- Premier League Apac media rights revenue falls 26 per cent to $450m per season

- Cycle-on-cycle decline almost entirely due to collapse of PP Sports deal in China

- Revenue to increase by about seven per cent in Apac, ex-China

The English Premier League’s latest round of media rights sales in Asia-Pacific are considered a major success by market experts, despite a substantial drop in overall value due to the collapse in the market in China.

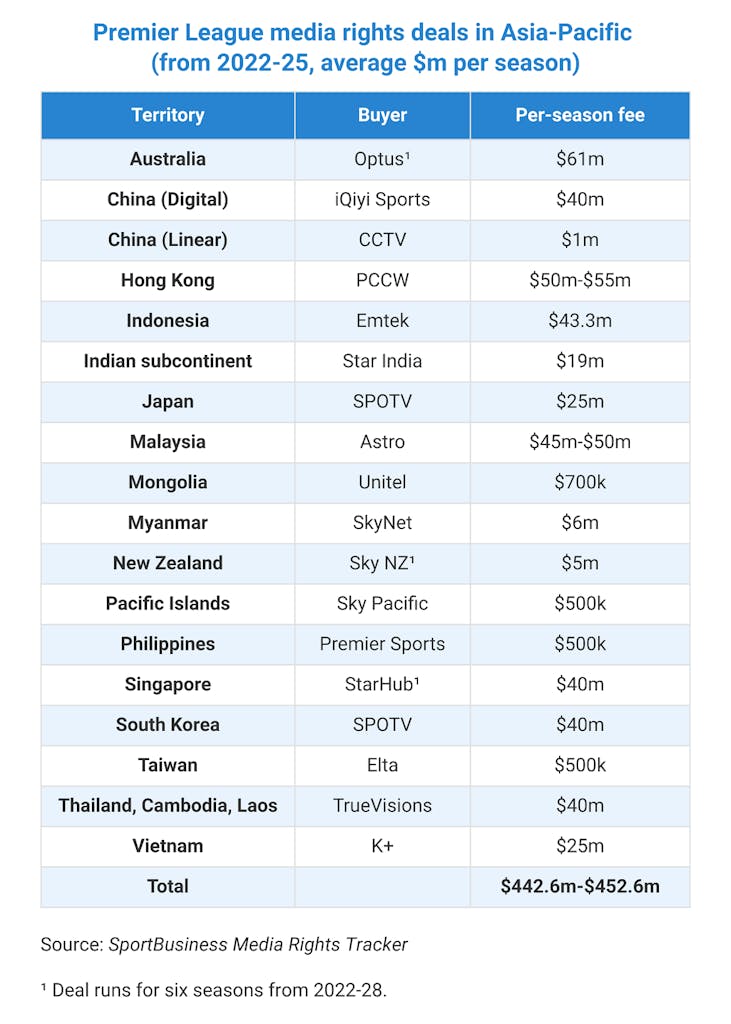

Premier League media rights revenue in Apac – including the Indian subcontinent and all East Asian and Pacific markets, but not Central Asia – in the 2022-23 to 2024-25 cycle will drop by around 26 per cent, equivalent to $165m (€160m) less for the league each season.

Revenue across Apac will amount to a total of about $450m per season. This is down from the $615m per season it was set to earn in the previous cycle, from 2019-20 to 2021-22, prior to the collapse of its deal with PP Sports in China, which was not paid in full.

The drop in overall value in Apac this cycle can almost entirely be attributed to China, where the value has declined from $236m per season under the unfinished PP Sports deal to $41m per season under deals with streaming service iQiyi Sports and state broadcaster CCTV. Excluding China, revenue from Apac is up by around seven per cent, at about $407m per season compared to about $380m per season for the equivalent markets last cycle.

The new cycle saw fewer Asia-Pacific markets dropping in value and fewer big decreases (see table) than last cycle.

The Premier League has defended the value of its content in markets where most other sports properties have suffered large cuts in recent cycles. Major football rights-holders such as the Asian Football Confederation, Uefa, the Italian Serie A and the German Bundesliga are among those to have recently suffered significant drops in value in Apac. Industry insiders spoken to by SportBusiness Media unanimously considered the sales round to be a major success for the English league.

The main reason for the wider reductions in Apac rights values over recent years has been the downturn in the region’s pay-television business. Under pressure from streaming services and audiences migrating to other forms of entertainment, many of the businesses historically focused on linear pay-television have been fighting declining subscriber numbers and revenues for several years.

This has shrunk content budgets and led to broadcasters putting a sharper focus on ‘must-have’, as opposed to ‘nice-to-have’, content. As the ultimate ‘must-have’ sports property in many markets, the Premier League has been able to maintain its value while other properties have languished. The English league remains uniquely powerful in many Apac markets in terms of its ability to get consumers to subscribe to pay-television or streaming services.

As one broadcast professional put it to SportBusiness Media last week: “We have to keep it [the Premier League]. We have to cut costs elsewhere because it is clear the Premier League is not something you can cut costs [on] sharply, as history has proved. So you have to cut elsewhere.”

Familiar tale

Asked for their thoughts on how the Premier League managed to maintain its value in Apac, industry insiders told a familiar tale. The league is unique in its power to drive pay-television or streaming subscriptions, and retaining the rights is a matter of survival for certain pay-television platforms. In addition, acquiring the rights can enable new entrants to immediately establish a credible and serious platform.

Premier League rights are by far the most powerful subscription-driving sports property in several major Apac markets, notably Hong Kong, Indonesia, Malaysia, Singapore, Thailand and Vietnam. While the league is not the top property in the likes of Australia, Japan and New Zealand, it still drives a significant number of subscribers for operators.

Incumbents in markets with little competition, notably Hong Kong and Malaysia, reduced their fees for the second cycle in a row. Despite the lack of competition, the decreases were relatively muted – down somewhere between 10 and 20 per cent in each market. The Premier League’s unique value to the incumbents, combined with the blind auction sales process, proved enough to deter the buyers from bidding too low.

Singapore provided a warning for those that might be tempted to push for bigger cuts. Incumbent Singtel submitted an aggressively low bid to renew its rights, understood to be at least 40-per-cent lower than its previous fee. Singtel’s management is attempting to steer its pay-television business towards profitability after years of heavy losses. The platform also believed it faced virtually no competition.

However, in the background, after years of showing little-to-no interest in exclusive sports content, rival telco StarHub was quietly contemplating a return to the top table of sports broadcasting. The Premier League and StarHub are understood to have had talks about the rights beginning in summer 2021. Several weeks after the bid deadline, the two sides shocked Singtel and the wider Apac market by announcing a six-season deal.

Streaming stimulation

The recent emergence and growth of streaming services played a major role in competition for the rights in several markets, notably Australia, Indonesia, Korea and Japan.

In Australia, IPTV and streaming platform Optus was defending its position in a market where two new sports streaming entrants had appeared in the last 12 months: Paramount+ and Stan Sport. Paramount ANZ – the business that comprises Paramount+ and the Network 10 television channels – is thought to have made a significant bid for Premier League rights.

In Indonesia, one of the main reasons for media group Emtek’s investment was to support the growth of its streaming service Vidio. Vidio, which is run by Emtek broadcasting subsidiary Surya Citra Media, has been a big success story. It offers both free and subscription content and claims around 61 million monthly active users. Media reports have put paying subscribers at around two million. A fundraise in November last year valued the business at $900m.

Vidio’s sports content portfolio also includes football from this year’s Fifa World Cup, the domestic Liga 1, the Italian Serie A, the French Ligue 1, and Asean Football Federation youth competitions. It also currently has rights for Formula 1 and WTA tennis.

Emtek is not thought to have faced significant, if any, competition in the Premier League rights auction. Again, the power of the property and the uncertainty created by the blind auction led the broadcaster to bid strongly to ensure it secured the rights.

The previous cycle had seen a newcomer emerge to acquire the rights in Indonesia: streaming platform Mola TV. Mola has since stepped back from premium sports rights acquisitions. There are understood to have been talks between Emtek and Mola about a deal to share Premier League rights this cycle but these never bore fruit.

In Korea, Eclat defended its Premier League rights from a strong bid by media group CJ ENM. CJ was this year aiming for an audacious capture of two of Eclat’s key rights properties: the Premier League and the Ultimate Fighting Championship. CJ wanted the rights to power growth for streaming platform TVing, which it jointly owns with broadcaster JTBC.

Eclat stunned CJ with its aggressive defence of the Premier League rights, paying the biggest increase of the Apac sales cycle. The increase was partly driven by the fact Premier League rights in Korea were arguably undervalued last cycle – the value declined by more than 40 per cent to just $8m per season in the 2019-20 to 2021-22 cycle.

Korea’s ecommerce market-leader Coupang was expected to make a significant play for the Premier League but did not bid competitively. Coupang has been investing in content, including sports content, for its streaming platform Coupang Play. It sublicensed Premier League matches from Eclat during the last cycle and also sponsored and broadcast a pre-season tour of Korea in July by Tottenham Hotspur.

Despite its weak interest in the Premier League rights, Coupang is expected to continue to invest in sports content. In recent months it has bolstered its sports rights team, hiring experienced staff from rival CJ.

The value of Premier League rights in Korea has been turbo-charged by the emergence of national team captain and Tottenham Hotspur player Son Heung-min as one of the league’s biggest stars.

At 30 years old, Son is arguably at the peak of his powers, meaning that his effect on the next media rights sales cycle is likely to be weaker. There is also the possibility he is transferred to a club in another league during the current three-season cycle, which would severely undermine the value of the current deal. However, Son appears settled at Spurs and does not appear likely to change clubs in the short term.

The Premier League rights are central to Eclat’s SPOTV platform in Korea. Since launch in 2010, SPOTV has pioneered a premium-priced sports pay-television and streaming model in a market where sports content was historically available on low-cost, basic-tier cable television. Hence, SPOTV must maintain a strong portfolio of premium content.

Eclat also surprised the market with its acquisition of Premier League rights in Japan, where it outbid incumbent DAZN with another aggressive valuation. This was arguably the deal that most strongly countered prevailing market trends.

The Japanese rights market has been contracting sharply in recent years, with broadcasters reining in spending on sport. And until the Premier League acquisition, Eclat was a minor player in the market with a streaming service – previously called Spozone and now branded SPOTV Now – focused almost entirely on Major League Baseball.

Eclat has offset some of its spend in Japan by sublicensing extensive rights to Abema, a streaming platform with which the company has forged deepening links. Abema has also sublicensed MLB rights from Eclat for the last two seasons. Last season, the deal saw Abema show 166 live regular season matches. This season, the deal covers 324 matches.

Streaming storm clouds

While streaming is expected to continue to grow across Apac in terms of user numbers and the number of platforms, it is not necessarily the case that this will give rise to increased competition for sports content. Investor confidence in the streaming sector globally has been shaken in recent months, notably by weaker-than-expected business performance by Netflix.

As one Asian sports media insider told SportBusiness Media, “At the time of the tender, we were seeing capital markets rewarding businesses disproportionately for adding subscribers… the market has shifted massively since then.”

In other words, until recently, streaming platforms were able to raise large amounts of funding on the back of strong subscriber growth, which encouraged big investments in content. Now the winds have changed, it is not clear investment in content will continue at the same level.

Tender tinkers

The Premier League’s main changes to the tender for the new cycles – mandatory bids for six-season deals and multiple packages in five markets – appear to have had some impact on the outcome of the sales processes, although were not transformational.

The six-season deals had the most impact, although there were only three across the 17 Apac territories – in Australia, New Zealand and Singapore. The longer duration played a significant role in each, coaxing strong fee increases in Australia and New Zealand, and also helping tempt StarHub back to the table in Singapore and saving the league from a major fall in revenue in that market.

It is not clear how much bidding there was on the alternative, smaller packages on offer in Indonesia and East Timor (sold as one market); Japan; South Korea; Thailand, Cambodia and Laos (sold as one market); and Vietnam. The packaging appeared aimed at drawing bids from smaller players who may not have had the appetite for the full package of 380 matches per season.

Most local industry insiders believe there was little appetite for the smaller packages. Most media companies in the region consider a move for the Premier League rights an all-or-nothing play – there is generally little interest in sharing the content with other platforms. However, the Premier League has a reputation for thoroughly researching each market before running its sales process and having a good understanding of the appetite for its rights. Perhaps notably, the rights value increased in all five markets where the multiple packages were offered.

China descent

Industry experts consider the decrease in value in China to be an outlier that the league could not have avoided. It was the result of the Chinese sports rights bubble bursting – a subject SportBusiness Media has reported on extensively.

China has descended from being the Premier League’s most valuable overseas rights market globally at the beginning of last cycle, to the fifth most-valuable in Apac this cycle.

Streaming platform PP Sports’ ultimately unsustainable deal last cycle was worth $236m per season. This covered fully exclusive gatekeeper rights in China, including linear rights. The deal was terminated after only one season. PP Sports had already paid $360m, more than half the total three-year fee, due to an accelerated payment schedule. The league is engaged in legal action to recover more money from the platform.

For the new cycle, the Premier League has two deals in China. In the biggest, iQiyi Sports is its digital rights partner, with a four-season deal covering 2021-22 to 2024-25. This is worth $40m per season, a reduction of about 80 per cent compared to the PP Sports deal.

It is, however, a big increase on the deal agreed with Tencent for the second season of the last cycle, 2020-21. Tencent paid a guarantee of between $12m and $15m, agreeing a cut-price deal as the league was scrambling for short-notice coverage after the collapse of the PP Sports agreement.

There was also a revenue share linked to Tencent’s sales of subscriptions for its Premier League coverage, but this is not thought to have generated significant extra revenue for the league, if at all.

iQiyi is understood to have recouped close to half of its $40m-per-season outlay on the Premier League rights in a sublicensing deal with Migu, the streaming service run by telco China Mobile.

In recent weeks, the Premier League finalised a significant new deal with Chinese state broadcaster CCTV covering all three seasons of the new cycle. The rights fee is low, thought to be just over $1m per season. This is understood to be substantially less than the league received in previous deals with the broadcaster. But the fee is only part of the story of a deal that can be considered a win for the league.

CCTV has not carried live coverage of the Premier League since the end of 2019-20. Then, the broadcaster had live rights under a sublicensing deal with PP Sports. After the breakdown of the PP Sports deal, the league struggled to reach a new agreement with CCTV.

Industry experts say political tensions between the UK and China played a big part in this. As the state broadcaster, CCTV is particularly sensitive to political concerns. It scaled back Premier League coverage in late 2019 after then-Arsenal FC player Mesut Ozil criticised the Chinese government for its treatment of Muslims in the Muslim-majority Xinjiang province.

One Chinese industry insider told SportBusiness Media there is ever-present concern at CCTV that people in crowds at sports events in the West will conduct public protests against China that are visible on television screens.

At a time of continuing tension between China and the West, for the Premier League to have secured a new deal with CCTV is a coup for the rights-holder.