.

The uptick in income in the new deal will be very welcome at NZR, which has made a loss in three of the last four years. The Lions tour helped it to a profit of NZ$33m, on revenues of NZ$257m, in 2017.

The Argentinian, Australian and South African rugby unions are understood to be deep in sales talks for the 2021-25 cycle and talks for the rights in international markets have also begun.

The central Sanzaar organisation is led by chief executive Andy Marinos. For the 2021-25 international rights sales cycle, it is being advised by Jarrod Frykberg, an experienced media-rights executive previously with Australian pay-television broadcaster Fox and the Pitch International agency.

The international rights sales process for the 2016-20 cycle was led by Sanzaar’s then-chief executive Greg Peters, advised by Australian media-rights consultant Jon Marquard.

Sky fightback

Failure to renew the NZR rights would have been catastrophic for Sky. At the time the current deal was signed in 2014, Sky viewed itself as one the world’s most profitable broadcasters. But the business is now under major pressure. Like many other pay-television operators around the globe, it is losing subscribers, its average revenue per user is falling and its financial results have been deteriorating. This year, the company wrote down its value by NZ$670m, and by mid-November its share price was down over 60 per cent since the start of the year.

In 2017, a proposed merger between Sky and mobile operator Vodafone was struck down by New Zealand’s competition commission. Spark, a rival of Vodafone in the mobile space, had registered opposition to the merger.

Sky is fighting back against the decline, spearheaded by its appointment in February of the highly-experienced Martin Stewart as the company’s chief executive. Stewart was previously chief executive at Middle East and North Africa pay-television broadcaster Orbit Showtime Network, and chief financial officer of UK pay-television broadcaster Sky, among other roles. He has a strong pedigree in sport – alongside his roles at major sports broadcasters, he has been chief financial officer at England’s Football Association and was on the board of the Organising Committee for the London 2012 Olympics and Paralympics.

Stewart has made sweeping changes, resulting in the departure of staff including former head of sport Richard Last, former chief financial officer Jason Hollingworth and former chief executive John Fellet. Tex Teixeira, director of broadcasting media, took over as head of sport.

The loss of 2019 Rugby World Cup rights to Spark was a hammer blow for Sky. This year, the broadcaster has renewed deals for Cricket Australia rights, International Cricket Council rights and Netball New Zealand rights. But Sky has not won every battle as illustrated by Spark’s acquisition of the New Zealand Cricket Board rights. Spark has also acquired ICC digital clip rights.

The big question for the New Zealand rights market now is how Spark’s failure to secure the NZR rights will affect its appetite for sport. Industry experts spoken to by SportBusiness Media broadly agreed that without the rugby, or indeed any other significant rugby property, Spark’s sports portfolio is not strong enough to drive significant subscriber growth, and there are not many rights coming to market soon that could change that.

Spark’s reliance on streaming, as opposed to broadcast technology, was said by some market insiders to have counted against it as regards the new NZR deal. New Zealand has a large rural population that does not yet have reliable, fast broadband access. Some households reported problems streaming the Rugby World Cup on Spark, although the numbers appeared to be small and the telco reacted quickly to resolve the issues.

Stake surprise

Sky’s inclusion in the deal of a five-per-cent stake in its business is thought to be unprecedented and raised eyebrows across the industry.

Most industry experts interpret the stake as a sweetener that allowed Sky to boost the value of the deal without laying out more cash. Sky and NZR say it has a broader significance in aligning the interests of two partners that are heavily dependent on one another.

NZR chief executive Steve Tew told SportBusiness Media: “It’s a small equity stake, we won’t be influencing big decisions, we’re a very small shareholder…But it means that if there are any joint projects, we are doubly incentivised to work on them.”

The stake deepens a long relationship between the two parties. The first Sky-NZR deal was in 1996 and since then the broadcaster has become synonymous with All Blacks television coverage. Sky’s Martin Stewart told local media that the stake sale was a “one-off”, adding: “I think you have to look at the importance of rugby within New Zealand and the DNA of what it means to be a Kiwi and I think it is a pretty unique situation.”

This is, however, the second time in recent months that Sky has included shares in a major sports deal — in August it included a 10-per-cent stake in its deal to take over OTT platform RugbyPass.

Several industry experts pointed out that the stake could raise a conflict-of-interest issue if it were still held by NZR when it next comes to market with its rights, for 2026 onwards. But this is quite far away, so is not yet considered an urgent issue.

‘Minor tweaks’

Sky’s willingness to commit to a large new deal indicates that the future structure of the Rugby Championship is close to being settled.

Tew told SportBusiness Media that the Rugby Championship would see only “minor tweaks” in the 2021-25 cycle, which appears to pour cold water on the prospects for some of the bigger restructuring proposals that have been under discussion. These included the possible entry of Japan and Fiji into the Rugby Championship, which seemed to be given impetus by Japan’s excellent performances at this year’s World Cup.

A plan to merge the two big annual national team competitions – the Rugby Championship and the Six Nations – was scrapped earlier this year after failing to get the support of all participating unions. The plan had been underpinned by a $6.6bn, 12-year proposal from the Infront agency.