- Value in Germany up almost 70 per cent, to €320m per season

- Amazon lands first-pick Tuesday package in first round, will pay about €90m per season

- DAZN beats Sky to remaining live rights, and ZDF takes highlights and final

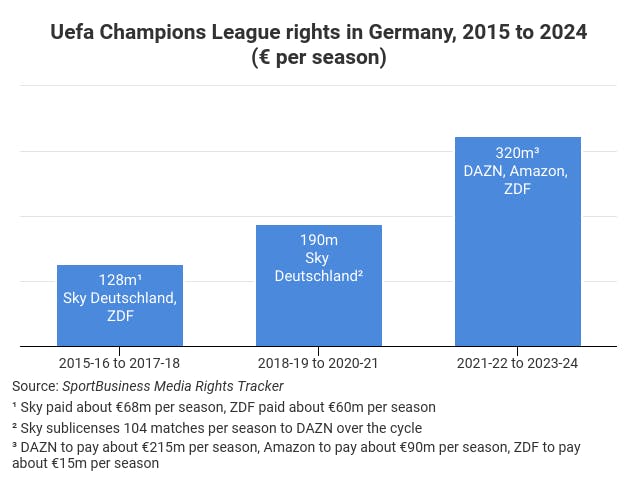

Uefa has increased the value of Champions League rights in Germany by nearly 70 per cent in the 2021-24 cycle, driven by an intense broadcaster battle in which DAZN ousted Sky Deutschland and Amazon made another foray into premium football.

The cumulative value of Uefa’s top-tier competition for 2021-22 to 2023-24 will be €320m ($356m) per season across three separate deals: with streaming service DAZN, internet retail giant Amazon, and public-service broadcaster ZDF.

DAZN will pay about €215m per season for exclusive live rights to the first-pick Wednesday matches, and all remaining live rights except the first-pick Tuesday match. Its inventory includes pay-television rights to the final and exclusive rights to the Uefa Super Cup, which is contested by the winners of the previous season’s Champions League and second-tier Europa League.

Amazon will pay about €90m per season for exclusive live rights to the first-pick match on Tuesday. ZDF will pay just under €15m per season for the free-to-air rights to the final, along with match highlights from both Tuesdays and Wednesdays.

The total per-season value of the rights is an increase of about 68 per cent on the approximately €190m per season pay-television broadcaster Sky pays in the current cycle, from 2018-19 to 2020-21. Sky currently sublicenses 104 matches per season to DAZN over the cycle in a deal worth about €80m per season.

ZDF does not hold any Champions League rights in the 2018-21 cycle. It did acquire non-exclusive live rights to 18 matches per season in the previous 2015-18 cycle, paying about €60m per season. Sky held rights to all matches in the 2015-18 cycle, paying Uefa about €68m per season.

Bid battle

Uefa, through its exclusive club competition sales agent Team Marketing, launched a tender in Germany on October 30, with a bid deadline of December 3.

The rights packages on offer to broadcasters were:

- A1 – the first-pick live match on Tuesday

- A2 – the first-pick live match on Wednesday, including pay-television rights to the final and exclusive rights to the Uefa Super Cup

- B – all remaining live matches

- C1 – highlights of Tuesday matches

- C2 – highlights of Wednesday matches, along with highlights of Tuesday matches

- D – live final for free-to-air

Amazon acquired the ‘A1’ package of rights in the first round of bidding with an aggressive offer for its first premium sports rights deal in Germany. Following Amazon’s acquisition, the pressure intensified on both Sky and DAZN to secure the remaining live matches. There were two further rounds of bidding, on December 6 and December 10.

Team then decided to combine packages A2 and B, with DAZN’s third-round bid of about €215m per season enough to secure the rights. It is thought Sky bid about €200m per season.

SportBusiness Media understands ZDF had little competition for the remaining three packages, which it is yet to formally announce. For Uefa, gaining a linear free-to-air partner for highlights and the live rights to the final is seen as a plus, having sold the bulk of live rights to non-linear subscription players.

There was no free-to-air coverage in Germany of last season’s final between Liverpool and Tottenham Hotspur, with the match only shown by Sky and DAZN. German listed-events legislation only requires the match to be shown free-to-air if a German team is participating.

It is understood that telco Deutsche Telekom expressed interest in the Champions League rights, but was not aggressive in its pursuit despite expectations following its record acquisition of rights to the 2024 Uefa European Championships.

Prime push

Amazon’s acquisition of Champions League rights in Germany is hugely significant and continues its recent Prime Video sports-rights strategy. The internet giant had previously picked up premium rights in the UK and France to the English Premier League and the French Open, respectively.

Its success in the German Champions League tender contrasts with its decision to not even bid in the equivalent UK and France tenders. It is thought that conditions in Germany, including the value of the rights and a better chance of taking on the incumbents, swayed Amazon’s thinking.

The retail giant is not completely new to working with premium rights in Germany. When US media group Discovery acquired domestic rights to Germany’s Bundesliga, from 2017-18 to 2020-21, it agreed a distribution deal with Amazon which granted Prime customers access to Eurosport content – including the Bundesliga. Since then, Discovery has sold on all its Bundesliga rights to DAZN, which also has a distribution agreement with Amazon.

Amazon also holds Bundesliga radio rights over the same 2017-21 cycle in a deal worth €5m per year. It also holds Champions League radio rights in the country.

However, the Champions League television deal is its first premium televisual rights acquisition for the most popular sport in the country. It is thought that until now, Amazon had only targeted tennis rights in the country, including the ATP Tour and Wimbledon.

Sky pressure

Sky’s failure to retain Champions League rights – its second-most valuable property – is a major blow.

It is unlikely to be able to agree a reciprocal sublicensing deal with DAZN for the 2021-24 cycle as both Team and the Bundeskartellamt, the German competition authority, imposed strict conditions upon bidders in the recent tender. It is thought that neither Uefa nor Team knew that Sky’s 2018-21 sublicensing deal with DAZN had been agreed before that cycle’s tender process. The Bundeskartellamt has an ongoing examination over whether that deal conformed with German competition law.

The timing of Sky’s loss will also put serious pressure on the broadcaster ahead of the Bundesliga launching its 2021-22 to 2024-25 domestic rights tender early next year. Sky holds exclusive live rights to 266 Bundesliga matches out of a possible 306 per season in the 2017-21 cycle, paying about €876m per season.

There is an argument that, with the addition of Amazon to the German premium-rights market and Sky already under pressure from DAZN, the Bundlesliga stands to benefit from increased competition.

But some experts have suggested that both DAZN and Amazon’s appetite for the Bundesliga could be lesser now they have acquired Champions League rights and must service those expenditures.

However, it is not only DAZN and Amazon that Sky should worry about. The absence of serious interest from Deutsche Telekom in the Champions League has led to speculation the telco will be more aggressive when it comes to the Bundesliga rights; it has already publicly expressed an interest.

One market expert told SportBusiness Media that despite the potential positive and negatives, “the league will be pleased to have a clear result from the Champions League process” as it can now better prepare for its own tender, knowing the positions of the interested parties.

Europa League

Team launched a separate tender for the second-tier Europa League and the new third-tier Europa Conference League in Germany at the same time as the Champion League. The process is ongoing.

Commercial broadcaster RTL holds free-to-air Europa League rights in Germany, from 2018-19 to 2020-21, in a deal worth about €13m per season. Pay-television rights are held by DAZN in the same cycle, in a deal worth about €15m per season.