- Broadcasters cite schedule changes, empty stadiums

- Australia’s NRL has already taken fee cut in Nine, Fox deals

- Focus turns to costly Premier League contracts

As major sports properties return to action, the attention of broadcasters in Asia-Pacific is turning to rights-fee rebates and other forms of compensation for the Covid-19 interruption.

Broadcasters spoken to by SportBusiness Media said the value of their rights had been depleted by two major factors:

- Changes to content schedules. Most obviously, media platforms have gone months without live content they were banking on to drive subscriptions and viewership

- The absence of fans from stadiums for restarted sports, which is not going down well with viewers.

Serious talks about the costs of these impacts have been on hold while federations focused on getting their competitions back up and running. Now that some have done so, including some of the most valuable, difficult discussions are approaching.

In late May, the National Rugby League, Australia’s second-most-valuable sports media-rights property, returned to action and agreed reduced rights fees in renegotiated domestic deals with pay-television operator Foxtel and free-to-air commercial broadcaster Nine.

Asia-Pacific broadcasters of the English Premier League, the most valuable football rights property in many markets, are keen to begin talks about the implications of the league’s three-month suspension. The Premier League has provisionally scheduled a June 17 restart for the competition.

Some broadcasters expect rights fee rebates; extended deal durations have also been floated as a form of compensation. The Premier League is anticipating having to make a £330m (€369m/$413m) rebate to its domestic and international broadcasters.

Broadcasters are not just being opportunistic in their calls for compensation; many are under severe financial pressure and desperate to reduce costs. Broadcasters of the NRL and of the Premier League have said the Covid-19 crisis must usher in a new, more prudent era for the sports properties. This reflects wider talk throughout the industry of ‘resets’ in revenue expectations and business models.

One Premier League broadcaster told SportBusiness Media: “[The competition’s] entire business model needs change. Clubs should be more prudent in their spending.”

NRL haircut

The NRL was forced back to the negotiating table with Foxtel and Nine as it was quickly running out of money and needed the broadcasters’ support to restart its season. Industry insiders say the federation was also realistic about its need to reset the terms of its relationship with the broadcasters.

NRL’s need to cut costs is widely recognised. As one insider put it to SportBusiness Media: “the sport has grown fat”, with big salaries at its head office and plentiful resources at teams for players and coaching staff.

It is widely considered to be overspending on its digital platform. In 2018, it launched NRL Digital, encompassing a new mobile app and new websites for the league and clubs, at a cost of A$120m (€74m/$83m) over five years. Peter V’Landys, chair of the Australian Rugby League Commission, the body that oversees the NRL, has promised to cut A$50m per year from its head-office budget.

Nine’s chief executive Hugh Marks put pressure on the NRL ahead of the recent talks. He said at a conference organised by Australian bank Macquarie: “When we’re losing on a regular basis a significant investment in NRL, in this environment, we have to really look at that analytically and say, ‘is that something that we really want to take going forward?’”. At the same event, he suggested Nine and Fox could manage the NRL’s digital presence “more cost effectively”.

Nine has secured a reduction of about A$121m in its outlay on the NRL, across rights fees and production, across the three remaining years of its contract, from 2020 to 2022. The production cost reduction will only apply this year due to the shortened season. Inventory is thought to be unchanged, although full details have yet to be released.

Nine’s original deal was worth A$925m in total – A$185m per year – from 2018 to 2022. Its outlay was reduced by a A$60m-per-year sublicense of some rights to Foxtel.

In a statement to the Australian stock exchange after the renegotiation, Nine said it would be saving A$66m this year and A$27.5m in each of the following two. Some of this year’s savings will be in the form of reduced production costs due to fewer NRL matches taking place.

Foxtel is also thought to have secured a reduction in its rights fees, as well as an extension for five years, to 2027. Precise details of the fees and rights package it has agreed to are not yet understood.

Foxtel, the company that has underpinned much of the media-rights revenue growth in the market – was struggling before the pandemic hit and is in deeper trouble now. It has taken loans from shareholders News Corp and Telstra, the Australian telco, in the last year to help it stay afloat. In April, it laid off 200 staff and furloughed 140 more until the end of June, in a week chief executive Patrick Delany described as the “toughest in Foxtel’s history”.

Foxtel’s challenges are familiar: declining subscribers and revenues and increasing competition from digital platforms such as Netflix. It has launched OTT services in response, which had performed well, but the pandemic brutally exposed a weakness in the business model of one of its platforms.

OTT service Kayo Sports saw subscribers fall by a third in April, from around 400,000 to 272,000, as live sport disappeared. Kayo subscribers are generally on one-month contracts that are easy to exit, unlike the 12-month, or longer, contracts typical for pay-television services.

Premier League

The Premier League has not yet begun formal talks with broadcasters about the implications of the Covid-19 interruption for their rights contracts, although there have been some informal conversations.

Putting a value on losses due to the Covid-19 interruption will be difficult, broadcasters admitted to SportBusiness Media.

One source said: “It’s quite subjective. But the product has changed materially. There are no fans in the stadium, that is a material change in the terms of the product… we have products that serve an entire calendar year and there have been months where we’ve had no live sports, so what were we paying for?”

One of the solutions being considered is understood to be automatic renewals of broadcasters’ rights for another three years. One current Premier League broadcaster in Asia said this would not be attractive because of the lack of visibility about the economic situation: “We don’t know what the market is going to be like in three to six years…All our businesses have to be smart because we don’t know what the economic outlook is.”

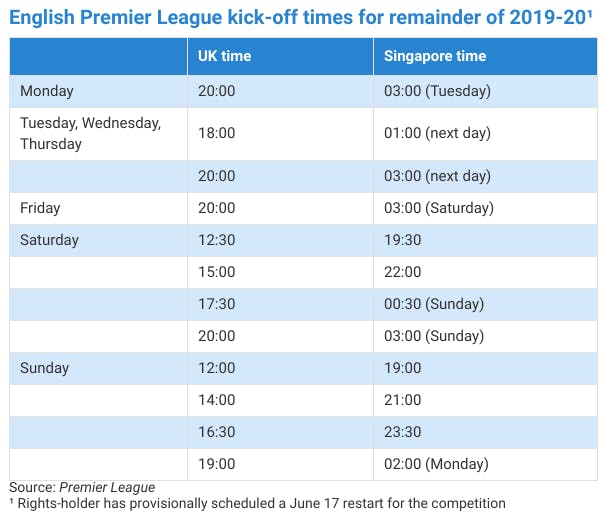

For Asia-Pacific broadcasters, a lot of the change in value will ride on which matches end up scheduled in early kick-off slots in the new 2019-20 schedule. In many Asian markets, only afternoon weekend matches kick off at attractive times for local viewers.

The league has produced a revised calendar for the remainder of the 2019-20 season, which will run from June 17 to August 1 and feature matches seven days a week. Kick-off times have been staggered so no matches will take place at the same time. This will raise the value for broadcasters somewhat, but the real drivers of value in Asian markets are matches scheduled in primetime slots featuring Manchester United, Liverpool and a small number of other leading teams.

There is a danger that the return of football behind closed doors will not be as powerful a draw as some are hoping. One broadcaster said the viewer response to the return of German Bundesliga football on their platform had been disappointing after a strong start, albeit in a market where the league is not a major property. While nearly 50,000 viewers tuned in for the first match, figures for subsequent matches fell to one-tenth of that. The company had complaints from fans on social media about the absence of crowd noise.

Partnership pressure

Most broadcasters and rights-holders today are keen to, and do, form partnerships that are wider and deeper than just rights transactions. Many broadcasters have played a central role in building up the rights value of their properties over the years. These mutually beneficial relationships could come under pressure during the coming negotiations.

One broadcaster told SportBusiness Media: “If they don’t play ball now, when it comes to renew, something will have to give. What am I investing in it for? What if this happens again, are they going to help me? It’s a relationship thing.”