- English Premier League secures about £1.670bn per season in domestic media rights revenue, from 2025-29

- Deals represent marginal uplift on league’s current domestic media income of £1.622bn, from 2019-25

- Sky drives marginal uplift, paying seven-per-cent more to secure huge increase in inventory

The English Premier League’s first domestic media rights auction for almost six years has produced an overall uplift of just over three per cent, prompting sighs of relief across offices in Paddington, Isleworth and Chiswick. The deals are neither a disaster nor a wonder, largely cementing the UK’s sports broadcasting status quo until the summer of 2029.

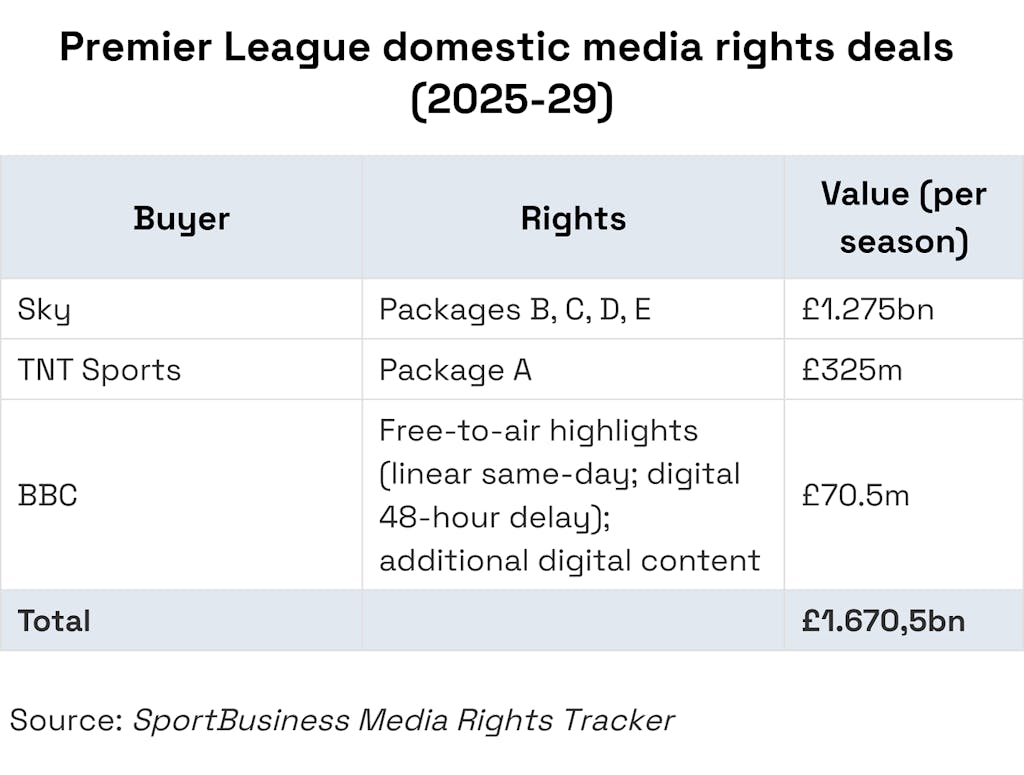

In total, the Premier League has thus far secured domestic media rights income of close to £1.670bn (€1.946bn/$2.093bn) per season over the four seasons from 2025-26 to 2028-29. New deals have been struck with incumbent pay-television broadcaster Sky and media group Warner Bros. Discovery, which will exploit the rights via its pay-television broadcaster TNT Sports. A free-to-air highlights deal was also agreed with public-service broadcaster the BBC.

The league’s domestic media rights total in the 2025-29 cycle is set to increase slightly once domestic near-live clips rights are sold in the first half of 2024. These rights are currently held by Sky in a deal worth an average of £13.3m per season.

The Premier League will also sell rights in Ireland in a separate tender during 2024. These rights are currently worth about £55m per season in deals with Sky, TNT Sports and pay-television broadcaster Premier Sports.

From 2019-20 to 2024-25, the league earns domestic media rights revenue — excluding Ireland — of about £1.622bn per season across deals with Sky, TNT Sports, the BBC and e-commerce giant Amazon.

SportBusiness Media understands pay-television broadcaster Sky will pay close to £1.275bn per season for a minimum of 215 and maximum of 224 matches per season over the four-season period. In total, Sky will receive between 87 and 96 more matches than it does in its current Premier League domestic rights deal, in which it pays £1.193bn per season for 128 live matches per season.

The number of matches will fluctuate depending on the number of English clubs competing in the Uefa Europa League and Uefa Conference League. Clubs that have played in these competitions on Thursday evenings have their matches rearranged for Sunday, 14:00 kick-offs, to which Sky will hold exclusive rights over the course of the cycle.

In all, Sky will pay about seven per cent more for between 68 and 75 per cent more matches each season. For this alone, Sky has emerged from the process as the greatest beneficiary. It was able to expand its inventory at relatively little extra cost due to a lack of competition – no other media group, broadcaster or streamer thought itself better able to monetise a dominant Premier League offering over the 2025-29 cycle.

As well as retaining all of its current kick-off slots (Friday/Monday 20:00; Saturday 17:30; Sunday 14:00; Sunday 16:30), Sky will show all Sunday 14:00 kick-offs live for the first time. In the current 2022-25 cycle, Sky only shows one Sunday 14:00 kick-off per matchweek. It has also added three complete midweek rounds of fixtures as well as showing all 10 matches live from the final matchweek.

TNT Sports has retained its position as the exclusive broadcaster of Saturday 12:30 matches and has also retained two midweek rounds of fixtures. It is understood to have kept its outlay flat at £325m per season for the 2025-29 cycle – the same amount it has paid for its Premier League rights since 2019-20.

The BBC also kept its outlay flat at £70.5m per season over the 2025-29 cycle – the same amount it has paid for the past two cycles. It will continue to be the exclusive home of free-to-air Premier League highlights via its Match of the Day highlights shows. In a marked difference from previous cycles, the BBC has gained extra digital content rights for use across its BBC Sport platforms.

As a result of Sky’s massively increased inventory, many analysts have pointed to the significant decrease in the Premier League’s price-per-match compared to the previous cycle as the defining takeaway from the process. This is not irrelevant, but most UK sports rights executives believe this to be largely insignificant.

The value of each Premier League match is not equal and fluctuates based on the participating clubs and the kick-off slot. In addition, the league also sold effectively dormant inventory — existing matches that were not previously shown live in the UK — to produce an overall increase in income. This is different to suffering an outright decline in the value of its entire 380-match-per-year inventory.

No Amazon, no DAZN

Analysts and experts are split on the reason behind Amazon’s absence from the 2025-29 bidding. Some believe the Premier League’s decision to reduce the number of live rights packages to five in 2025-29 – down from seven from 2019-25 – effectively froze Amazon out of the bidding. Others believe the inverse to be true, with the Premier League led to its strategy by Amazon’s early notice of withdrawal.

Whichever version is true, Amazon will bow out of showing two rounds of midweek Premier League matches per season at the end of 2024-25, for which it has paid about £20m per season from 2019-20 to 2024-25. The company had no ambition to pay 15 times that amount to compete with Sky or TNT for a larger package.

Amazon’s investment in Premier League rights is thought to have at least partly influenced the growth of its Prime subscription service in the UK, which incorporates live sport, on-demand entertainment, free shipping on its ecommerce platform and a plethora of other services. In 2018, prior to the commencement of its Premier League deal, 5.14 million UK households had an Amazon Prime subscription. In 2023, it is estimated that this number has risen to about 13 million UK households.

Last year, Amazon agreed to pay about €200m ($215m) per season for exclusive live rights in the UK to 17 first-pick Uefa Champions League matches, from 2024-25 to 2026-27. The deal acted as an insurance policy ahead of the Premier League auction, providing Amazon with premium live football in nine months of the year, spread evenly across those months.

Sources say Amazon has found football fans – a group that constitutes people from much more varied socioeconomic backgrounds in the UK than sports such as tennis or rugby union – to be less ‘sticky’ on average than fans of other sports, which are more likely to remain as Prime subscribers purely for the e-commerce offering.

As a result, Amazon is thought to have viewed the Champions League as a more cost-effective option to keep football fans subscribed to Prime, through which Amazon drives almost all of its margins. It is thought that Prime members spend roughly double the amount of money on Amazon’s ecommerce platform compared to non-Prime members, making Prime member acquisition a key goal for the company.

The other potential competitor for Sky and TNT Sports was multi-platform broadcaster DAZN, which is also understood not to have bid for a package of Premier League rights. DAZN is currently focused on launching in France, where the company believes it will be able to participate in Ligue 1’s domestic media rights auction without affecting its goal of breaking even by the end of 2024.

Experts say that should DAZN have acquired even one package of domestic Premier League rights over the 2025-29 cycle, it could have seriously harmed its ability to get its balance sheet in shape for the company’s inevitable sale of equity – either privately or via IPO – in 2025 or beyond.

Unlike Sky or TNT, DAZN is not available in the UK as part of a wider package of telephony and broadband internet services, putting it in an ‘additional subscription’ bracket rather than part of an ‘essential’ bundle. Its current inability to monetise sports rights across those services is a major reason for the company’s significant losses to date, and also the reason why it is seeking to expand into other verticals such as betting and ecommerce.

Aside from Amazon and DAZN, no other media groups, broadcasters or streamers felt it was worth taking the giant risk to spend over £1bn to break into the UK market.

The near-collapse of media group Viaplay has served as a cautionary tale for companies seeking to expand into new markets on the back of content alone, while more established global media groups such as Disney and WBD have been almost singularly focused on cost-cutting for the past 12 months.

Media giant Apple’s interest in sports rights seems limited to global opportunities, which seems highly unlikely to apply to the Premier League for at least the next decade.

The Premier League has several six-season international media rights deals set to expire at the end of the 2027-28 season, leaving the league at least partially out of sync with its new domestic media rights cycle. The league’s decisions to date regarding international media rights deals from 2025-26 indicate a similar pattern, making any global media rights deal difficult to arrange before the end of the decade and likely beyond.

Is flat the new up?

With little to no competitive tension to speak of, the Premier League is thought to be happy with the result of the process. Its offering of an extended term – four seasons instead of the traditional three – and a vastly increased number of matches has prevented England’s top football league from suffering a fate similar to its Italian or Spanish counterparts. Serie A suffered almost 10-per-cent decrease in domestic media rights revenue from 2024-25 onward, while LaLiga’s income has also fallen thanks to the league assuming responsibility for production costs.

However, the league knows that it is in danger of suffering another decrease in value – as it did coming out of the 2016-19 cycle – should it once again rely on an extended term and yet more matches to produce a better result. The ‘Saturday 3pm’ blackout — which prevents all football played between 2:45pm and 5:15pm on Saturdays from being shown live in the UK — will remain for the 2025-29 cycle. The discussion surrounding its suitability will undoubtedly rear its head before the league’s next auction.

Aside from the Premier League’s ability to affect the market with its strategy, there is a growing feeling among sports rights experts that broader macroeconomic conditions in the UK and across mainland Europe will have to change for the better in order for domestic football rights to begin growing once more.

High inflation rates and a lack of real-terms wage growth across Europe since the 2008 global financial crash has left the majority of football fans with less disposable income to pay for premium sports content. The rise of pirated sports content over that period – either accessed for free or at much lower prices than legal forms of consumption – is not coincidental. In tough economic times, premium sport is increasingly unaffordable for median wage earners.

UK pay-television experts broadly agree that given this economic outlook, there is simply no way for any company to earn significantly more money from premium sport than at present. Sky’s recent renewals of its other core rights – Formula 1 and major international cricket properties – also featured marginal uplifts in the face of zero competition. The premium sports content market is, in its current form, close to maxed out.

In that context – and the context of other European football leagues – flat is very much the new up.