- Fifa will sell rights in Asia to 2026 and 2030 Fifa World Cups in-house

- Infront thought to have made $170m-$175m on Fifa rights deal, from 2015-22

- Total Fifa media rights sales in Asia worth about $1.65bn over eight-year period

Infront is set to lose one of its most profitable commercial rights deals from next year onward as Fifa, football’s world governing body, has decided to bring sales of its Asian media rights in-house through its Zurich-based sales team, SportBusiness Media has learned.

Fifa made the decision to move Asian media rights sales in-house earlier this year and is thought to have notified its two current sales agencies in the region, Infront and Dentsu, several months ago. Fifa has used agencies to sell rights in the region since 2007, while Infront was responsible for global media rights sales to the 2006 Fifa World Cup.

Local sources say that Fifa’s sales team is already active in the region for sales to the 2026 tournament – to be held across the US, Mexico and Canada – and has been speaking with media companies to ‘warm up’ the market ahead of negotiations next year. It is not clear whether Fifa will establish a full-time sales team on the ground in Asia, but it has not yet made moves to do so.

The decision is a blow to Infront, which is owned by Chinese conglomerate Wanda. Its media rights deal with Fifa in 26 Asian territories, in which it pays a minimum guarantee of $600m for all Fifa national team tournaments from 2015 to 2022, has been one of the agency’s most lucrative contracts.

SportBusiness Media understands Infront earned about 12-per-cent commission on all its Fifa media rights sales across the region, as well as a share of about 20 per cent of all revenue over and above the $600m minimum guarantee.

The total value of the agency’s Fifa World Cup deals in Apac over the 2015-22 period is understood to be between $907m and $920m, meaning that the agency earned in the region of between $170m and $175m over the eight-year period.

The agency’s deal excluded Fifa media rights in Japan, South Korea, North Korea, Malaysia and Brunei, where Fifa agreed direct deals with local broadcasters and agencies.

Fifa sold its rights in Japan, from 2015 to 2022, to agency Dentsu for a minimum guarantee of about $450m. The deal had a similar commission and revenue-sharing model.

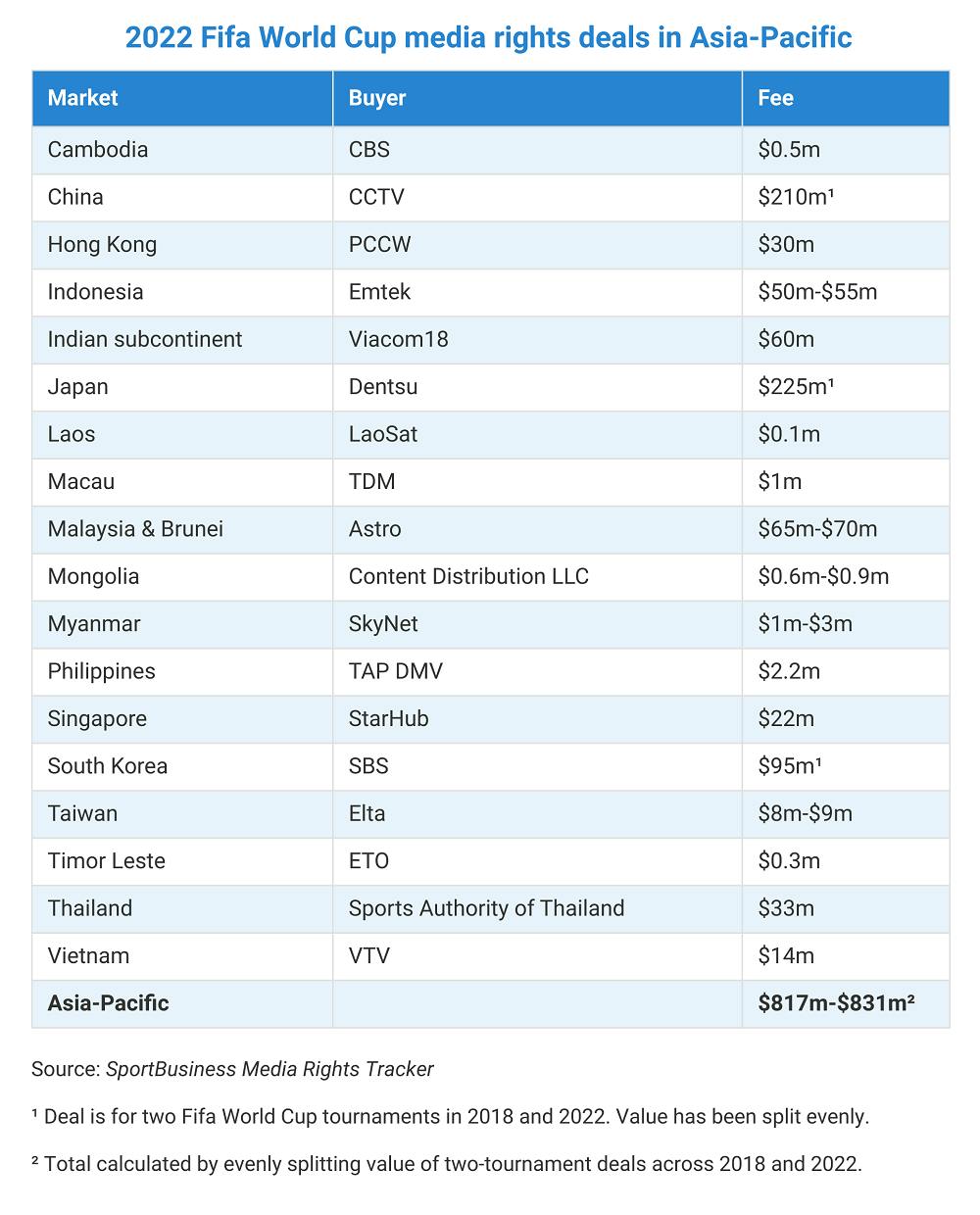

In total, Infront and Fifa’s sales across the region amounted to between $1.65bn and $1.67bn across the 2018 and 2022 Fifa World Cups.

In the previous eight-year deal, from 2007 to 2014, Fifa sold rights across Asia to Football Media Services, a joint venture of Infront and Dentsu. FMS put up a guarantee of $350m for the rights. The company was paid 15-per-cent commission and upside was split 50:50. FMS earned about $200m from the contract.

Holding out hope

The loss of the Fifa contract in Apac follows Infront’s loss of two other profitable football contracts: as media adviser to Italy’s Serie A and selling marketing rights to domestic cup football for the German Football Federation (DFB).

However, the agency hopes that Fifa’s in-house sales team will consider striking deals with agencies in Apac from 2023 onward, given Infront’s strong performance over the past eight years.

Infront told SportBusiness Media: “We are unable to comment of the specifics of our ongoing discussions with Fifa and we cannot confirm the speculation about Fifa’s future business strategy. Generally, we remain very confident that we will continue to collaborate with Fifa beyond the current event cycle, given Infront’s unique breadth and wealth of our experience along the football business value chain.

“This includes, in particular, further opportunities with Fifa for its media rights in Asia, where we continue to have the most experienced and highly successful team in place. We are not shutting down our media rights distribution resources in Asia but will continue to provide a pan-Asian hub to our partners and clients.”

The agency added that it “expected” to continue working with Fifa across a range of projects, include the sale of sponsorship and media rights.

Infront had no automatic right of renewal on its deal with Fifa, nor any rights to an exclusive negotiation window; technically, it has not ‘lost’ the World Cup contract. But Fifa’s decision is still likely to have come as a disappointment after so many years as its partner in the region.

When Infront’s parent company issued a prospectus for a planned initial public offering in the summer of 2019, it acknowledged that it could lose business as a consequence of rights-holders changing to “operating models that contemplate moving monetisation efforts in-house”.

Infront’s wholly-owned subsidiary, HBS, will remain the host broadcaster for Fifa events, while the agency itself will retain commercial links with Fifa on other projects.

Infront is providing LED advertising board services for the next year’s Women’s World Cup in Australia and New Zealand. It is also Fifa’s exclusive World Cup licensing agent in China up to and including the 2026 World Cup in the US, Mexico and Canada. Infront’s Asian operation also holds important contracts outside football, including an eight-year deal to handle all commercial rights of the Badminton World Federation.

The wider agency continues to be a major player in football rights, working with over 50 different partners. It has also rekindled its long-running relationship with the DFB, for whom it now provides LED board services for both the domestic cup competition and the homes games to the German national team.

Infront said that it had a proven track record in “transforming and growing its business across different sports” despite “changing requirements on the rights-holder side”. The agency added: “We continue to implement a growth strategy by further diversifying our rights-in partnership portfolio, by investing in IP ownership in various fields and by entering into new business fields, such as betting with Infront Bettor, where European football spearheads our ‘tech-led’ betting rights operation.”

Additional reporting by Callum McCarthy